Flashing warning signals are abound in the stock market, particularly for those investors who place momentum on a pedestal when it comes to trading decisions.

One such indicator, the Relative Strength Index (RSI), measures a stock’s strength on its upward versus downward price movements. An RSI above 70 typically indicates an overbought asset. This prompts investors to tread cautiously in the short term.

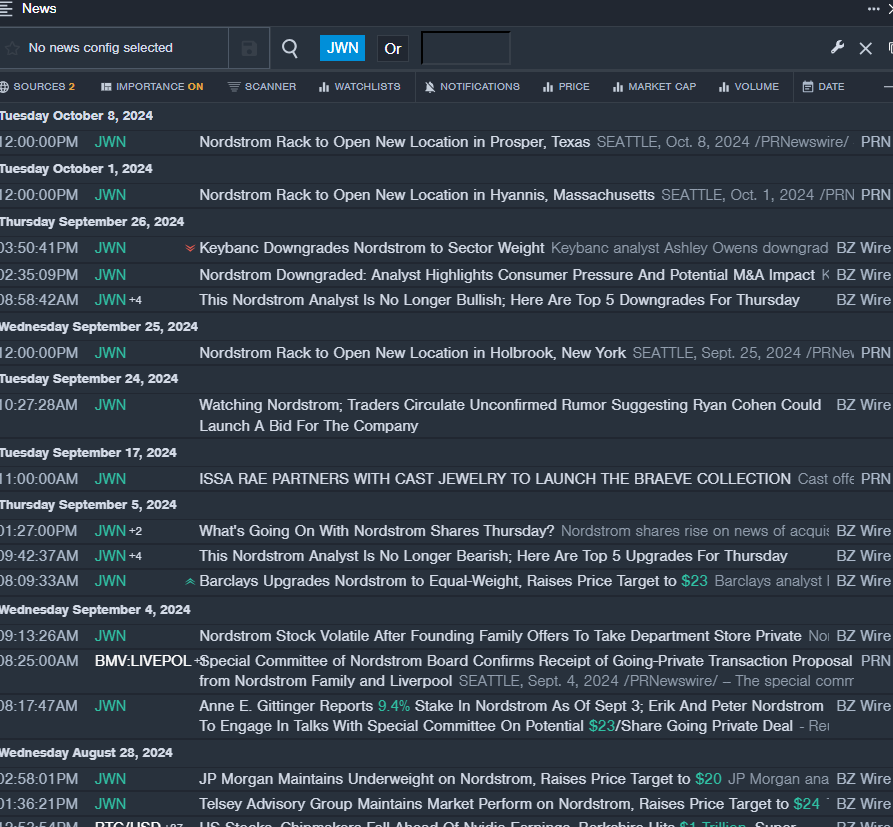

Nordstrom Inc (JWN)

- On Sept. 26, Keybanc analyst Ashley Owens downgraded Nordstrom from Overweight to Sector Weight. Despite this, the company’s stock saw a 10% increase over the past five days, hitting a 52-week high of $24.93.

- RSI Value: 76.29

- JWN Price Action: Nordstrom’s shares closed at $24.67 on Friday, marking a 0.9% gain.

- Leveraging real-time alerts from Benzinga Pro is vital for staying updated on JWN news.

Toll Brothers Inc (TOL)

- On Oct. 2, Oppenheimer analyst Tyler Batory maintained a positive outlook on Toll Brothers, upgrading the stock from Outperform to Outperform with a revised price target of $189. Over the past five days, the company’s stock surged by 6%, reaching a 52-week high of $160.12.

- RSI Value: 72.41

- TOL Price Action: Toll Brothers’ shares closed at $159.58 on Friday, marking a 1.9% rise.

- Utilizing Benzinga Pro’s charting tools is crucial for keeping track of trends in TOL stock.

