Fertile Ground for Investment

Panning for gold in the oversized waters of the stock market can sometimes yield precious undervalued gems. The materials sector, often overlooked, contains stocks that have been unjustly battered to levels of oversold territory. These downtrodden equities present an opportunity, a hidden pathway for investors to discover undervalued companies with immense potential.

The RSI Indicator: A Beacon in the Night

One such tool in the investor’s arsenal is the Relative Strength Index (RSI). This momentum indicator acts as a compass in the stormy seas of the stock market, guiding traders by comparing a stock’s strength on up days to its performance on down days. When the RSI falls below 30, it is a signal that the asset may be oversold, hinting at a potential bounce back in the near future.

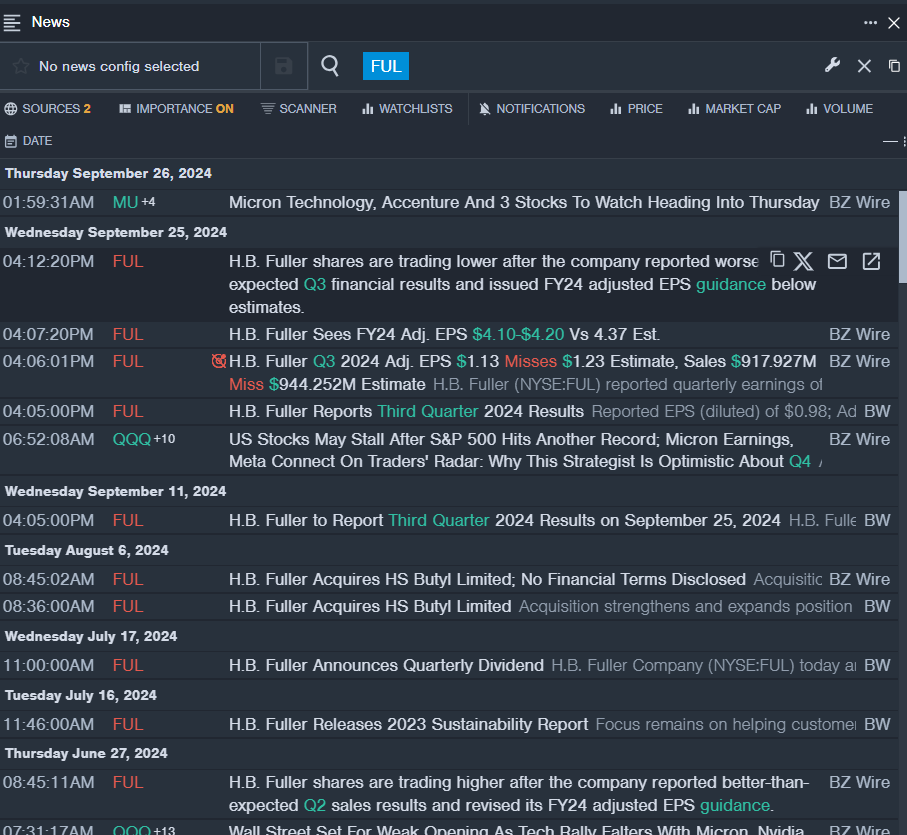

H.B. Fuller Company FUL

- Amidst recent turbulent waters, H.B. Fuller Company reported third-quarter results that failed to meet expectations, causing waves in the market. Nevertheless, President and CEO Celeste Mastin remains steadfast, steering the company through strategic advancements and acquisition endeavors. The company’s stock price declined modestly over recent days, but with an RSI value of 28.45, could a favorable wind be on the horizon?

- RSI Value: 28.45

- FUL Price Action: Shares fell 1.8% to close at $80.63 on Wednesday.

Weathering the Storm

Market conditions in the materials sector have been less than ideal, pushing companies like Clearwater Paper Corp to navigate through rough seas. Despite quarterly losses, President and CEO Arsen Kitch emphasizes the acquisition of new assets and a commitment to synergy targets. While the stock may have dipped by 15% recently, its RSI of 28.90 might hint at a silver lining amidst the clouds.

Clearwater Paper Corp CLW

- With a 52-week low of $27.69, Clearwater Paper Corp has seen better days, weathering market storms and economic turbulence. However, as the RSI value hovers near the 30-mark, could this be a signal of calmer waters ahead?

- RSI Value: 28.90

- CLW Price Action: Shares closed down 4.7% at $28.40 on Wednesday.

Agricultural Alchemy

In the agricultural realm, Bioceres Crop Solutions Corp has faced headwinds with fourth-quarter sales falling short of expectations. CEO Federico Trucco remains optimistic, highlighting record revenue levels despite challenging agricultural landscapes. Even with shares down by 22% in recent weeks, an RSI value of 21.88 may indicate a turnaround in the winds for this crop-centric company.

Bioceres Crop Solutions Corp BIOX

- At a 52-week low of $7.74, Bioceres Crop Solutions Corp stands at a crossroads, facing the vagaries of the market with resilience. Could the RSI value of 21.88 be a signal of a budding growth season ahead?

- RSI Value: 21.88

- BIOX Price Action: Shares closed down 3.3% at $7.85 on Wednesday.