Axonics, Inc. AXNX has garnered regulatory approval from the Therapeutic Goods Administration in Australia, allowing the company to introduce its innovative R20 rechargeable sacral neuromodulation (SNM) system to the market.

The cutting-edge R20 device boasts a 20-year functional lifespan, reducing recharging frequency to just once every 6 to 10 months for a mere hour. With a compact 5cc form factor similar to its predecessor, the Axonics R15, and enhanced features like intuitive remote control and improved MRI compatibility, the R20 reinforces Axonics’ unwavering commitment to enhancing incontinence care.

The Axonics R15 is tailored to address bladder and bowel dysfunctions, including overactive bladder and fecal incontinence, by administering electrical stimulation to the sacral nerves, enabling patients to regain control and experience enduring relief.

Axonics initiated commercial operations for its SNM systems in Australia in March 2023. By May 2024, it had secured TGA approval to market its F15 recharge-free SNM system. In addition, Axonics offers Bulkamid, a hydrogel utilized to treat female stress urinary incontinence in Australia.

Share Performance Reaction to TGA Approval

Subsequent to the announcement, Axonics’ shares experienced a 0.1% decline, closing at $69.53 yesterday.

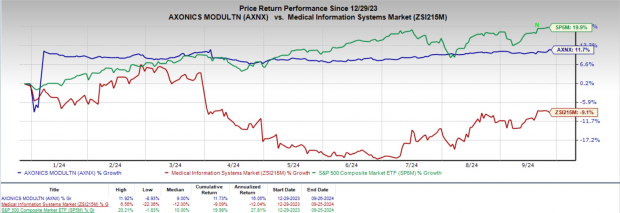

Axonics shares have demonstrated a 11.7% increase year-to-date, outperforming the industry’s 9.1% downturn, while the S&P 500 has advanced by 19.9% during the same period.

Image Source: Zacks Investment Research

Despite the recent drop in stock price, the TGA’s endorsement of Axonics’ R20 rechargeable SNM system underlines a positive outlook for the company, showcasing its dedication to providing effective, long-lasting therapies for individuals battling overactive bladder and fecal incontinence. Furthermore, Axonics’ Bulkamid hydrogel presents a durable solution for women contending with stress urinary incontinence, addressing a significant global healthcare need.

Significance of TGA Approval for Axonics’ R20 Rechargeable SNM System

The approval by the TGA for Axonics’ R20 signifies a notable leap forward in the treatment of bladder and bowel dysfunctions for Australian patients. Boasting a 20-year lifespan and minimal recharging requirements, the R20 delivers enduring symptom relief and enhanced convenience. This fourth-generation device underscores Axonics’ innovative stride and bolsters the company’s standing in the Australian SNM market following the introduction of the F15 recharge-free system earlier this year. The launch of the R20 underscores Axonics’ continuous commitment to delivering top-tier incontinence therapies.

Axonics is set to commence sales of its R20 rechargeable SNM system to Australian consumers in November following the recent regulatory approval.

Market Outlook Favors AXNX

As per a report by Grand View Research, the global neuromodulation devices market size is projected to reach $5.8 billion by 2024, surging further to an estimated $10.4 billion by 2030 at a remarkable CAGR of 10.2%.

This robust growth trajectory is anticipated to be propelled by the surge in lifestyle diseases such as chronic pain and depression, a rise in neurological conditions, and increased investments by private entities in neurological disorder research.

Zacks Rank & Top Picks

Presently, Axonics holds a Zacks Rank #3 (Hold).

Within the broader medical domain, some standout stocks include Universal Health Services UHS, ATI Physical Therapy ATIP, and Aveanna Healthcare AVAH. While Universal Health Services boasts a Zacks Rank #1 (Strong Buy), ATI Physical Therapy and Aveanna Healthcare each carry a Zacks Rank #2 (Buy) at present.

Universal Health Services is projected to achieve a long-term growth rate of 19%. The company has consistently surpassed earnings estimates over the past four quarters, with an average beat of 14.58%.

Anticipated year-to-date gains for Universal Health Services stand at 41.1%, surpassing the industry’s growth of 34.8%.

ATI Physical Therapy has exceeded earnings projections in all four trailing quarters, with an average surprise of 7.25%.

ATIP has seen a 5.5% increase year-to-date compared to the industry’s 18.6% growth.

Aveanna Healthcare has outperformed earnings expectations in all four trailing quarters, posting an average beat of 47.5%.

Year-to-date, AVAH’s shares have surged by 104.5%, in contrast to the industry’s 15.7% growth rate.

Market News and Data brought to you by Benzinga APIs