Investors’ decisions on stocks often hinge on analyst verdicts. The call by brokerage firm analysts on stocks like Netflix (NFLX) holds sway over market movement. But what’s the true worth of these recommendations?

Before delving into the reliability of broker recommendations and their strategic use, let’s first glance at Wall Street’s stance on Netflix.

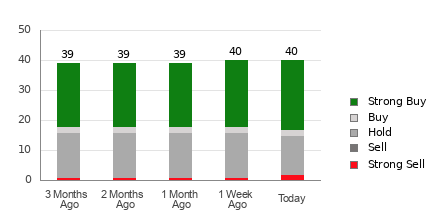

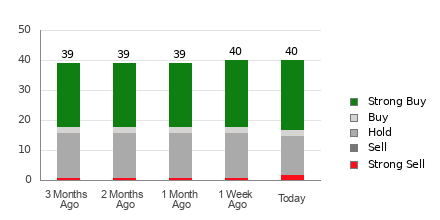

Netflix currently carries an average brokerage recommendation (ABR) of 1.89, a figure that signifies a consensus among 40 brokerage firms. Positioned between Strong Buy and Buy on a scale of 1 to 5, the ABR leans towards a favorable outlook.

Of the 40 voices that compose the ABR, 23 shout Strong Buy, while only two chant Buy. This translates to 57.5% for Strong Buy and a mere 5% for Buy.

Tracking Trends in Brokerage Recommendations for NFLX

While the ABR may spark interest in Netflix, relying solely on it might not be a prudent move. Studies show brokerage recommendations often fall short in predicting stocks with the highest price surge potential.

Ever wondered why? Brokerage firms, tethered to stocks they cover, tilt their recommendations towards a positive bias. As per research, for every “Strong Sell” recommendation, there are five “Strong Buy” recommendations.

These recommendations might not necessarily align with retail investors’ interests, leaving room for doubt on the true course of a stock’s price. Hence, it’s best to view these as a supplement to personal research or a tool that complements other effective indicators for predicting stock price movement.

Zacks Rank, a proprietary stock rating tool, sorts stocks into five bands, from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell). This tool, with a solid audited track record, acts as a reliable gauge for a stock’s near-future price trajectory. Thus, validating the ABR against the Zacks Rank could aid in making a well-informed investment choice.

Differentiating Zacks Rank from ABR

Although both ABR and Zacks Rank utilize a scale from 1 to 5, they are distinct metrics.

ABR hinges solely on broker recommendations, typically displayed in decimals, like 1.28. Conversely, Zacks Rank employs a quantitative model capitalizing on earnings estimate revisions, showcased in whole numbers – 1 to 5.

Broker analysts, led by their firms’ interests, are often excessively optimistic in their ratings, potentially misleading investors. In contrast, Zacks Rank is molded by earnings estimate revisions, a factor strongly correlated with short-term stock price shifts.

Zacks Rank’s grades are uniformly applied across all stocks with current-year earnings estimates, ensuring fair evaluation. Moreover, Zacks Rank promptly reflects earning trends as brokerage analysts update their estimates, enhancing its timeliness in predicting future price movements.

Is Netflix (NFLX) a Promising Investment?

Noteworthy increments in Netflix’s earnings estimate revisions have lifted the Zacks Consensus Estimate for the year to $19.09, up by 0.1% in the past month.

The burgeoning optimism among analysts, evident in their unanimous upward revisions of EPS estimates, could potentially propel the stock in the short term. This shift, combined with other earning-related factors, secures a Zacks Rank #2 (Buy) for Netflix.

Given this scenario, Netflix’s Buy-equivalent ABR could offer valuable insights to investors.

Unlock All Zacks’ Picks for Just $1

Yes, you read it right.

Years back, we astonished our members by granting them a 30-day pass to all our selections for a mere $1. No strings attached.

While many seized this opportunity, a few remained skeptical. But fret not, our intention was clear. We aimed for you to explore our diverse portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators, and more, boasting 228 positions with double- and triple-digit gains in 2023 alone.

Seek expert insights from Zacks Investment Research. Download 5 Stocks Set to Double for free now.

Netflix, Inc. (NFLX) : Free Stock Analysis Report