The Tech Titan’s Triumphant Journey

Steering through choppy waters, technology stalwart Alphabet Inc has been soaring, gathering over 5% in the past month. The fervor can be ascribed to the escalating appetite for artificial intelligence.

In recent times, Sir Demis Hassabis, head of Google AI, was revealed to be spearheading the creation of an AI model tailored for research support. This endeavor aims to enhance cross-disciplinary collaboration and cultivate synergistic efficiencies in scientific inquiries.

Moreover, Alphabet’s Waymo section unveiled its state-of-the-art sixth-gen hardware at the tail end of August. The fresh venture is anticipated to slash costs while delivering superior performance, especially in wintry driving conditions. Notably, industry prognosticators from S&P Global Mobility forecasted that autonomous vehicle sales in the U.S. might hit 230,000 units by 2034.

Options Market Bustling With Activity

An intriguing stir is perceptible in the trading domain, with implied volatility (IV) for GOOG stock orchestrating the rhythm. Around mid-September, the IV rank stood at approximately 28%, ascending to nearly 75% by close of play on Wednesday.

IV epitomizes the market’s anticipation of price fluctuations, whether upward or downward. During elevated IV phases, option premiums usually command a premium due to heightened demand.

The swell in trading transactions of GOOG stock is likely in preparation for Alphabet’s impending third-quarter earnings declaration scheduled for October 22. While recent transactions have been predominantly bullish, murmurs from the market suggest that a few whales have bet against the tide.

Exploring Direxion’s ETF Landscape

Amidst the swirling tides engulfing one of the globe’s dominant enterprises, financial enterprise Direxion finds itself in fertile soil. The company’s leveraged and inverse exchange-traded funds, fixated on GOOGL, offer traders a platform for swift directional bets on the tech behemoth.

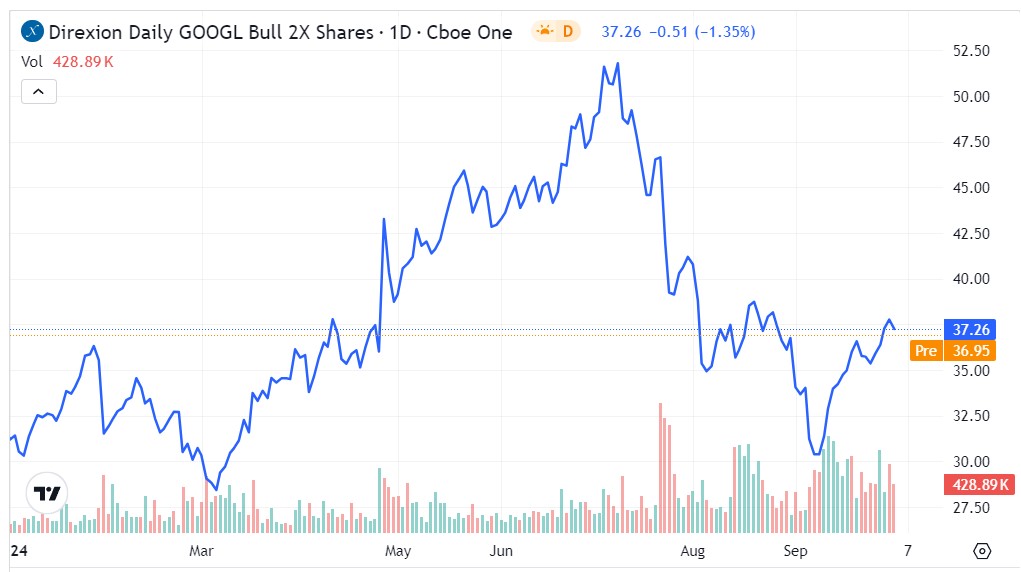

The Optimistic Outlook: GGLL

Direxion’s bullish GOOGL fund has witnessed significant tumult this year, securing a return of over 19% since January’s dawn.

- Surging ahead of Alphabet’s Q3 revelation, GGLL displayed a sturdy growth of nearly 23% post the September 10th wrap-up.

- Elevated volume levels herald optimism among bullish traders as they brace for the crucial litmus test.

- However, for prospective speculators to find allure in this trade, the GGLL ETF must break beyond the $38 resistance barrier.

The Pessimistic Picture: GGLS

Contrarily, a gloomy cloud looms over Direxion’s bearish GOOGL fund this year, witnessing a depreciation of about 19%.

- Significantly, GGLS is trading beneath both its 50-day and 200-day moving averages, hinting at profound pessimism.

- Precariously balancing above the $14 support line, the inverse GOOGL fund faces a tumultuous road.

- Despite bouncing resiliently from this year’s rock bottom of $12.34, backed by bearish options activity, dissenters might find solace in this setback.

Market News and Data brought to you by Benzinga APIs