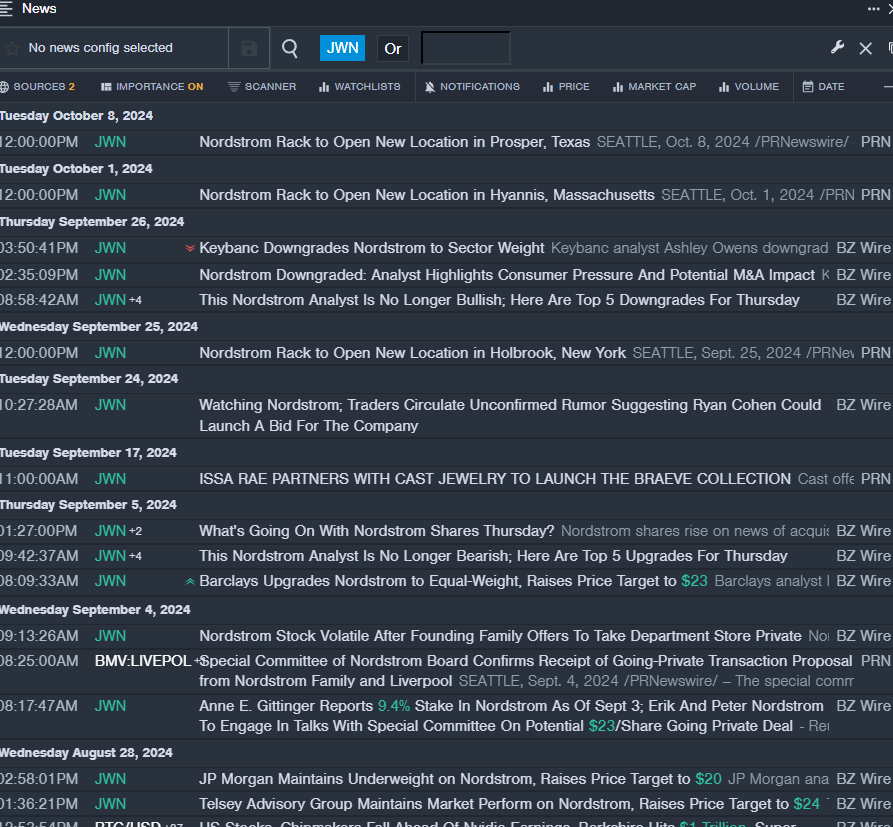

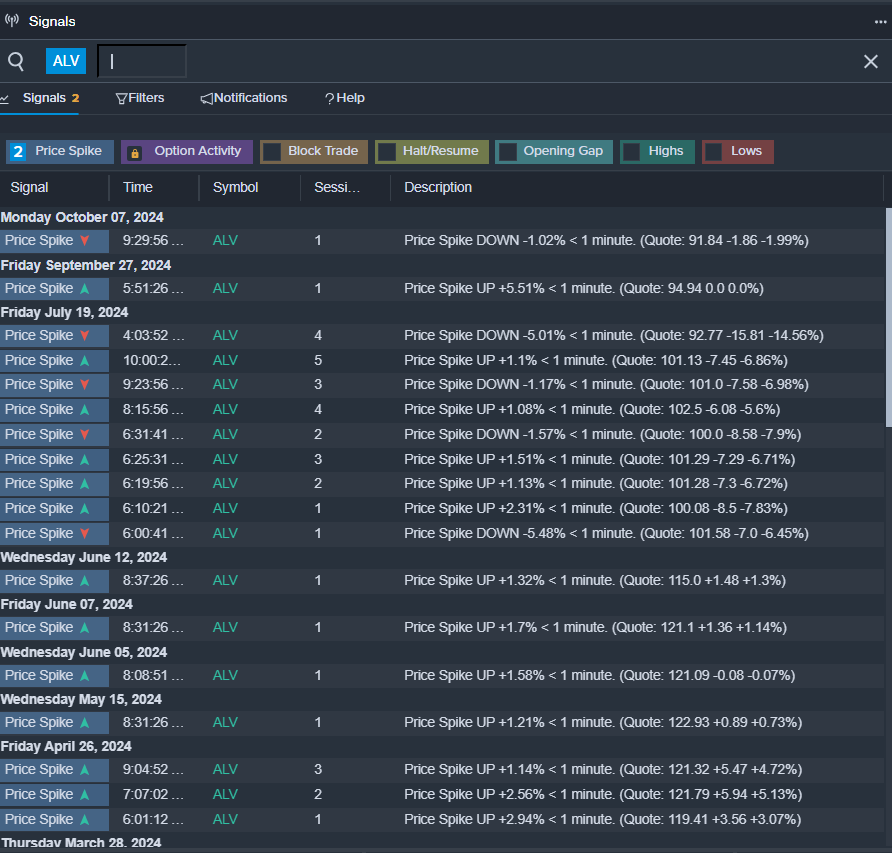

Autoliv Inc (ALV)

