The Quest for Undervalued Consumer Stocks

Opportunities in the stock market are akin to hidden treasures waiting to be discovered. The realm of consumer stocks, in particular, is buzzing with potential gems that may have been overlooked. As traders navigate the tumultuous seas of price action, the RSI indicator emerges as a compass, guiding them towards promising prospects.

Exploring Oversold Territory

When the RSI indicator dips below 30, consumer stocks are said to have ventured into oversold territory. This signals a potential buying opportunity for savvy investors looking to capitalize on undervalued companies.

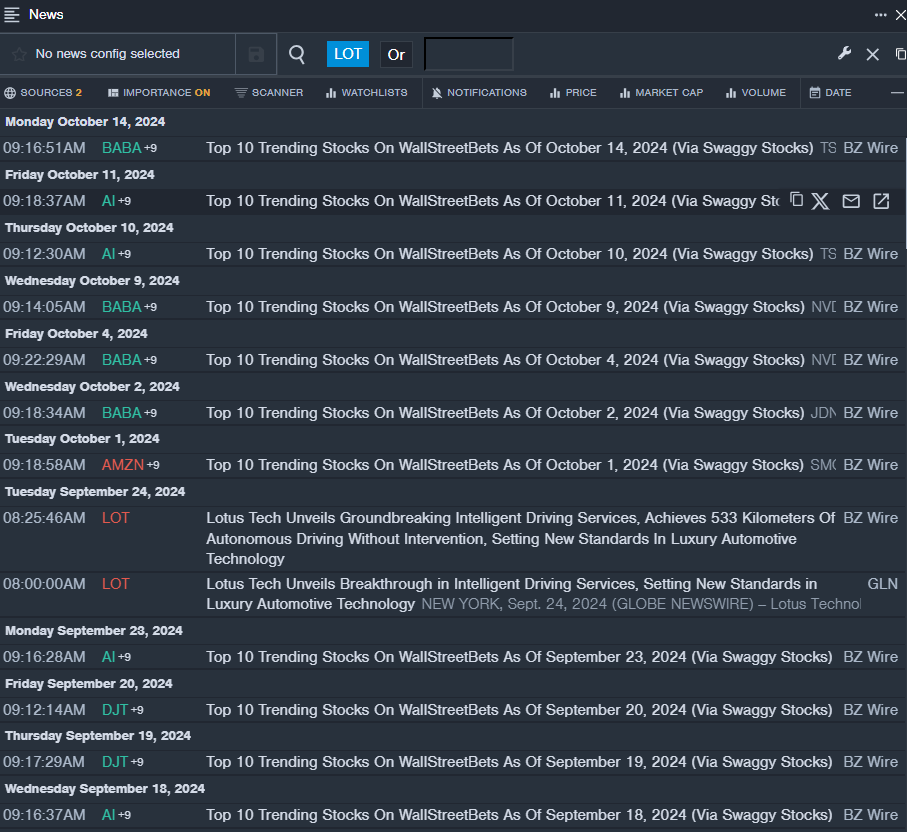

Lotus Technology Inc – ADR (LOT)

- Lotus Tech recently made waves with its groundbreaking innovations in intelligent driving services, elevating the bar for luxury automotive technology. Despite this, the company’s stock witnessed a decline of approximately 14% over the past month, reaching a 52-week low of $4.27.

- RSI Value: 27.96

- LOT Price Action: Shares of Lotus Technology experienced a modest 0.8% drop, trading at $4.32 on a recent Wednesday.

Stride Inc (LRN)

- Stride Inc found itself in the spotlight following a report by Fuzzy Panda Research that raised concerns about the company heavily relying on Covid funds. With its stock plummeting around 20% in the last month and hitting a 52-week low of $43.77, LRN faces uncertain times.

- RSI Value: 17.43

- LRN Price Action: Stride’s shares took a 6.6% nosedive, closing at $65.94 during a midweek trading session.

Digital Brands Group Inc (DBGI)

- Amidst regulatory challenges, Digital Brands Group received a delisting notice from the Nasdaq, leading to a sharp 59% drop in its stock value over the past month. With a 52-week low of $0.14, DBGI is navigating stormy waters.

- RSI Value: 28.93

- DBGI Price Action: Digital Brands witnessed a substantial 10.9% decrease, concluding at $0.20 in recent trading activity.

Despite the trials and tribulations faced by these consumer stocks, the observant trader may discern hidden potential waiting to be unleashed. As the market ebbs and flows, opportunities arise for those with a keen eye and strategic acumen to uncover the buried treasures within.