Advanced Micro Devices or AMD is carving its path in the artificial intelligence (AI) landscape, positioning itself as a formidable competitor. While currently holding a small market share, AMD’s strategic investments in its “full-stack” offering are poised to elevate its standing and potentially lead to market outperformance. Forecast trends hint at a promising future for AMD, driving optimism among investors despite recent market fluctuations.

AMD’s Competitive AI Landscape

AMD, headquartered in Santa Clara, has emerged as a prominent player in the semiconductor industry, focusing on high-performance computing and graphics processors. The company’s significant strides in AI and data centers underscore its alignment with broader market shifts, signaling strong growth potential.

Despite playing catch-up to primary rival Nvidia, AMD boasts of EPYC processors and Instinct accelerators that deliver robust performance for AI inferencing workloads, particularly in data centers. Notably, the MI300X accelerator stands out for its prowess in handling extensive language models and generative AI applications, challenging Nvidia’s dominance in the space.

While AMD is making headway against Nvidia, its market share in AI and data centers remains modest. With less than 5% GPU market share for AI and around 11% AI market share when considering CPUs inclusive, AMD is gradually but steadily expanding its foothold in the sector.

AMD’s Strategic Full-Stack Shift

AMD encountered a lag due to Nvidia’s substantial lead in GPU technology and client-specific software development. However, the acquisition of ZT Systems marked a pivotal moment for AMD, catalyzing its entry into the comprehensive AI software solutions domain. This strategic move is poised to bolster AMD’s AI capabilities, adding depth to its offerings and aligning with positive market projections.

The ZT Systems acquisition is anticipated to enhance AMD’s system-level integration, accelerate AI solution deployment, and expand its presence in the hyperscale market, heralding a new phase of growth and innovation for the company.

AMD’s Competitive Prospects

The developments within AMD are set to intensify its competition with Nvidia, particularly with Intel facing its own innovation hurdles. The shift towards a full-stack solution can potentially elevate AMD’s appeal among customers seeking diversified supply options, driving its market traction in AI and data center segments.

Despite historical disparities with Nvidia in market share and profitability, AMD shows promising signs of narrowing the gap. The company’s improving return on capital employed (ROCE) trajectory is closing in on Nvidia’s benchmarks, underscoring its evolving competitive stance.

AMD Stock: Valuation and Forecast

Market sentiment towards AMD remains bullish, fueled by robust growth projections. Forecasts indicate a rapid surge in earnings per share (EPS) over the upcoming years, propelling investors’ confidence in the company’s trajectory.

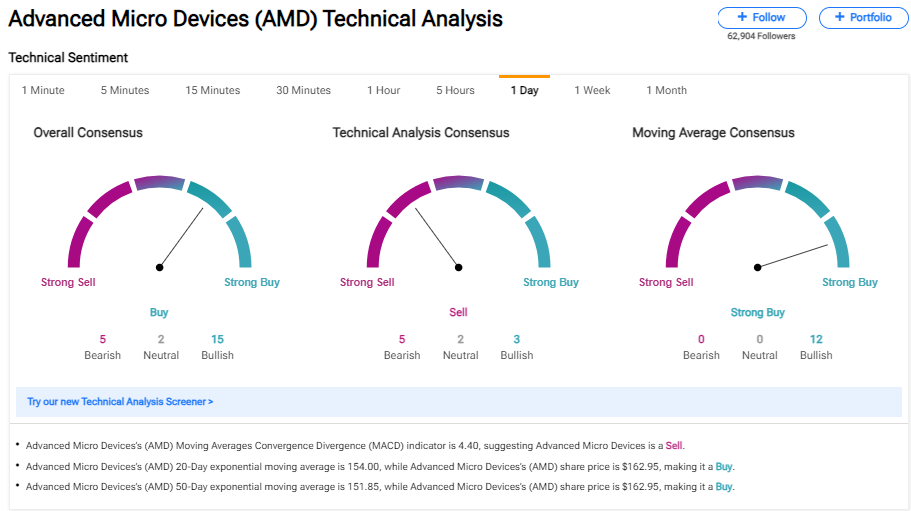

Although AMD’s stock trades at a premium, with a forward earnings multiple of 47.2x, its PEG ratio stands at 1.12, positioning it favorably compared to the broader information technology sector. The technical outlook corroborates this optimism, with AMD shares trading above key moving averages, reinforcing positive market sentiment.

Analysts’ Perspective on AMD Stock

Analysts on TipRanks vote AMD as a Strong Buy, supported by 25 Buy ratings and six Holds over the last quarter. The average price target for AMD is set at $188.04, implying a substantial upside potential of over 15% from current levels.

Concluding Thoughts on AMD’s Future

As AMD continues to demonstrate growth momentum and enhance its full-stack capabilities, the company stands poised for a transformative journey in the AI market. The recent acquisition of ZT Systems signals a strategic milestone that could chart AMD’s next phase of evolution. With an optimistic outlook, AMD stock holds promise for investors as the company gears up for its upcoming quarterly earnings release on October 29.