Netflix (NFLX) has outperformed the stock market year-to-date, rewarding investors with a 51% gain during that stretch. However, that’s not the only reason I am bullish on the stock. Rising profits, promising growth opportunities from online ads, and struggling competitors are some additional catalysts that can propel Netflix stock to new highs.

Profit Margins Are Exceptional

Netflix closed the second quarter of 2024 with $9.6 billion in revenue and $2.1 million in net income, resulting in a 22.5% net profit margin. The high-profit margins make me feel bullish on the stock, given how other competitors have fared.

Disney (DIS) only recently turned an operating profit for its streaming segment. The company reported $47 million in operating income compared to $6.4 billion in revenue, resulting in a far less impressive 0.7% operating margin. Meanwhile, Warner Bros (WBD) announced a $10 billion loss in the second quarter. While streaming was profitable for the company, those significant losses will hamper the company’s growth opportunities.

Not only did Netflix report solid profit margins, but the company is also growing at a good pace, enhancing the bullish sentiment. Revenue increased by 16.8% year-over-year, a higher growth rate than Disney and Warner Bros. Meanwhile, Netflix’s net income jumped by 44.4% year-over-year. Rising profits will make the streaming giant’s valuation more attractive for long-term investors.

Online Ads Present an Opportunity

Another growing segment in Netflix’s operations is its advertising business, presenting a compelling long-term growth opportunity that makes me bullish on the stock. The company reported 34% quarter-on-quarter growth for its ads tier memberships. Netflix is also working on an in-house ad tech platform that will roll out broadly in 2025. The in-house platform can drive revenue and margins to even higher places.

Those ads have also boosted overall memberships. While the company only delivered 8.0% year-over-year membership growth in Q2 2023, the company’s total members increased by 16.5% year-over-year in Q2 2024. Netflix now has 277.65 million total members, and the advertising tier should get the company beyond 300 million members next year.

Netflix’s decision to remove its Basic plan further demonstrates the rising profits from its advertising. The Basic plan costs $11.99/mo compared to the ad tier’s $6.99/mo price point. Also, as NFLX sees a promising runway for its online advertising business, it can become an advertising leader. It won’t reach the ranks of Alphabet (GOOGL) or Meta Platforms (META), but the company can gain plenty of market share in the industry.

Streaming Is the Main Focus

Netflix’s ability to focus on streaming without addressing ailing business components is another reason investors should feel bullish. While Disney and Warner Bros have each reported profitable quarters for their streaming services, both companies have significant obstacles that make future growth more difficult.

Disney reported year-over-year declining revenue in its linear networks business. That part of the business makes up more than 10% of total revenue. Disney Parks also indicated some struggles. Revenue only increased by 2% year-over-year. Operating income for Disney Parks dropped by 3% year-over-year. Warner Bros has its own challenges and reported declining revenue in the second quarter. Disney and Warner Bros shares are down by 30% and 68% over the past five years.

Netflix, on the other hand, doesn’t have those issues because it’s a pure streaming play. Netflix doesn’t have parks, cable TV, or extraneous income streams that drag down the stock. While putting all your eggs in one basket is risky, NFLX diversifies its revenue with online ads. The company’s ability to focus solely on streaming for several years explains why its stock has performed well despite many competing stocks losing investors a lot of money.

Is Netflix Stock a Buy?

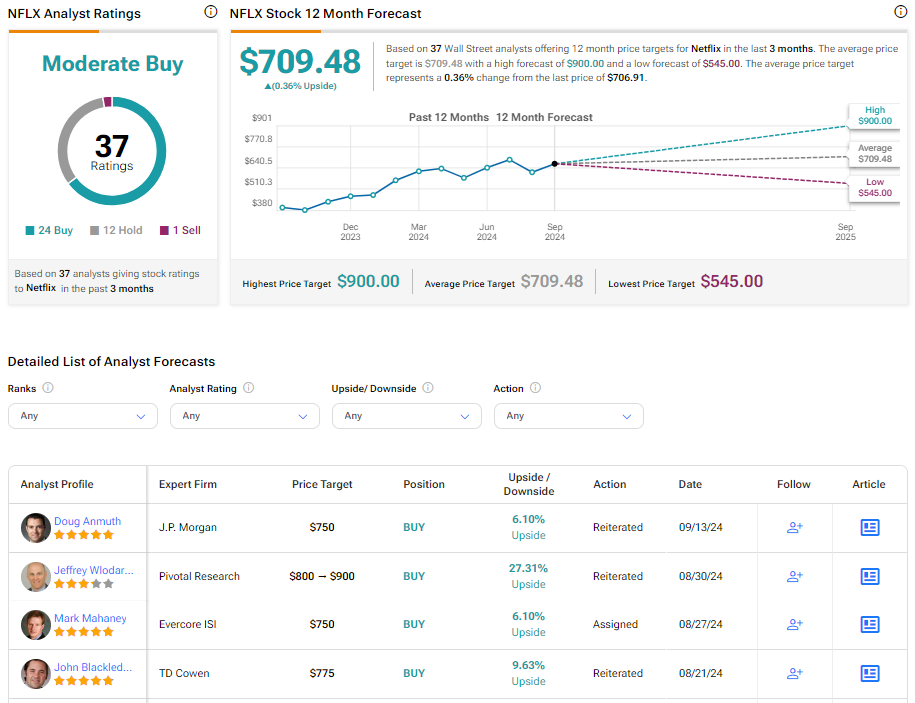

NFLX stock is currently rated as a Moderate Buy with a projected 1% upside from current levels. The highest price target of $900 implies that the stock can gain an additional 27%. NFLX has 37 analyst ratings, which include 24 Buy ratings, 12 Hold ratings, and one Sell rating.

The Bottom Line on NFLX

Most streaming companies aren’t good stocks. Disney and Warner Bros. are two of the many choices that have decimated shareholder value over the past five years. However, Netflix is an exception to the rule, having rallied by 161% over the past five years.

Netflix reports high revenue and net income growth as new members flock to the streaming platform. The advertising tier is accelerating quickly and can turn Netflix into an online advertising leader. Furthermore, the company has high profit margins that should make the valuation more attractive in the future.

The company’s top-tier product is enough to attract investors. However, the lack of robust competitors allows Netflix to maintain its dominant lead and gain market share. Netflix’s growth rates suggest that the company will exceed 300 million members by the end of 2025. This development should translate into solid gains for long-term investors. Therefore, I am bullish on NFLX stock.