The Rapid Rise of Nvidia Stock

Investors in Nvidia Corp (NVDA) have reason to rejoice as the company’s shares closed at $138 on Friday, marking a 233% surge in the past year. The market capitalization now stands tall at over $3 trillion, drawing attention from bullish experts who foresee further upside potential.

Optimistic Outlook from Industry Experts

Several prominent figures in the tech and financial sectors are echoing optimistic sentiments regarding the future trajectory of Nvidia’s stock value. Ram Ahluwalia, CEO of Lumida Wealth Management, projects a potential $4 trillion valuation for the company, underlining the robust demand for GPU chips. T. Rowe Price portfolio manager Tony Wang and Dan Niles, founder of Niles Investment Management, are among those who share the belief in Nvidia’s growth prospects, with Niles even predicting a doubling of both revenues and stock value over the coming years.

Goldman Sachs also sees a bright path ahead for Nvidia, particularly in the realm of Inference compute, where exponential growth could unfold. This positive outlook is further reinforced by Bofa Securities, which not only maintains a ‘Buy’ rating on the stock but has raised its price target from $165 to $190.

Market Trends and Potential

The consensus price target for Nvidia stands at $234.49, reflecting the confidence of 38 analysts in the stock’s upward momentum. With a staggering year-to-date increase of almost 186.5%, Nvidia has solidified its position as a top performer in the market, boasting a market cap of approximately $3.39 trillion.

Comparative Market Standing

Surpassing a 233% surge in the past year, Nvidia’s stock price has skyrocketed from $41 to $138, outperforming various ETFs tracking its performance. Notably, both the GraniteShares 2x Long NVDA Daily ETF (NVDL) and the Direxion Daily NVDA Bull 2X Shares (NVDU) have yielded remarkable gains exceeding 440% during the same period.

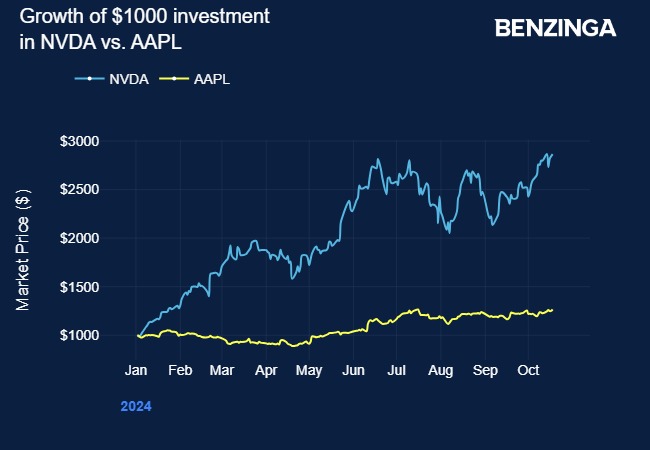

With Apple being the sole American company boasting a higher market cap than Nvidia, the potential for further growth remains a tantalizing prospect. As Nvidia charts its upward trajectory with unwavering momentum, the tech world eagerly awaits the unfolding chapters of this remarkable success story.