When stocks rise to or hover near all-time peaks, it signifies a notable surge in positivity, where prevailing trends favor buyers. Stocks hitting new highs often set the stage for further climbs, especially amidst favorable earnings estimates in a flurry. This narrative beautifully encapsulates the current stance of three players – Duolingo DUOL, SharkNinja SN, and DaVita DVA. They presently boast an advantageous Zacks Rank and are poised precariously close to their 52-week pinnacles.

SharkNinja’s Flourishing Success

SharkNinja, a Zacks Rank #1 (Strong Buy) entity, thrives as a multifaceted product design and technology firm crafting lifestyle solutions for discerning consumers. A recent cascade of stellar quarterly performances has illuminated the company’s outlook glowingly across the spectrum.

Notably, in the last quarterly unveiling, SN displayed a staggering 34% surge in EPS amidst a 31% uptick in sales, raking in $1.2 billion – marking the fifth successive stretch of year-on-year sales growth in double digits. Looking ahead, anticipations remain rosy, with the ongoing fiscal year expected to witness a 31% boost in EPS alongside a 21% revenue escalation. Casting a glance further, projections for FY25 tip an additional 14% surge in EPS coupled with a 9% revenue uptick.

With a Growth Style Score of ‘B’, the stock has seen a remarkable upsurge of 110% in 2024, reflecting an earnings trajectory that heralds further ascendancy.

DVA’s Alluring Valuation

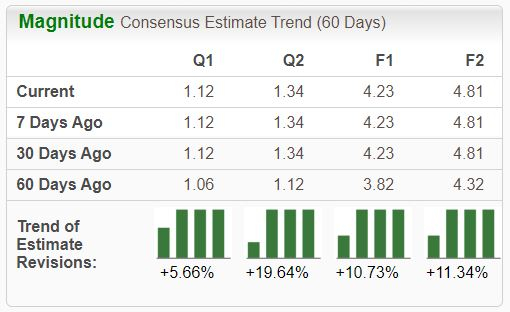

DaVita, a prominent provider of dialysis services in the U.S. for chronic kidney failure patients, basks in the limelight as a Zacks Rank #1 (Strong Buy) candidate, with expectations soaring skyward across temporal horizons.

The valuation landscape for DVA presents an enthralling sight, with the present forward 12-month earnings ratio of 14.0X closely aligned with past benchmarks. Furthermore, the existing PEG ratio stands at 0.8X, embodying a bargain concerning the forthcoming growth projections.

A PEG ratio under 1.0 not only signifies growth but also tantalizes with value. The stock notches an ‘A’ Style Score for Value.

Duolingo’s Stark Growth Prospects

Duolingo, a Zacks Rank #1 (Strong Buy) contender, delivers a mobile language learning platform teeming with explosive growth forecasts. The consensus anticipates a staggering 430% surge in EPS and a 40% uptick in sales for the current fiscal period.

Buoyed by historical robustness, the company has consistently posted double-digit year-over-year sales growth rates across the last ten quarters – a testament to its resounding success. Graphic below illustrates Duolingo’s quarterly sales aggregation.

Shares are currently valued at lofty multiples, with the forward 12-month earnings ratio standing at 109.3X – emblematic of investors’ towering growth ambitions. However, the projected growth trajectory appears poised to fulfill these expectations.

Epilogue

Stocks breaching new highs often pave the way for loftier peaks and when positive earnings forecasts come into play, the excitement amplifies.

The trio of Duolingo DUOL, SharkNinja SN, and DaVita DVA revel in this very narrative, all holding a prized Zacks Rank and witnessing shares dancing near their 52-week zeniths.

Revamping American Infrastructure – A Stock Boom in the Making

A gargantuan endeavor to revamp the ailing U.S. infrastructure is looming large, a bipartisan, pressing, and inevitable move. Trillions are destined for expenditure, heralding an age of fortunes waiting to be minted.

The million-dollar question remains: “Will you partake in the right stocks early, capturing their prime growth waves?”

Zacks has unleashed a Special Report to guide you through this maze, and it comes without a price tag today. Unveil 5 special firms set to savor the most benefits from the renovation and fortification of roads, bridges, and edifices, along with the transformation of cargo hauling and energy on a colossal scale.