With a history as enduring as the wheel, Ford has long captivated investors with its staying power in the tumultuous automotive industry. However, a recent move by Morgan Stanley sent shockwaves through Ford’s share price, causing a nearly 4% drop in Wednesday’s trading session.

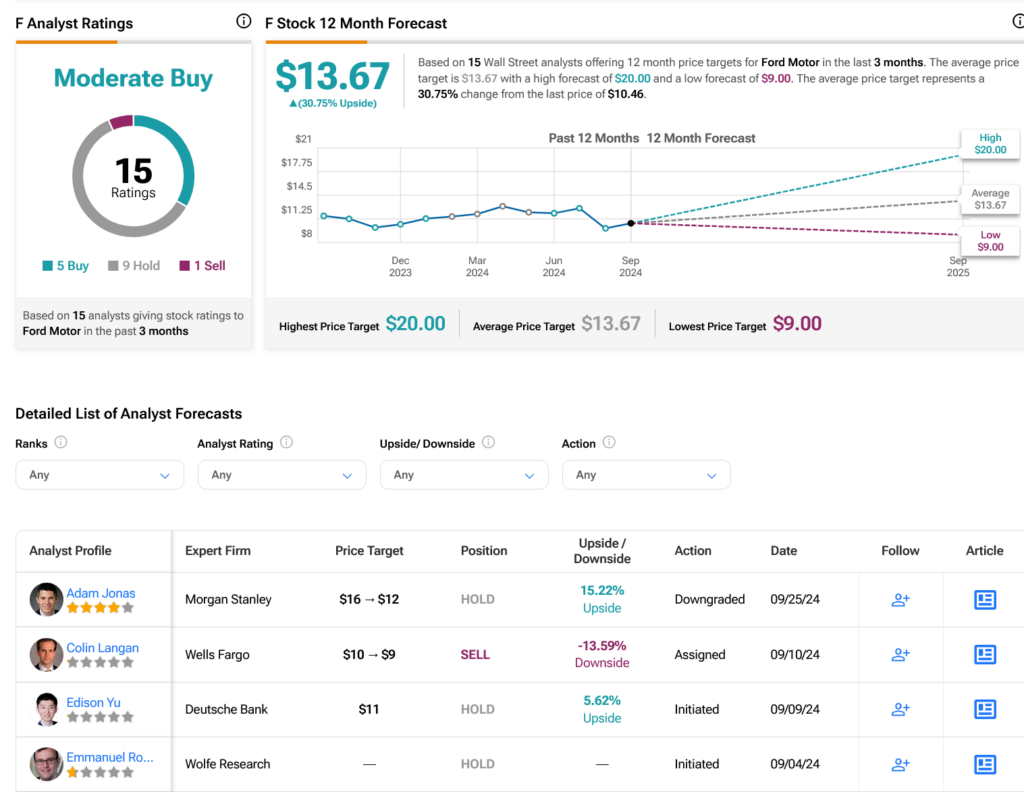

Morgan Stanley’s Adam Jonas downgraded Ford from Overweight to Equal Weight, coupled with a slashing of the price target from $16 to $12. The heart of the issue lies in China, where Ford produces its Territory compact SUV.

China’s oversupply of approximately nine million cars poses a significant threat to Ford’s export business. While not all these cars will flood the U.S. market, the competition in other regions will erode Ford’s market share and profitability. Adding to the headwinds is the tightening regulatory environment around electric vehicles, highlighting further challenges for Ford and its competitors.

Potential Game-Changers

Despite the storm clouds gathering, Ford has a few aces up its sleeve. Recently unveiled images of the 2024 Mustang Dark Horse showcase a visually stunning vehicle poised to attract attention, offering a glimpse of hope amidst economic uncertainties.

Moreover, Ford has commenced production of the electric Capri in Cologne, Germany, marking its second electric vehicle manufacturing endeavor in the country. Initial reports suggest similarities between the Capri and the Explorer, both SUV coupes sharing a common technical foundation but differing in roofline design. While the launch will feature large battery models, smaller battery variants are expected to join the lineup by year-end.

Investor Outlook

Wall Street analysts maintain a Moderate Buy consensus on Ford stock, reflective of five Buy, nine Hold, and one Sell ratings issued in the past three months. Despite a 10.14% decline in the stock price over the last year, the average price target of $13.67 suggests a potential upside of 30.75% from current levels.

Explore more Ford analyst ratings