- On Oct. 18, Autoliv announced strong third-quarter sales results, defying market challenges. Despite a 6% surge in the past five days, with a 52-week high of $129.38, the company managed stable sales and operating income, showcasing resilience in a tough market.

- RSI Value: 70.49

- ALV Price Action: Autoliv’s shares closed at $99.52 on Friday, reflecting a 6% increase.

- Staying alert to Benzinga Pro’s signals is crucial for identifying potential shifts in ALV shares.

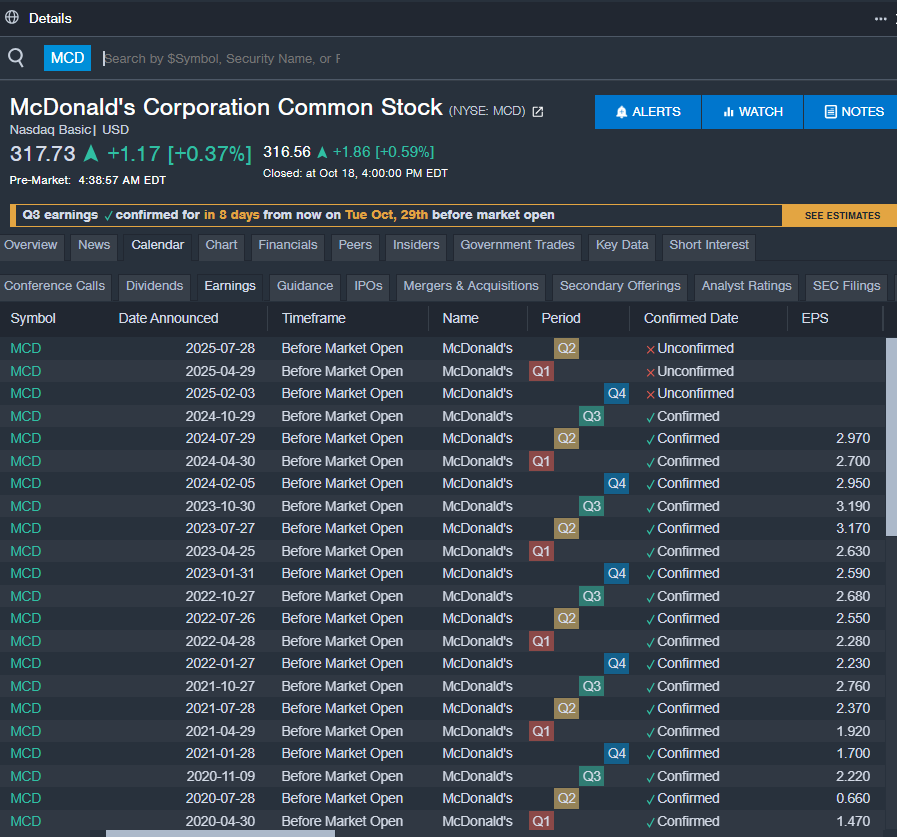

McDonald’s Corp (MCD)

- On Oct. 16, TD Cowen analyst Andrew Charles maintained McDonald’s at Hold with an enhanced price target of $300. The stock witnessed a 6% surge in the past month, with a 52-week high of $317.18.

- RSI Value: 82.85

- MCD Price Action: McDonald’s shares closed at $316.56 on Friday, marking a 0.6% rise.

- Tracking upcoming earnings announcements for McDonald’s is simplified with the help of Benzinga Pro’s earnings calendar.

Read More: No further details are available

Market News and Data brought to you by Benzinga APIs