Investors eye undervalued gems in the real estate sector as they surge into oversold stocks.

RSI, the momentum indicator, reveals a potential short-term performance of stocks by comparing strength on up and down days. When RSI dips below 30, experts consider an asset oversold, as noted by Benzinga Pro.

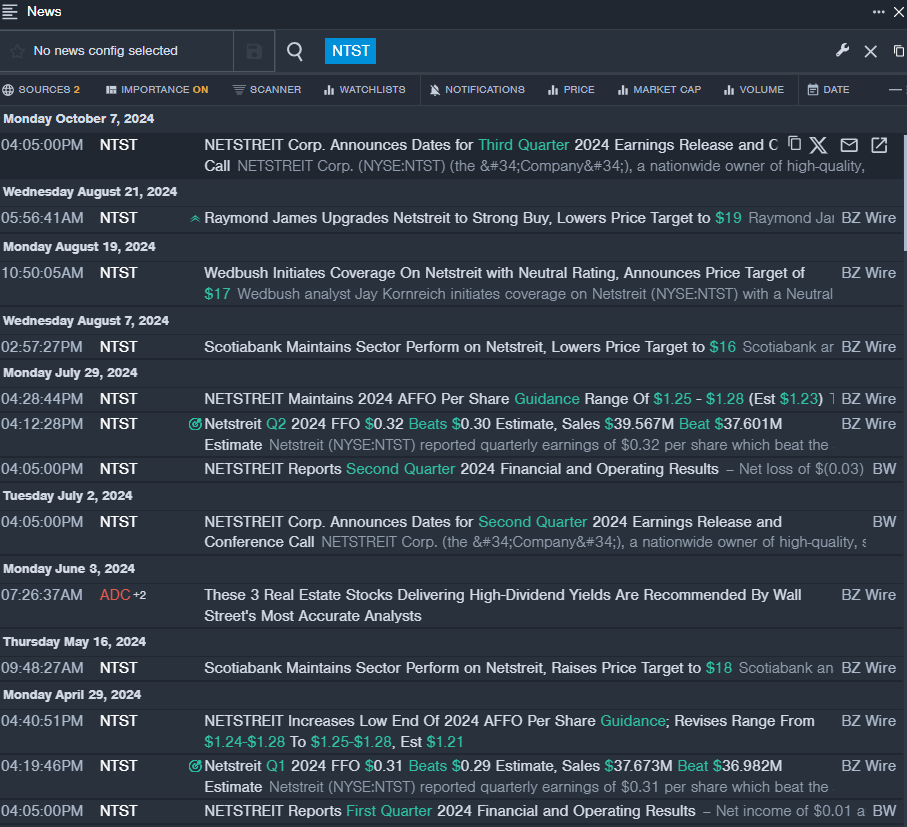

NetSTREIT Corp NTST

- NETSTREIT announced its Q3 2024 results are due on Nov. 4, 2024, post NYSE hours closure. Shares saw a recent 10% slump with a 52-week low of $13.49.

- RSI Value: 27.18

- NTST Price Action: Closing at $15.44 on Thursday, NetSTREIT caught the investors’ eye.

Lineage Inc LINE

- Lineage will unveil its Q3 2024 financial results on Nov. 6, 2024, before the markets open, post a recent 10% downtrend. They possess a 52-week low of $73.16.

- RSI Value: 26.01

- LINE Price Action: With shares closing at $73.99 on Thursday, Lineage Inc garnered attention.

Prologis Inc PLD

- Barclays’ Anthony Powell, on Oct. 10, lowered Prologis’ price target to $131 but retained an Overweight rating. The company, with an 11% recent dip and a 52-week low at $10.02, stirred interest.

- RSI Value: 28.20

- PLD Price Action: Closing at $118.28 on Tuesday, Prologis Inc’s potential was under the radar.

Market News and Data brought to you by Benzinga APIs