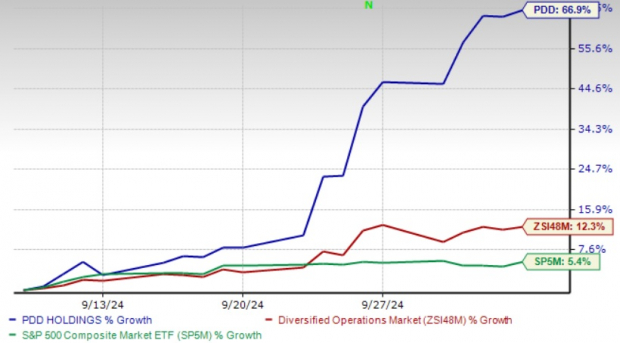

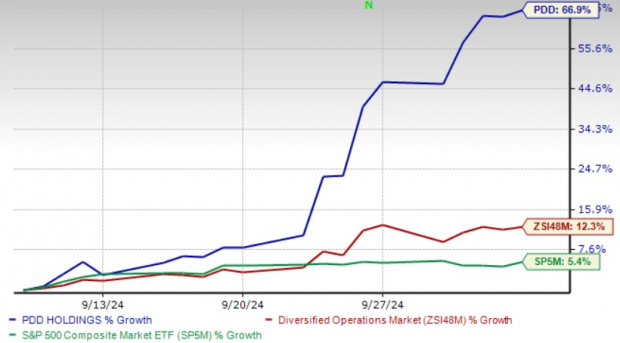

PDD Holdings has been on a rollercoaster ride, soaring 66.9% in just one month, leaving behind its industry’s 12.3% gain and the S&P 500 index’s 5.4% return. This stark rise can be attributed to the recent stimulus efforts by the People’s Bank of China, aimed at resuscitating the nation’s faltering economy.

The central bank’s strategic moves, including interest rate cuts and relaxed restrictions on stock investments, have paved the way for PDD to shine in the short term.

Unveiling One Month’s Market Performance

Image Source: Zacks Investment Research

Delve into Attractive Valuation: Silver Linings for PDD

PDD Holdings is presently trading at a bargain, with a forward Price/Earnings ratio of 11.94X, below the industry’s 16.89X and the median 16.98X. This spells a lucrative opportunity for investors.

Image Source: Zacks Investment Research

Thrust of E-commerce Business Driving PDD’s Growth

PDD Holdings’ surge can be mainly attributed to the momentum of its Pinduoduo platform, boasting an array of product offerings including agricultural produce, apparel, electronics, furniture, and more. Its vibrant promotional activities have been pivotal in elevating customer engagement.

The company’s unwavering commitment to enhancing its technological infrastructure alongside strengthening relationships with global brands and merchants underscores its long-term growth agenda.

PDD’s Earnings Outlook and Market Challenges

Concerns loom over PDD Holdings amid economic downturns, market fluctuations, and fierce competition both domestically and internationally. The ongoing US-China tensions pose further threats.

Despite exhibiting an 82.2% growth prediction in 2024 earnings, a 3% decline in estimates over the past 60 days implies underlying uncertainties the company faces.

Image Source: Zacks Investment Research

The Final Verdict

PDD Holdings’ e-commerce magnificence and devotion to agriculture hint at a promising investment avenue. Nonetheless, navigating through cut-throat competition and economic fragility demands caution from investors.

While near-term challenges persist, the business’ core strength and long-haul growth potential remain intact.

For now, holding onto PDD stock with a mindful eye on market dynamics seems prudent.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 5 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation

Unprecedented Growth for E-Commerce Giant PDD

An E-Commerce Phenomenon

The global e-commerce landscape has witnessed a seismic shift in recent times, with the rise of one industry player dominating the scene like a behemoth in a pond of minnows.

The PDD Meteoric Rise

Pinduoduo Holdings Inc. (PDD) has surged, akin to a shooting star streaking across the night sky, experiencing an astounding 66.9% gain in just a month.

The Driving Force

The momentum behind PDD’s meteoric rise is like a powerful gust of wind, fueled by the insatiable appetite for e-commerce among consumers globally.

Industry Implications

The ramifications of PDD’s exponential growth are rippling through the e-commerce industry, leaving competitors scrambling to keep pace or risk being left in the dust.

A Glimpse into the Future

As Pinduoduo Holdings Inc. continues its upward trajectory, one can’t help but wonder what the future holds for this e-commerce juggernaut and the industry at large.