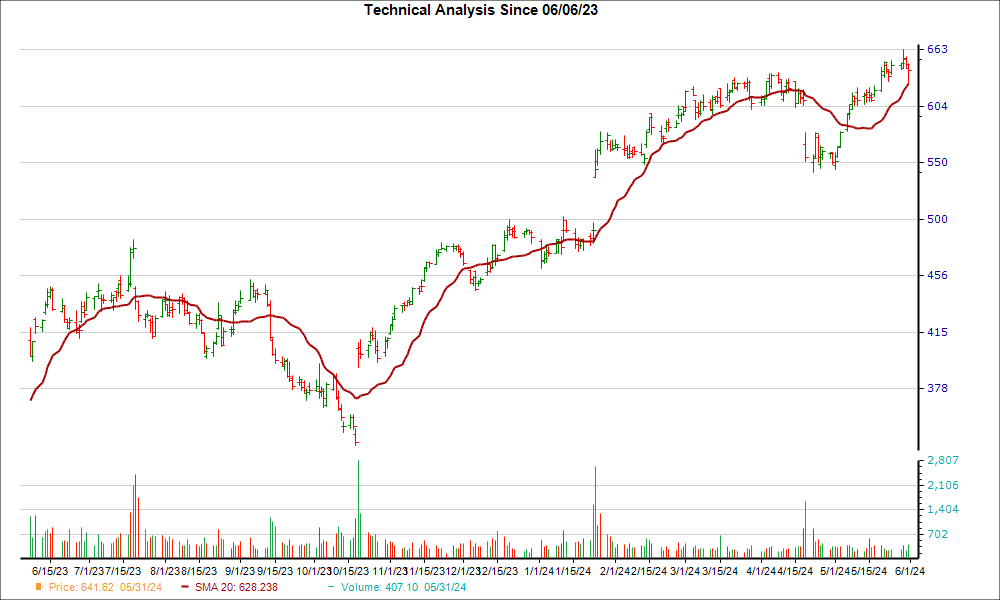

Technical Indicator Insight

Netflix (NFLX) is currently catching the eye of investors for its recent performance against a crucial technical benchmark. The company has surged past the 20-day moving average, hinting at a potential short-term uptrend.

In the realm of investing, the 20-day simple moving average holds significant sway. Traders favor this indicator for its ability to provide a retrospective view of a stock’s price movement over a concise period, thereby smoothing out price fluctuations. Moreover, the 20-day moving average is adept at revealing trend reversals compared to longer-term moving averages.

Once a stock’s price surpasses the 20-day moving average, it often signifies a favorable trend, while a decline below this average can indicate a bearish trend.

Following a 9% climb over the past four weeks, NFLX seems poised for another surge. Additionally, the company currently holds a Zacks Rank #2 (Buy).

Strong Technical Position

The bull case gains further strength when considering NFLX’s positive earnings estimate adjustments. Not a single estimate for the ongoing fiscal year has seen a downward revision in the last two months; conversely, 10 estimates have been revised upwards, while the consensus estimate has also seen an uptick.

Given the company’s optimal technical standing and the optimistic earnings revisions, investors are advised to keep a close watch on Netflix (NFLX) for further potential gains in the near future.