Sony’s Paradigm Shift in Content Creation

Sony Group (SONY) has departed from its traditional role as a content supplier to streaming behemoths like Netflix (NFLX) and plunged headfirst into original content creation. with a colossal investment of $10 billion over the last six years, Sony has strategically diversified its portfolio across the gaming, film, and music domains, accounting for a substantial 60% of its annual revenue.

Sony’s Emergence as a Media Powerhouse

This transformative strategy positions Sony at the epicenter of a global content expenditure escalation, projected to hit almost $250 billion this year by Ampere Analysis. Leveraging its diverse media enterprises, Sony has successfully harnessed acquired intellectual properties (IPs) to spawn hits such as The Last of Us, transitioning from a PlayStation game to a highly acclaimed television series.

Another potential blockbuster in the making is Black Myth: Wukong, deeply entrenched in Chinese mythology, derived from the classic novel Journey to the West. The exponential success of this action role-playing game swiftly translated into record-breaking sales figures for the PlayStation 5 in China.

Sony’s Strategic Venture into Anime

Beyond video games, Sony eyes substantial profits in the burgeoning Anime segment. With a significant repository of Japanese anime, Sony’s acquisition of AT&T’s (T) Crunchyroll in 2021 for $1.2 billion fortifies its position in the surging global anime market. Boasting 15 million paid subscribers and an annual release of nearly 200 titles, Crunchyroll has emerged as a dominant player in the anime landscape, captivating over 130 million registered users spanning 200 countries.

Sony’s profitable anime venture, integrated within its music division, has contributed significantly to the company’s recent profit surge, propelling its music segment to the forefront of its earnings portfolio. Bolstered by a robust lineup of top-selling artists, Sony Music stands tall as the world’s second-largest music label. Forecasts predict escalated sales in both the music and gaming spheres by 3%, underscoring the profound impact of anime on Sony’s revenue streams.

Strategic Imperatives for a Sony Stock Investment

Sony’s future earnings trajectory appears promising, buoyed by the upsurge in IP monetization spanning gaming, film, music, and anime domains. The prospective upsurge in semiconductor business, driven by image sensor restocking demands from phone OEMs, presents an additional avenue for revenue growth.

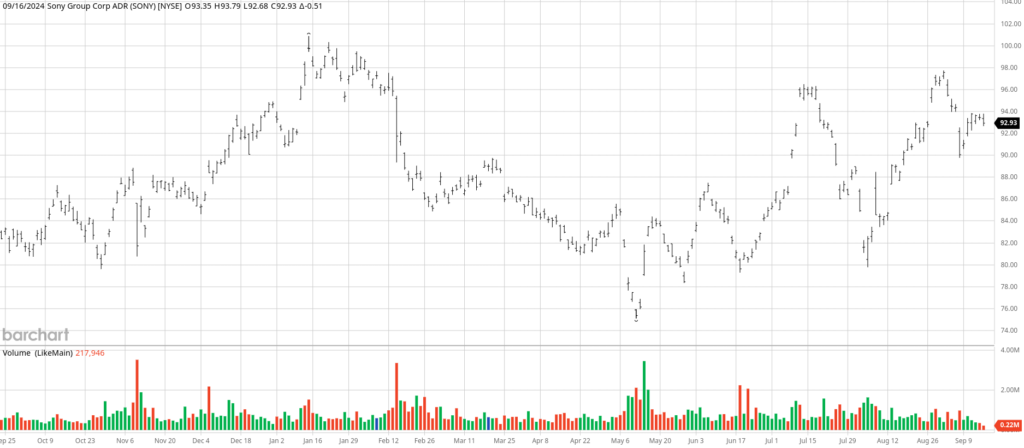

Faster margin expansion from Sony’s IP monetization strategy and the prospective spinoff and listing of its financial arm in October 2025 are poised to mitigate earnings volatility and amplify shareholder value. An amalgamation of these factors reinforces the investment appeal of SONY below the $95 threshold.

More Stock Market News from Barchart