Unveiling Oversold Gems

The consumer staples sector has been abuzz with the news of oversold stocks presenting themselves as golden opportunities for discerning investors. The Relative Strength Index (RSI), a trusted momentum indicator, has been signaling potential buys among undervalued companies, offering a glimmer of hope amidst market volatility.

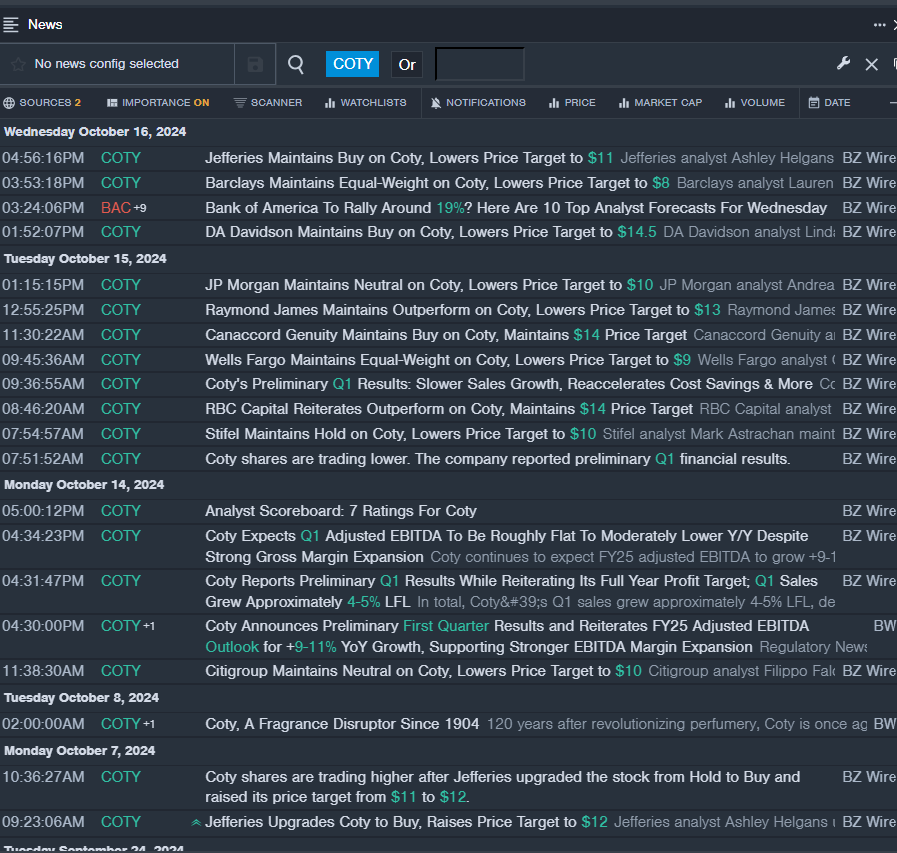

Coty Inc

- Oct. 14 saw Coty Inc unveil its preliminary first-quarter results alongside a reiterated FY25 adjusted EBITDA outlook, projecting a promising 9-11% year-over-year growth. Despite this positive stance, the company’s stock nosedived approximately 11% over the last five trading days, hitting a 52-week low of $7.95.

- RSI Value: 29.19

- COTY Price Action: The unsettling trajectory continued as shares of Coty dipped by 2.3%, concluding at $7.99 on Wednesday.

22nd Century Group Inc

- Sept. 13 witnessed 22nd Century Group Inc’s Chairman and CEO, Lawrence Firestone, make a significant purchase of 39,000 shares at an average price of 27 cents per share. However, the company’s stock faced a stark decline of about 43% over the past week, marking a 52-week low of $0.10.

- RSI Value: 22.29

- XXII Price Action: The downward spiral persisted as shares of 22nd Century Group plummeted by 17.4%, closing at $0.11 on Wednesday.

Mangoceuticals

- On Oct. 14, Mangoceuticals rocked investors with a surprising 1-for-15 reverse stock split. This move was accompanied by a steep 21% drop in the company’s stock prices over the preceding five days, touching a 52-week low of $2.14.

- RSI Value: 29.63

- MGRX Price Action: Further adding to the turmoil, shares of Mangoceuticals slid by 6.8%, settling at $2.47 by the closing bell on Wednesday.

This recent turbulence has sent shockwaves throughout the sector. However, diligent investors stand poised to capitalize on these shaky grounds, potentially witnessing a turnaround in fortunes.

Keep a close eye on these undervalued gems as they navigate the challenging waters of the market, presenting a unique opportunity for those willing to take the plunge into the world of oversold stocks.

Disclaimer: The content in this article is for informational purposes only and should not be construed as investment advice.