Diving into the realm of market volatility, the consumer staples sector is offering a goldmine for discerning investors looking to strike while the iron is hot.

One critical metric in this venture is the Relative Strength Index (RSI). This key indicator measures a stock’s strength on both up days and down days, providing traders with a window into its potential short-term performance. Typically, an asset is deemed oversold when its RSI dips below 30.

Let’s uncover three diamonds in the rough, hovering near or below this oversold threshold within the consumer staples sector:

Farm-Fresh Potential at Farmer Bros Co (FARM)

- Recent strides at Farmer Bros Co manifested in robust fourth-quarter financial results, exceeding market expectations. President John Moore hailed this period as transformative, attributing success to strategic business decisions. Despite this, the company’s stock suffered a 30% dip over the past month, hitting a 52-week low of $1.85.

- RSI Value: 27.27

- FARM Price Action: Closing at $1.89 on Thursday, Farmer Bros Co shares faced a 2.1% decline.

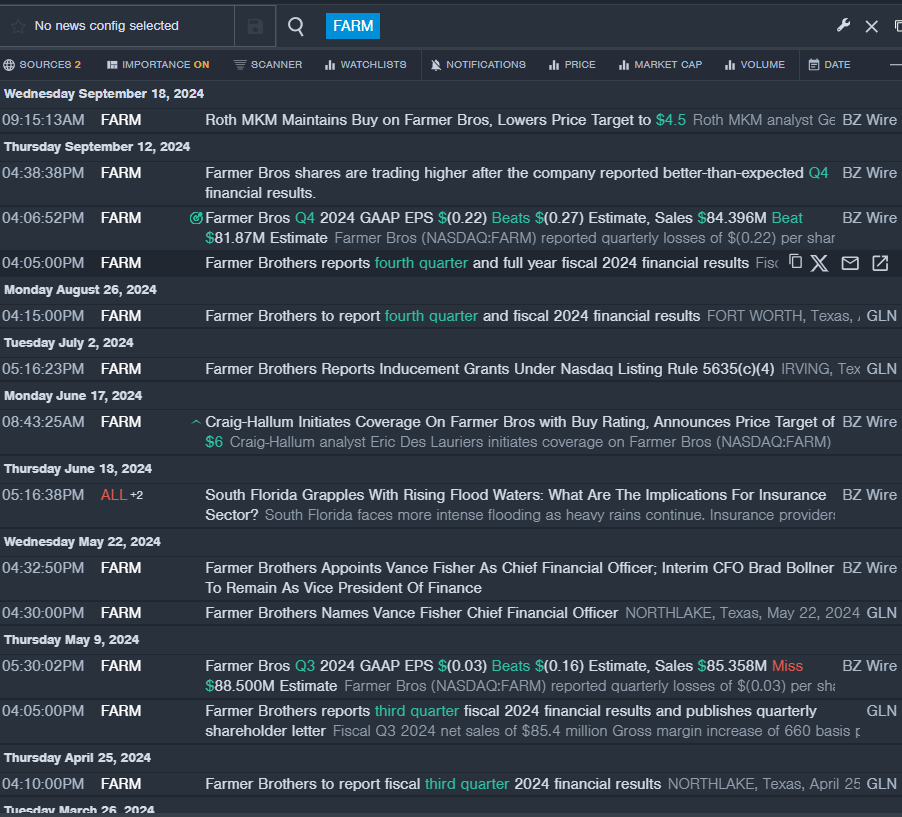

- Benzinga Pro’s real-time newsfeed remained vigilant, providing timely updates on Farmer Bros Co.

British American Tobacco PLC (BTI): Lighting Up Bargain Hunters’ Radar

- Amid market turmoil, British American Tobacco disclosed a drop in adjusted EPS during H1, signaling stormy weather. With a recent 6% decline over five trading days, the company’s stock hit a 52-week low of $28.25.

- RSI Value: 24.49

- BTI Price Action: Registering a 2.4% descent to $35.11 on Thursday, British American Tobacco has attracted attention from discerning investors.

- Benzinga Pro’s insightful charting tool illuminated the shifting tides in BTI stock.

Conagra Brands Inc (CAG): A Buffet of Opportunity for the Savvy Investor

- Conagra Brands recently weathered a storm of worse-than-expected first-quarter financial results, casting a shadow over its short-term prospects. Despite reaffirming fiscal 2025 guidance, the company witnessed a 10% plunge in shares over the last five trading days, hitting a 52-week low of $25.16.

- RSI Value: 25.52

- CAG Price Action: With a 2.4% drop to $29.35 on Thursday, Conagra Brands unfolded as a tapestry of potential amidst the market tumult.

- Benzinga Pro’s signals spotlighted a potential breakout scenario in Conagra Brands Inc shares.

Read Next:

Market News and Data brought to you by Benzinga APIs