If you’ve been keeping your eye on the financial market pulse, you’re likely aware that the technology sector, particularly software stocks, is currently attaining unprecedented highs. The recent rapid surges have left many of these stocks soaring beyond the reach of most investors. However, a select few software stocks seem to be lagging behind, presenting a golden opportunity for savvy investors to capitalize on their hidden potential before they skyrocket.

Despite the ongoing market frenzy, there exist software gems poised for a major upswing due to a variety of factors.

Datadog: Unseen Potential

One such diamond in the rough is Datadog (NASDAQ: DDOG). This tech company, with its $40 billion market cap, might not boast the name recognition of its peers, yet its growth potential is undeniable. While the stock has dipped 37% from its late-2021 peak and remained relatively stagnant this year, Datadog’s observability products offer a unique proposition to enterprises managing extensive networks of servers and cloud-computing platforms. Gartner ranks Datadog as a top player in observability software, particularly excelling in cybersecurity, facilitating real-time threat detection and response.

Despite the stock’s premium valuation, Datadog’s robust revenue growth trajectory makes it a compelling investment opportunity. With anticipated year-over-year revenue growth of 24% and subsequent earnings growth projections, Datadog’s fiscal health signals sustained growth potential well into the future.

HubSpot: Disrupting the CRM Space

HubSpot (NYSE: HUBS), a CRM software provider, has managed to carve out a significant market share, placing it on the heels of industry behemoth Salesforce. While Salesforce dominates in revenue, HubSpot’s customer-centric approach has earned it accolades for delivering on its promises to clients. Despite a recent stock underperformance, HubSpot’s projected revenue and earnings growth rates indicate a promising outlook for investors.

Microsoft: The Time-Tested Contender

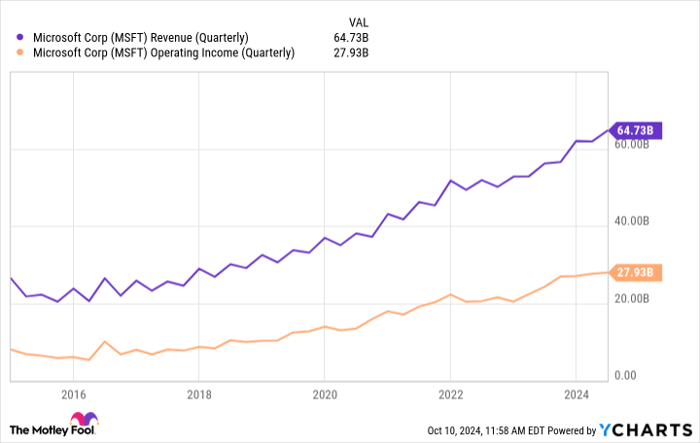

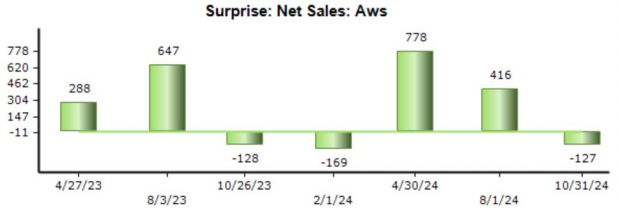

Adding Microsoft (NASDAQ: MSFT) to the list of potential software stocks set to surge is a prudent move. Despite its long-standing presence in the market, Microsoft has lagged in recent months compared to its tech counterparts. Competitors catching up in the AI realm have prompted concerns, leading to stock downgrades. However, Microsoft’s diversified revenue streams, formidable brand reputation in consumer and corporate spheres, and robust cloud computing segment underscore its resilience and growth potential.

Moreover, Microsoft’s dominance in cloud computing, outpacing even industry titan Amazon, positions it favorably for sustained growth in this critical sector. The company’s consistent mid-teen revenue and earnings growth paint a positive outlook for prospective investors.

Unlocking the Potential of Microsoft Stock: A Deep Dive for Investors

Reassessing the Outlook

As investors navigate the unpredictable waters of the stock market, one thing remains constant – the allure of Microsoft stock. Despite a history of lukewarm performance, the tide may be turning in favor of this tech giant. Analyst sentiment is unwavering, with over three-quarters of experts maintaining a steadfast ‘strong buy’ rating on Microsoft shares.

Charting Success

Analyzing the quarterly revenue chart of Microsoft unveils a fascinating narrative. While the stock may have lacked luster in the past, a promising trajectory lies ahead. The consensus-price target of $497.04, set by seasoned analysts, stands as a beacon of hope for investors – signaling a potential upswing of nearly 20% from the current valuation.

A Bold Investment?

Contemplating a $1,000 investment in Microsoft demands careful consideration. The Motley Fool Stock Advisor team, renowned for their astute market insights, casts a spotlight on the top 10 stocks for investors – with Microsoft notably absent from this elite list. Could this omission be a red flag, or does it merely mask the latent potential waiting to be tapped?

Reflecting on Historical Success

Delving into the past unveils remarkable success stories, like that of Nvidia which graced the esteemed list in 2005. An investment of $1,000 back then would have ballooned into an eye-watering $826,069 today. The lesson is clear – foresight can yield substantial rewards in the fickle world of stocks.

Proven Track Record

The Stock Advisor service emerges as a guiding light for novice and seasoned investors alike. With a track record that surpasses the S&P 500 fourfold since 2002, this platform offers a blueprint for success. Regular updates, expert stock picks, and invaluable portfolio-building strategies make it a compelling resource for those seeking financial growth.

Investors contemplating the leap into Microsoft stock must weigh the advice of both seasoned analysts and historical success stories. The market is rife with possibilities, and as the saying goes, fortune favors the bold.