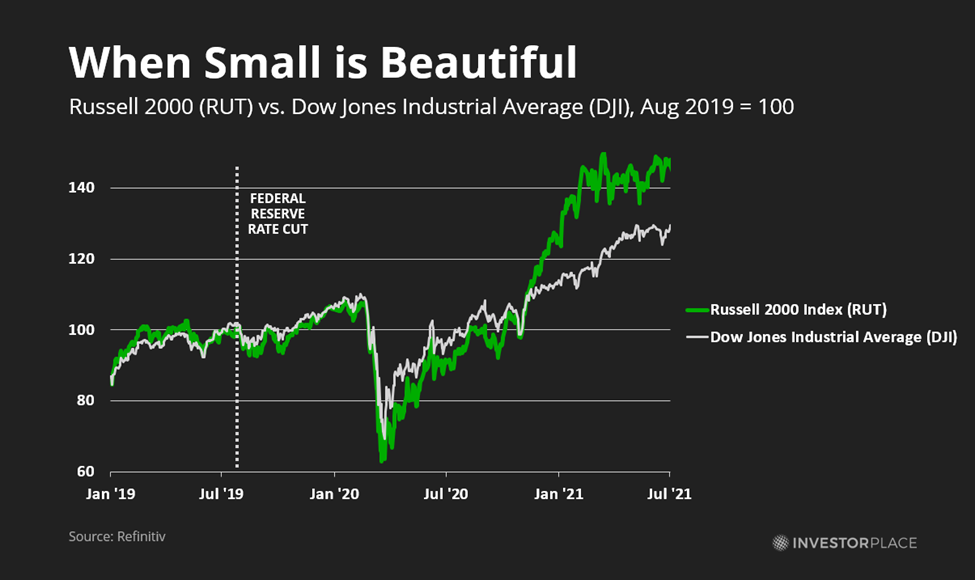

As the financial world navigated turbulent waters post-2019, small-cap stocks emerged as the unexpected victors, outshining even the stalwarts of the Dow Jones Industrial Average. The Russell 2000 index witnessed an impressive 34% surge, eclipsing the Dow Jones’ 19% gains. This era unveiled a new reality – one where smaller, nimble companies reigned supreme in the investing realm.

Embracing the Automation Revolution

The dawn of automation beckons, with the ILA’s recent strike echoing a larger societal concern – the encroachment of artificial intelligence on traditional job roles. Dockworkers grapple with the existential threat of innovation, yearning for guarantees against automation in their sector. However, the tide of progress waits for no one, as AI innovations such as those from ABB Ltd. and Symbotic Inc. reshape industries.

The portents of automation have already been set into motion, with AI solutions poised to disrupt conventional labor paradigms.

Amidst this transformation, Evolv Technologies Holdings Inc. emerges as a beacon of hope, revolutionizing security processes through AI integration. With seamless scanning and threat detection capabilities, Evolv presents a compelling case for the future of security operations in domains like transportation and large-scale events.

Navigating Risk with Strategic Investments

Amidst the tumult of market dynamics, strategic investors seek havens of stability and growth prospects. Eli Lilly and Co. emerges as a beacon of resilience, offering risk-adjusted returns in an uncertain economic landscape.

The Small-Cap Investment Universe: Hidden Gems Beyond the Giants

When it comes to the realm of pharmaceuticals, established giants like Eli Lilly have long dominated the landscape, their histories rich with scientific breakthroughs and market triumphs. However, as with any great dynasty, there comes a time when challengers emerge – young, nimble, and hungry for a piece of the pie.

A New Generation of Drug Developers

As Eli Lilly continues its legacy of innovation, newer players are stepping up to offer fresh perspectives and alternatives. Companies like Viking Therapeutics, Zealand Pharma, Structure Therapeutics, Altimmune, and Terns Pharmaceuticals are making waves in the highly competitive arena of weight-loss drugs.

- Viking Therapeutics: With a rapid pace of drug development, this San Diego-based firm is aiming to disrupt the status quo.

- Zealand Pharma: Hailing from Denmark, this research powerhouse is hot on the heels of industry giants with its promising pipeline.

- Structure Therapeutics: Focusing on oral-based weight-loss solutions, this company presents an enticing buy-out target for industry leaders.

- Altimmune Inc.: Leveraging the power of clinical trials, Altimmune is carving its niche with its GLP candidate.

- Terns Pharmaceuticals Inc.: Despite being a newcomer, Terns offers a diversified approach to tackling obesity, hinting at potential breakthroughs.

These emerging stars provide investors with a fresh perspective, offering higher risks but the promise of substantial rewards in a market dominated by behemoths.

The Nuclear Option: A Glowing Opportunity

Shifting gears from pharmaceuticals to uranium, the nuclear energy sector presents a landscape ripe with potential. Cameco Corp., BWX Technologies Inc., and NuScale Power Corp. stand as stalwarts in the industry, offering stability but limiting upside potential.

For those seeking a bolder play, Uranium Energy Corp. emerges as a standout candidate. With significant reserves and a track record of insider confidence, this company blends existing projects with untapped potential, hinting at a bright future in the realm of uranium exploration.

A Visionary Move: The Small-Cap Self-Driving Revolution

As the race for self-driving technology heats up, companies like Tesla are at the forefront of innovation. However, amidst the buzz surrounding Musk’s “Robotaxi Day,” a small-cap stock lurks in the shadows, poised to play a crucial role in the industry’s evolution.

With the potential to become a key supplier to industry leaders, this under-the-radar gem offers investors a shot at exponential growth, presenting an opportunity that could rival even the most hyped announcements from the established giants.

Investing in small-cap stocks isn’t just about financial gains; it’s a bold statement of faith in the power of innovation and the spirit of entrepreneurial drive. As these upstarts redefine the boundaries of what’s possible, investors stand to reap the rewards of courage and vision in an ever-evolving market landscape.