Uncovering Oversold Gems

Investing in the stock market is often likened to a grand treasure hunt, where the savvy and vigilant may uncover hidden gems that hold the promise of great returns. In the industrials sector, the concept of oversold stocks beckons like a siren song to investors seeking undervalued opportunities.

Unlocking the RSI Code

One key tool in the arsenal of investors is the Relative Strength Index (RSI), a momentum indicator that unveils the underlying strength of a stock amidst the ebb and flow of market fluctuations. A stock is deemed oversold when its RSI dips below the 30 threshold, signaling a potential buying opportunity in the eyes of astute traders.

The Industrials Underdogs

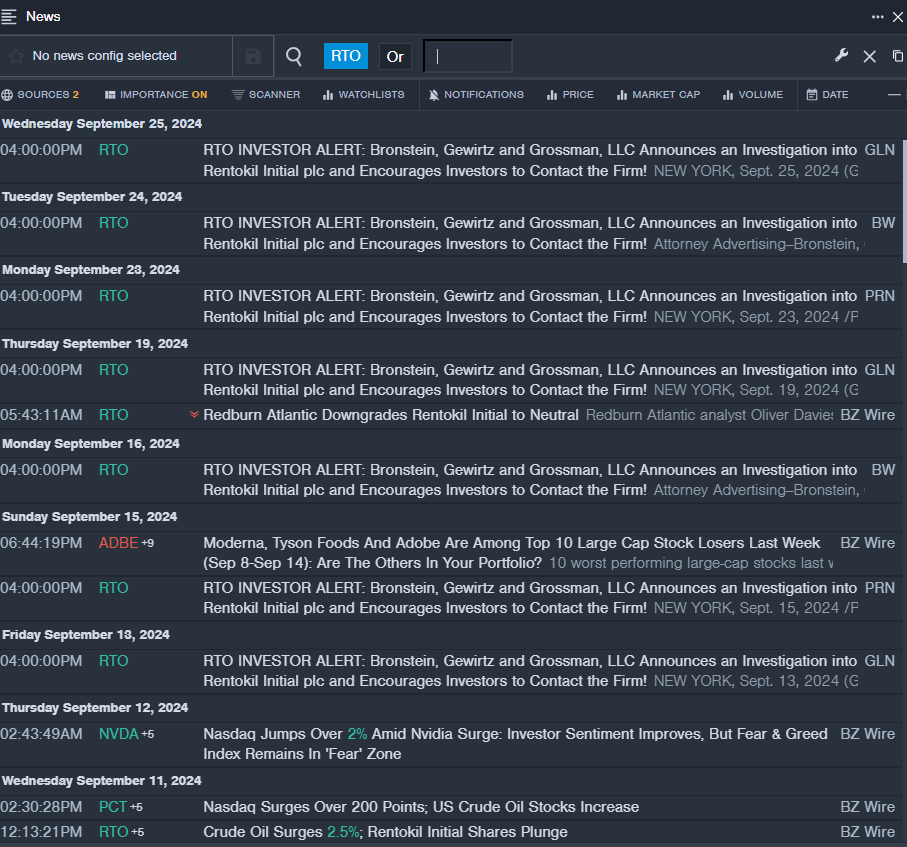

Among the notable players in the industrials sector currently flashing signals of being oversold are Rentokil Initial plc, Blue Bird Corp, and Concentrix Corp. These companies, despite their recent downtrends, may be on the brink of a turnaround that could see their stocks soar.

Rentokil Initial plc

With Rentokil Initial revising its guidance for the second half of FY24, the company’s organic revenue growth projections for its North America operations paint a cautiously optimistic picture. The recent dip in stock price, coupled with an RSI value hovering just below 30, could represent an intriguing entry point for discerning investors.

Blue Bird Corp

Following a downgrade by Roth MKM analyst Craig Irwin, Blue Bird Corp finds itself in the oversold territory with an RSI value indicating potential value. Despite recent stock price declines, the company’s fundamentals may hold the key to a future resurgence.

Concentrix Corp

Baird analyst David Koning’s initiation of coverage on Concentrix with an Outperform rating adds a glimmer of positivity to the company’s current oversold status. With the RSI hitting a low point, this could be a moment of opportunity for investors looking to capitalize on a possible upswing.

Reading the Signals

Delving into the realm of oversold stocks requires more than just numbers; it demands a keen eye for patterns and a strategic mindset. By staying attuned to signals like RSI values and expert analyses, investors can position themselves to ride the wave of potential gains that these undervalued industrials stocks may offer.