Entering a New Era in the Semiconductor Industry

The semiconductor industry is infamous for its cyclicality, prone to turbulent shifts based on fluctuations in supply and demand. Companies within this sector face challenges during oversupply periods but can reap significant rewards when demand outpaces supply.

Market analysts at Bain & Company suggest that a surge in artificial intelligence (AI) devices is on the horizon, expected to drive heightened demand for smartphone and PC upgrades. Coupled with ongoing geopolitical tensions and supply chain vulnerabilities, this could potentially lead to a new chip shortage scenario.

This impending situation hints at a prosperous period for semiconductor companies. However, not all players in the industry are equally poised to leverage the opportunities presented by the AI-driven landscape.

Advanced Micro Devices (AMD)

AMD, a prominent name in the semiconductor sphere, has made significant strides over the last decade. Once on the brink of bankruptcy, under the leadership of Lisa Su, AMD has transformed into a powerhouse in the industry. Renowned for its high-performance processors and graphics cards, AMD competes directly with industry giants like Intel and Nvidia, providing CPUs for various devices and GPUs for gaming and professional applications.

Having chipped away at Intel’s CPU market share and eyeing Nvidia’s dominance in AI, AMD is on a trajectory of growth. In its recent quarterly report, Q2 data showcased record data center revenue of $2.8 billion, with an impressive 115% year-over-year increase. With a bullish outlook for Q3, expecting revenues of around $6.7 billion, AMD is poised for continued growth.

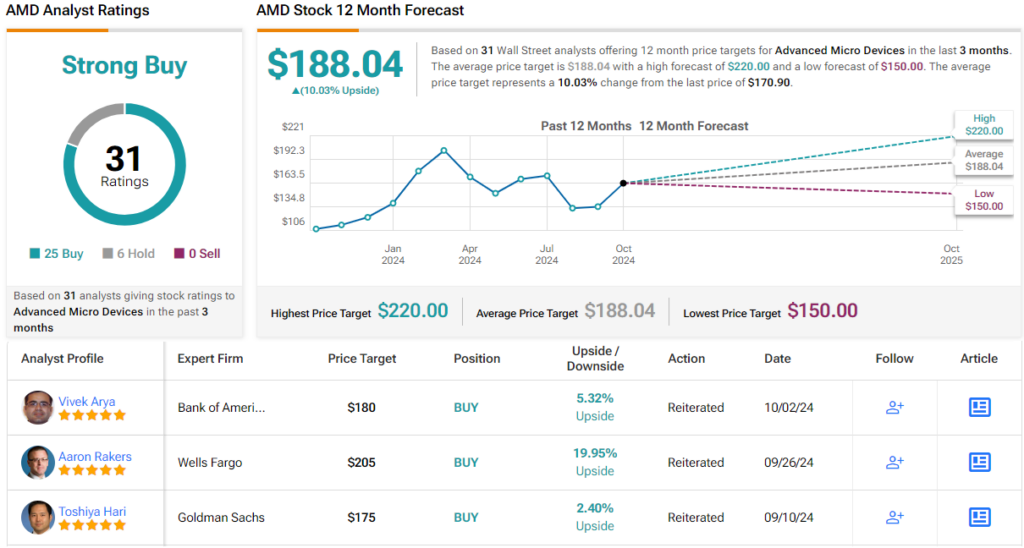

Bank of America’s analyst, Vivek Arya, asserts a positive outlook on AMD’s future, rooting for the company’s potential to capitalize on CPU market share gains from Intel and expand its presence in the AI market. Arya envisions substantial long-term sales and earnings growth for AMD, driving the stock’s Strong Buy consensus rating.

Intel

In contrast, Intel’s journey has seen a downturn in recent years. Challenged by manufacturing delays, competition from AMD, and organizational upheavals, Intel has struggled to maintain its once-dominant market position. The company’s Q2 financial performance reflected these obstacles, with revenue falling short of expectations and an anticipated decline in Q3 revenue.

Bank of America, through Arya’s analysis, expresses caution towards Intel’s current predicament. Intel’s challenges across competitive, financial, and strategic fronts raise concerns for potential investors. With a bleak outlook, Intel’s stock rating remains neutral, reflecting the company’s struggles in an evolving market landscape.

While AMD shines with promising growth prospects, Intel grapples with mounting obstacles, depicting a tale of contrasting fortunes in the semiconductor realm.