Wealthy investors, akin to whales in the vast financial ocean, have taken a notably bullish stance on the enigmatic entity known as PDD Holdings.

Delving into the annals of options history for PDD Holdings through the lens of the NASDAQ marketplace, a staggering 104 trades have been unearthed.

An analysis of these trades unveils a fascinating dichotomy: 49% of investors embarked on trades with bullish glee, contrasting with 39% who harbored bearish sentiments.

Within this maelstrom of trading activities, 21 puts were identified, commanding a cumulative sum of $2,224,901, while 83 calls loomed large, with a total value of $9,801,050.

Foreseen Price Fluctuations

An overarching trend appears to suggest that the astute investors are setting their sights on a price range spanning from $100.0 to $230.0 for PDD Holdings in the recent trimester.

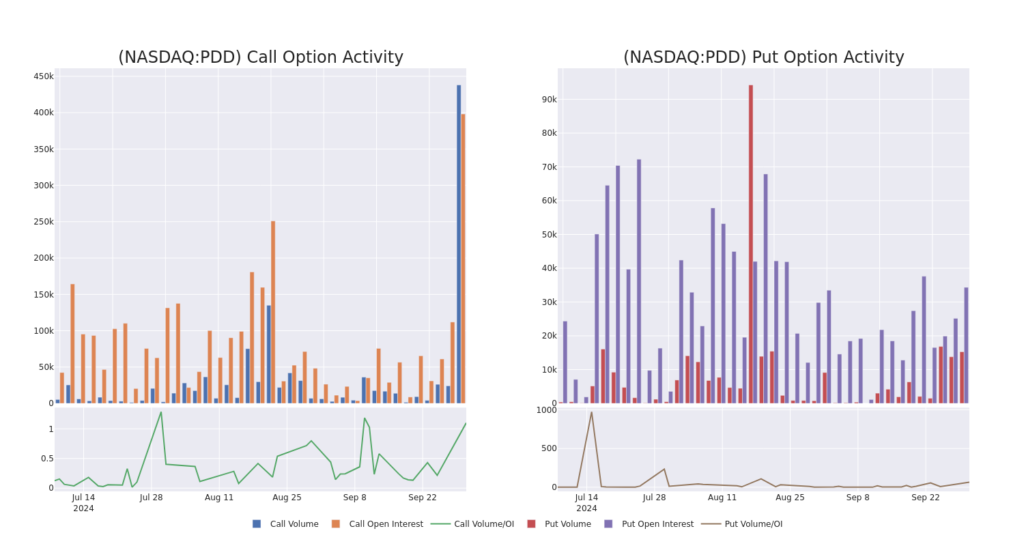

Vitalization of Volume & Open Interest

Evaluating the evanescent nature of volume and open interest represents a pivotal facet in the realm of options trading. These metrics serve as beacons, illuminating the realm of liquidity and investor intrigue in PDD Holdings’s options, especially within the strike price spectrum oscillating from $100.0 to $230.0 over the preceding 30 days.

PDD Holdings Option Expedition: The Past 30 Suns

Grandest Options Unveiled:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PDD | CALL | TRADE | NEUTRAL | 11/01/24 | $9.35 | $8.8 | $9.1 | $155.00 | $910.0K | 696 | 2.0K |

| PDD | CALL | SWEEP | BULLISH | 11/15/24 | $7.5 | $7.4 | $7.5 | $165.00 | $675.0K | 6.8K | 14.8K |

| PDD | CALL | SWEEP | NEUTRAL | 01/16/26 | $22.0 | $21.9 | $21.92 | $200.00 | $320.2K | 2.1K | 1.5K |

| PDD | CALL | TRADE | NEUTRAL | 12/20/24 | $29.8 | $29.6 | $29.7 | $130.00 | $297.0K | 4.8K | 206 |

| PDD | CALL | TRADE | BULLISH | 12/20/24 | $54.7 | $54.35 | $54.7 | $100.00 | $273.5K | 3.0K | 174 |

Insight into PDD Holdings

PDD Holdings emerges as a multinational commerce conglomerate that presides over a diverse portfolio of enterprises. PDD champions the cause of integrating more businesses and individuals into the digital realm, thereby fostering local communities and small-scale enterprises to reap the benefits of heightened efficiency and fresh possibilities. A vast network of sourcing, logistics, and fulfillment capabilities serves as the backbone supporting PDD’s underlying ventures.

Current Trajectory of PDD Holdings

- With a trading volume of 16,894,034, PDD’s value has experienced a marginal decline of -0.16%, resting at $152.38.

- Indicators derived from the Relative Strength Index hint at the potential overbought status of the underlying stock.

- The upcoming earnings release is slated for 53 days from now.

Identification of Uncommon Options Activity: Perceptive Investors on the Move

The Unusual Options board curated by Benzinga Edge offers a glimpse into potential market dynamics before they come into full fruition. Discover the strategic positions adopted by significant investors in your favored stocks. Click here for access.

While options prove to be a riskier investment avenue when juxtaposed with traditional stock trading, they bring forth a heightened profit potential. Seasoned options traders mitigate this risk by engaging in daily learning endeavors, scaling in and out of trades, adhering to multiple indicators, and vigilantly tracking market trends.

For those seeking real-time updates on the latest options maneuvers in the realm of PDD Holdings, Benzinga Pro offers a conduit for receiving instantaneous alerts on trades.

Market News and Data brought to you by Benzinga APIs