Unleashing the Alibaba Behemoth

Alibaba Group (BABA), a Chinese e-commerce titan, has dominated the online retail landscape with renowned platforms like AliExpress and Taobao. Beyond e-commerce, Alibaba ventured into diverse sectors such as Alibaba Cloud, China’s second-highest revenue generator. Riding high on international wholesale, digital payments, and logistics, the conglomerate surged ahead, mirroring the success of its American counterpart, Amazon (AMZN).

Revived Economy Fuels Alibaba’s Momentum

The resurgence of the Chinese economy, propelled by a substantial stimulus package in 2024, presented Alibaba with a lucrative opportunity. With impressive growth metrics and robust retail sales figures, Alibaba capitalized on the country’s fiscal rejuvenation. The ample liquidity and economic uptrends favor Chinese equities like BABA, emerging from the depths to potentially experience colossal gains.

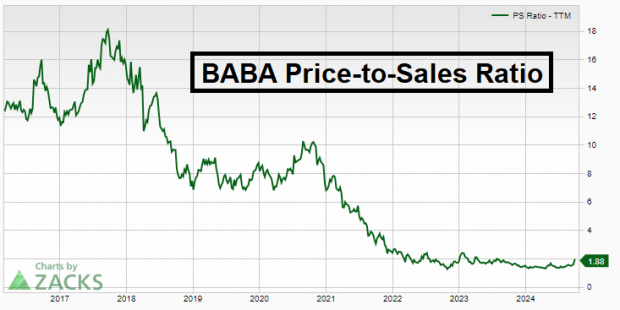

Embracing Bargain Valuations

Despite BABA’s 34% YTD stock surge, its valuation remains surprisingly economical. With a price-to-sales ratio near record lows, savvy investors might find Alibaba’s current valuation irresistibly enticing compared to its 2018 peak multiples.

Image Source: Zacks Investment Research

Strategic Stock Repurchase Initiatives

Alibaba’s extensive share buyback program signifies confidence in company performance. The recent daily repurchases totaling millions, akin to Apple’s successful buyback history, signal positive market sentiment and potential stock growth.

Institutional Favor and Investor Access Expansion

Renowned investors like Michael Burry and David Tepper have firmly anchored themselves in Alibaba, evident from their 13F disclosures. Additionally, the Hong Kong listing and Stock Connect program are set to significantly broaden investor access to Alibaba shares, aligning with Goldman Sachs and Morgan Stanley’s bullish inflow projections.

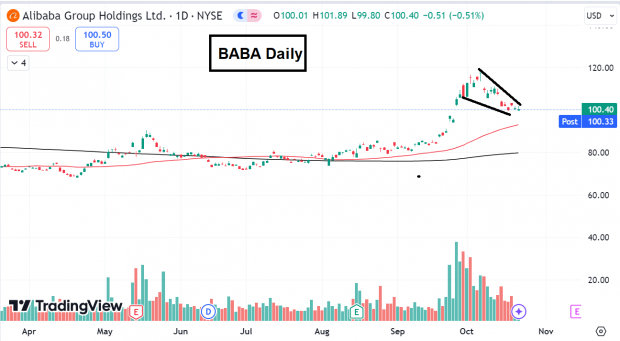

Oscillating Markets and Investment Opportunities

Amidst a market retreat to the 50-day moving average post a substantial breakout, Alibaba faces a possible pullback scenario. Such market oscillations post-stimulus peaks often present opportune moments to enter or extend positions in promising stocks like BABA.

Image Source: TradingView

The triumphant return of China’s titanic e-commerce player, Alibaba, underscores its firm footing in the international market. With attractive valuations, increased investor outreach, and institutional backing, Alibaba sets a compelling stage for prospective investors.