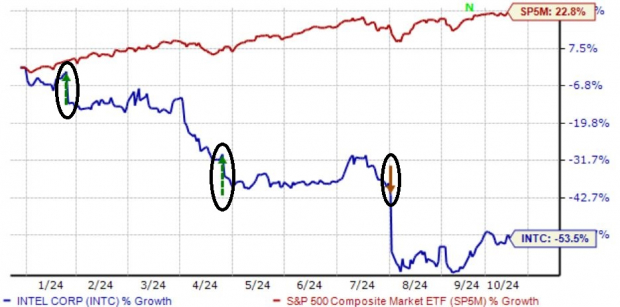

Intel INTC shares have faced a turbulent journey in 2024, failing to catch the wind in the semiconductor sector and witnessing a sharp decline of over 50%. Quarterly results have only added insult to injury, with the stock struggling to gain momentum post-earnings.

Take a glance at the chart below showcasing the year-to-date performance of Intel shares in comparison to the S&P 500, with quarterly releases highlighted by circled arrows.

Image Source: Zacks Investment Research

Despite the downtrend from previous highs, is it perhaps time to seize the moment and consider investing in Intel shares? Let’s delve deeper into the current scenario.

A Closer Look at Intel’s Bearish Outlook

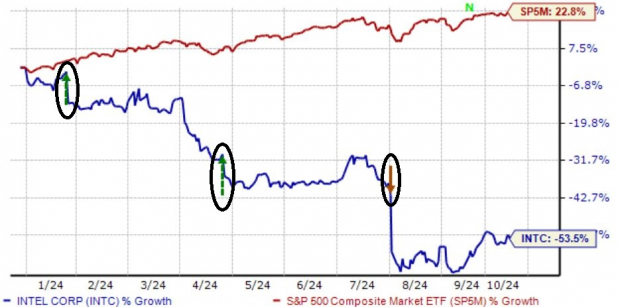

Presently, Intel holds a Zacks Rank #4 (Sell), reflecting pessimistic earnings estimates from analysts. Projections for its ongoing fiscal year have taken a notable hit, with the Zacks Consensus EPS estimate of $0.27 plummeting by 85% over the past year.

The unfavorable revisions, stemming from disappointing quarterly results, do not paint a pretty picture for the stock’s near-term performance.

Image Source: Zacks Investment Research

Nevertheless, it’s important to highlight that CEO Pat Gelsinger exhibits confidence by purchasing 12.5k shares worth around $250k in early August post the latest quarterly report. He acknowledged unexpected challenges in the second half but remains optimistic about the company’s market positioning.

Focused on mitigating margin pressures, Intel has intensified its cost-cutting initiatives in recent periods, as seen in the following chart. Notably, in August, Intel unveiled a $10 billion cost-savings target.

Keep in mind that the chart below displays data on a trailing twelve-month basis.

Image Source: Zacks Investment Research

Should Investors Consider Buying Intel Shares?

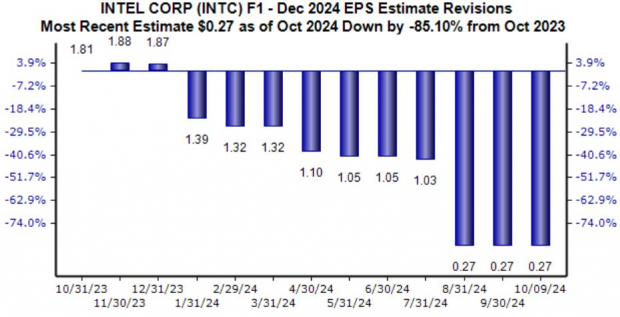

It’s advisable for investors to hold off until positive earnings estimate revisions emerge, indicating a significant shift in sentiment. Anticipations for the upcoming release scheduled on October 24th have already been slashed, with the company now anticipated to report a loss of -$0.03 per share.

Image Source: Zacks Investment Research

Intel shares have witnessed a surge in the last month, gaining close to 20%. While the upward momentum is encouraging, the spike is likely due to a short squeeze triggered by acquisition rumors.

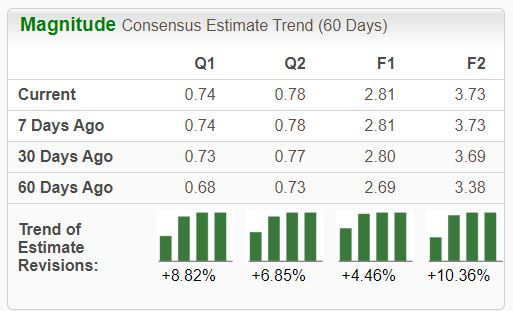

For those eyeing exposure to the semiconductor market, several more optimistic options are on the horizon, with Nvidia NVDA being a prime example. Nvidia currently holds a Zacks Rank #2 (Buy), with its earnings forecast showing a positive trajectory post exceptional quarterly outcomes.

Moreover, Nvidia’s revenue is projected to more than double in the ongoing fiscal year.

Image Source: Zacks Investment Research

Exploring Zacks’ Investment Offer

Years back, Zacks startled members by providing a 30-day access to all recommendations for just $1. No strings attached. Thousands seized this opportunity, while others hesitated, questioning if there was a catch. The motive is simple: to acquaint you with services like Surprise Trader, Stocks Under $10, and more, which closed 228 positions with substantial gains in 2023 alone.

Intel Corporation (INTC) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report