Amazon (NASDAQ: AMZN) and Chewy (NYSE: CHWY) are at the forefront of the e-commerce sector, each with its unique approach towards online retail.

Image source: Getty Images.

Distinguishing Features of Amazon and Chewy

Amazon, being a behemoth in the industry, offers diverse products through its established marketplace and has expanded into high-margin third-party sales. In contrast, Chewy, born from PetSmart, caters to pet owners, prioritizing pet food and related supplies.

Amazon’s primary earnings derive from its widespread retail dominance across numerous countries, with prime subscription services locking in millions of users globally. And while Amazon flaunts revenue diversity, Chewy’s focus remains largely on U.S. operations.

Chewy, undersized compared to Amazon, relies heavily on third-party sellers and subscriptions for a significant portion of its income. To combat market competition, Chewy has diversified into proprietary products and other services to fortify its operations.

Growth Trajectory: Amazon vs. Chewy

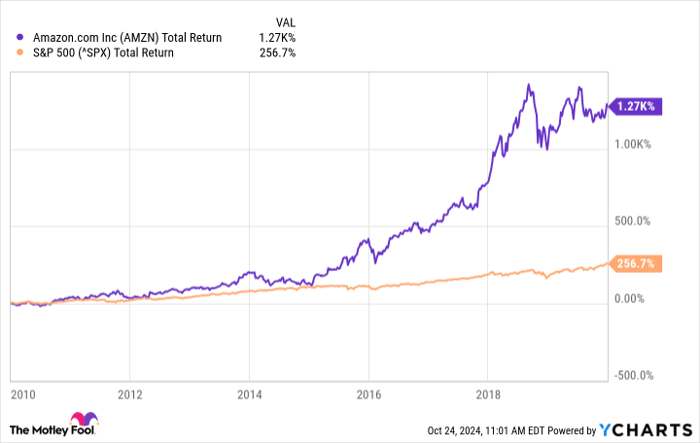

Over the past few years, Amazon has shown consistent sales growth, weathering market fluctuations and scaling its offerings. Chewy, on the other hand, experienced a slowdown due to customer acquisition challenges, resulting in a far slower revenue growth rate.

Despite a brief slack in performance, Amazon swiftly rebounded and displayed impressive net sales figures, indicating robust resilience. Analysts foresee sustained growth for Amazon, driven by international expansion and AI ventures.

While Chewy grapples with stabilizing growth rates, its focus on enhancing customer value remains predominant. The company aims to sustain its revenue through innovative customer-centric approaches, offsetting stagnant customer acquisition figures.

The Favorable Choice: Amazon

In valuation considerations, Amazon may seem pricier compared to Chewy, but its expansive business model, accelerated growth rates, and broad market presence make it a more compelling investment candidate. The prospects of Amazon continuing to outpace Chewy in the future seem highly probable.

Implications of Investing in Amazon

Before delving into Amazon stock, investors should carefully assess the dynamic market trends affecting the e-commerce giant. While Amazon remains a solid investment choice, exploring alternative stock options, aligned with current market conditions, could lead to substantial returns in the long term.

Investors seeking guidance on strategic investment choices can benefit from expert recommendations, enhancing their portfolio diversification while maximizing profit potential.

Engaging with a trusted advisory service can offer invaluable insights, aligning investment decisions with long-term financial goals. Consistent guidance can significantly impact portfolio growth, providing a competitive edge in the dynamic stock market landscape.