Investors, brace yourselves! The oversold stocks in the utilities sector are creating a compelling opportunity – a chance to dive into undervalued companies at bargain prices.

One can gauge the potential of these stocks through the Relative Strength Index (RSI). This momentum indicator, comparing a stock’s strength on up-days to down-days, offers traders a glimpse into its short-term performance. When the RSI falls below 30, the stock is deemed oversold, signaling a possible rebound on the horizon.

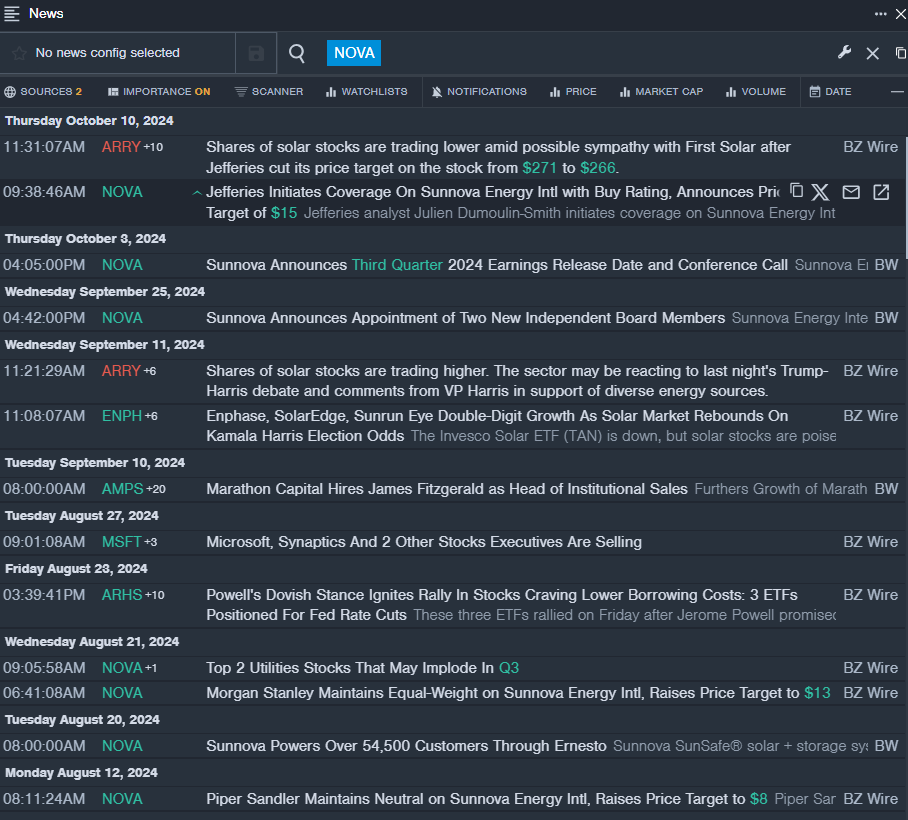

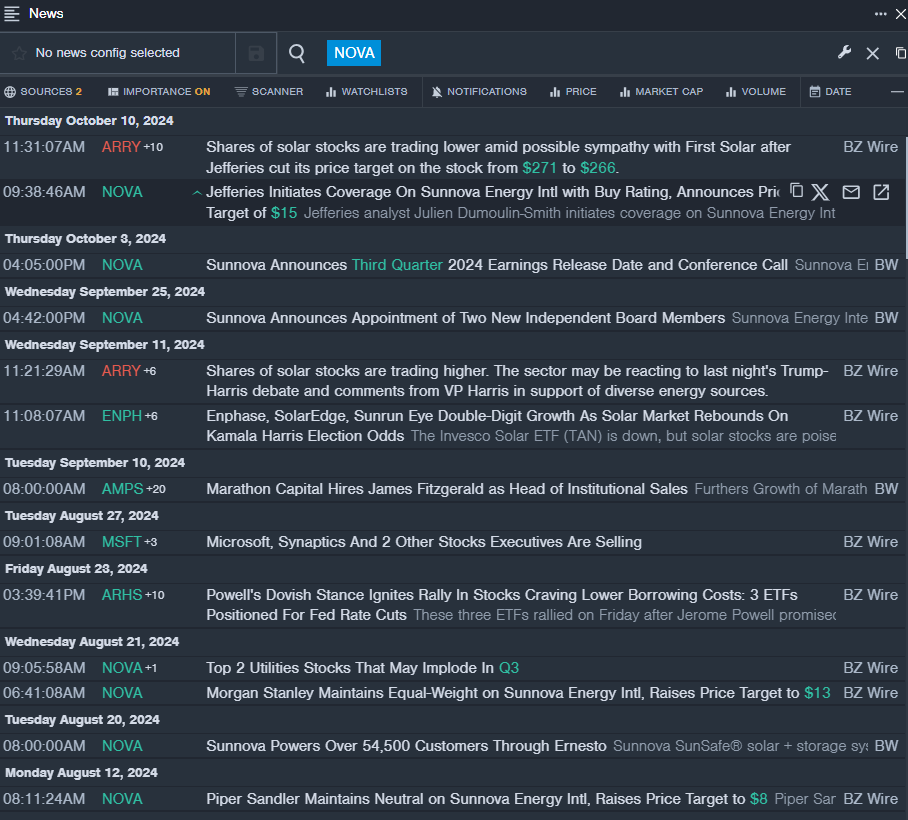

Sunnova Energy International Inc – NOVA

- Jefferies analyst Julien Dumoulin-Smith recently bestowed a Buy rating on Sunnova Energy Intl, setting a price target of $15. After tumbling approximately 43% in the past month, with a 52-week low of $3.37, this stock now boasts an RSI value of 29.94.

- On Friday, Sunnova Energy’s stock inched up by 1.1%, closing at $6.57.

VivoPower International PLC – VVPR

- VivoPower’s Tembo recently inked a significant deal with Sarao Motors in the Philippines’ lucrative jeepney market, valued at a staggering US$10 billion. Amid a 59% decline over the last month and a 52-week low of $0.73, VivoPower’s RSI value now sits at 28.53.

- Closing at $0.78 on Friday, VivoPower’s stock saw a marginal uptick of 0.1%.

What an intriguing landscape for astute investors! These undervalued gems, despite recent declines, offer the potential for a lucrative upswing. The RSI values, standing below 30, hint at a probable reversal in fortunes. So, is it time to seize the moment and dive into these bargain opportunities?

Market News and Data brought to you by Benzinga APIs