Tesla’s stock symbol TSLA is sparking investor enthusiasm as the third quarter winds down, yet predictions are far from unanimous among analysts. The impending robotaxi event scheduled for October 10 is stoking the flames, with hopes soaring high. Barclays anticipates Tesla will announce Q3 deliveries of approximately 470,000 units, marking an 8% increase year-over-year and outshining the anticipated 461,000 units. The surge is largely attributed to robust sales in China, laying to rest doubts about the company’s fundamentals. A robust delivery report could prop up Tesla’s fluctuating stock.

Conflicting Estimates from Analysts

Wolfe Research aligns with the bullish outlook but places Tesla’s Q3 deliveries closer to 460,000 vehicles, in line with the broader consensus. They emphasize the focus on profitability, especially Auto Gross Margins, which they expect to see slight enhancement. Following suit, Goldman Sachs holds a similar view, projecting around 460,000 deliveries but indicates varied performance across regions – strong in China, flat in the U.S., and weak in Europe.

Anticipation Builds for Tesla’s Robotaxi Venture

As fervor mounts ahead of the robotaxi event, UBS adheres to a Sell rating with a target price of $197. They caution that while excitement is palpable, actual outcomes may fall short of investors’ lofty hopes. On the flip side, BofA adopts a more positive stance, maintaining a Buy rating with a price target of $255. They argue that the event offers Tesla a pivotal opportunity to showcase its Full Self-Driving technology and outline the potential functioning of its robotaxi service. Nonetheless, they acknowledge a commercial rollout remains years away, likely post-2025.

GM Partners with Tesla to Expand Charging Network

In fresh developments, General Motors’ stock symbol GM is collaborating with Tesla to broaden charging infrastructure access. Commencing September 18, GM customers can utilize over 17,800 Tesla Superchargers through a GM-approved NACS DC adapter. This alignment spells good news for EV drivers, significantly augmenting charging options. With GM set to facilitate access to more than 231,800 public chargers, this partnership aims to streamline the charging process for patrons of both companies.

Bernstein Downgrades GM Amid Trials

However, the horizon isn’t entirely sunny for GM. Bernstein recently downgraded the automaker to “Market Perform” status with a price target of $53, citing potential obstacles ahead as the company gears up for its forthcoming capital markets day. With ongoing inventory accumulation and escalating pricing hurdles, analysts are advising a cautious stance.

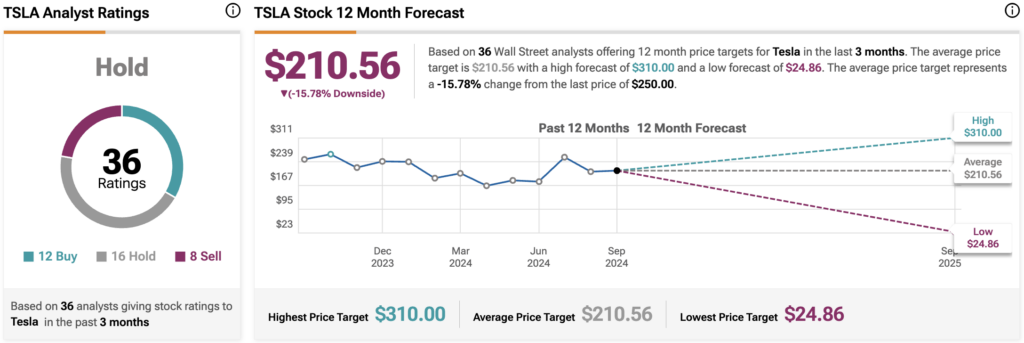

Should Investors Buy, Sell, or Hold Tesla Shares?

Analysts are teetering on the sidelines regarding TSLA stock, maintaining a Hold consensus rating comprising eight Buys, 15 Holds, and nine Sells. The average TSLA price target of $173.29 suggests a downside of 6.2% from current levels.