Celebrate or commiserate, investors! NVIDIA Corporation NVDA has yet again outdone itself, this time crossing the elusive $3.5 trillion market capitalization milestone. With its stock soaring to unprecedented heights, one might rue missing the boat, but fear not – the time to dive in may well be upon us!

NVIDIA’s Epic Market Cap Feat

In the kingdom of chip stocks, NVIDIA reigned supreme as its share value climbed 4.1% in a single day, propelling it beyond the $3.5 trillion market cap mark for the first time. Earlier in June, NVIDIA achieved the $3 trillion milestone, momentarily surpassing tech giant Apple Inc. AAPL in valuation.

Although Apple clinched the $3.5 trillion crown first, NVIDIA is a formidable contender for the title. Riding on a wave of AI innovation, NVIDIA’s shares have skyrocketed by 243% in the past year and an astounding 543% over the last three years.

Four Aces of NVIDIA’s Winning Hand

The frenzy around NVIDIA’s cutting-edge Blackwell B200 chips, trumping even the esteemed Hopper H100 chips in AI throughput, is fueling a surge in stock prices. The hyper demand from tech bigwigs like Microsoft Corporation MSFT and Alphabet Inc. GOOGL has spurred NVIDIA to scale up production to meet the stellar demand.

The burgeoning data center landscape is a boon for NVIDIA, with the H100 chip expected to power a plethora of generative AI applications like ChatGPT. Giants of the tech realm are doubling down on AI data centers, a trend that bodes well for NVIDIA’s growth. Take Microsoft’s recent commitment to shell out $108.4 billion on data centers over the next half-decade as a cue.

NVIDIA’s dominion over the GPU market is a telling advantage, with developers favoring the CUDA software platform over rivals like Advanced Micro Devices, Inc. AMD. Holding an 80% market share and poised to tap into a GPU sector set to balloon to $1,414.39 billion by 2034 (from the current $75.77 billion, as per Precedence Research), NVIDIA’s footing seems unshakable.

In a show of cosmic favor, the Federal Reserve’s proactive interest rate cuts, with more in the offing amidst abating price pressures, are propelling NVIDIA’s shares upward. Lowered borrowing costs, augmented profits, and stable cash flows spell a golden era for NVIDIA’s growth pursuits.

Eagerly Eyeing NVIDIA’s Stock Surge

From the Fed’s friendly stance to the GPU realm reign, booming data center enterprise, and the insatiable hunger for AI chips – NVIDIA’s stock appears poised to keep ascending, painting an enticing investment scenario.

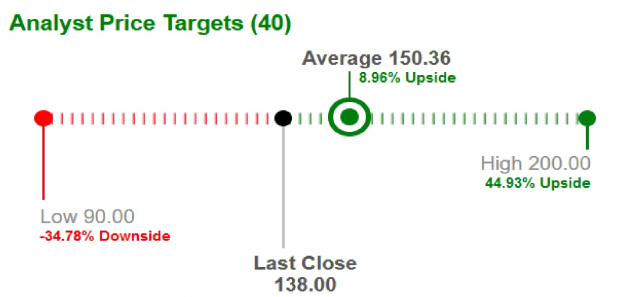

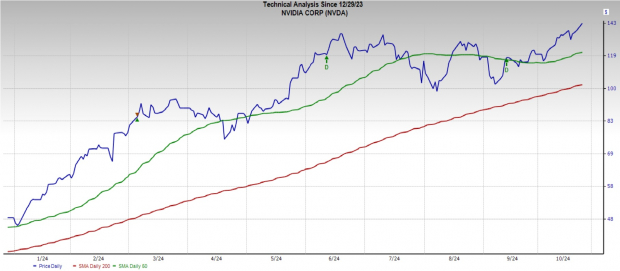

Market analysts have unanimously upped the average short-term price target for NVDA shares by a notable 9%, settling at $150.36 from the $138 closing price. The green signal doesn’t stop there – with the highest short-term price target pegged at $200, promising a 44.9% surge.

Image Source: Zacks Investment Research

The AI arena’s stronghold has even inspired Bank of America Corporation’s BAC analyst Vivek Arya to elevate NVIDIA’s short-term price projection from $165 to $190. The past week also witnessed CFRA research lifting NVIDIA’s short-term price target from $139 to $160, embodying the widespread optimism surrounding the stock.

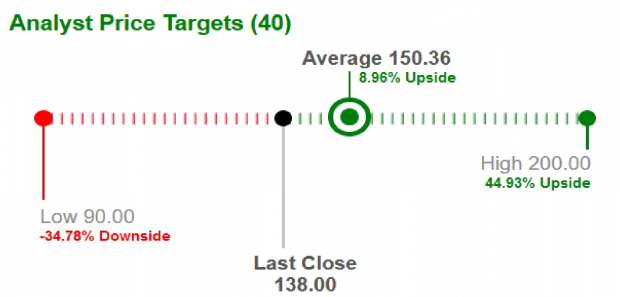

Furthermore, NVDA’s stock straddles the bullish realm, soaring above the near-term 50-day moving average (DMA) and long-term 200-DMA, beckoning forth a green pasture for potential investors.

Image Source: Zacks Investment Research

Notably, NVDA stock presently boasts a 51.0X forward earnings price/earnings ratio, a figure that falls shy of the Semiconductor – General industry’s 55.8X forward earnings multiple.

Image Source: Zacks Investment Research

NVIDIA presently glimmers with a Zacks Rank #2 (Buy).

Mountains of Infrastructure Stocks Teetering on the Horizon

A surge to resurrect the ghostly U.S. infrastructure draws nigh, bipartisan, urgent, and inevitable. A treasure trove awaits those who dare to invest as trillions cascade for this grand endeavor.

The burning inquiry remains, “Will you leap into the right stocks early, maximizing their growth potential?”

Zacks’ Special Report unfolds the secret to navigating this terrain, guiding you to the five chosen entities poised to reap the bounties of colossal construction and reparation endeavors, steering fortunes in roads, bridges, buildings, transport, and energy metamorphoses on an almost fantastical scale.

Grab Your Free Copy: Unleashing the Potential Profits from Trillions in Infrastructure Spending >>

Bank of America Corporation (BAC) : Insightful Stock Analysis Awaits

Apple Inc. (AAPL) : In-Depth Stock Analysis Free of Charge

Advanced Micro Devices, Inc. (AMD) : Expert Stock Analysis Offered Here

Microsoft Corporation (MSFT) : Your Gateway to Informative Stock Analysis

NVIDIA Corporation (NVDA) : Comprehensive Stock Analysis Now Available

Alphabet Inc. (GOOGL) : Delve into Detailed Stock Analysis Here

For more insights, read the original article on Zacks.com here.