In the realm of financial markets, the oversold stocks within the energy sector are akin to hidden treasures awaiting discovery. An opportunity presents itself to discerning investors, beckoning them to delve into undervalued companies that may hold the promise of turnaround and prosperity.

Gran Tierra Energy Inc

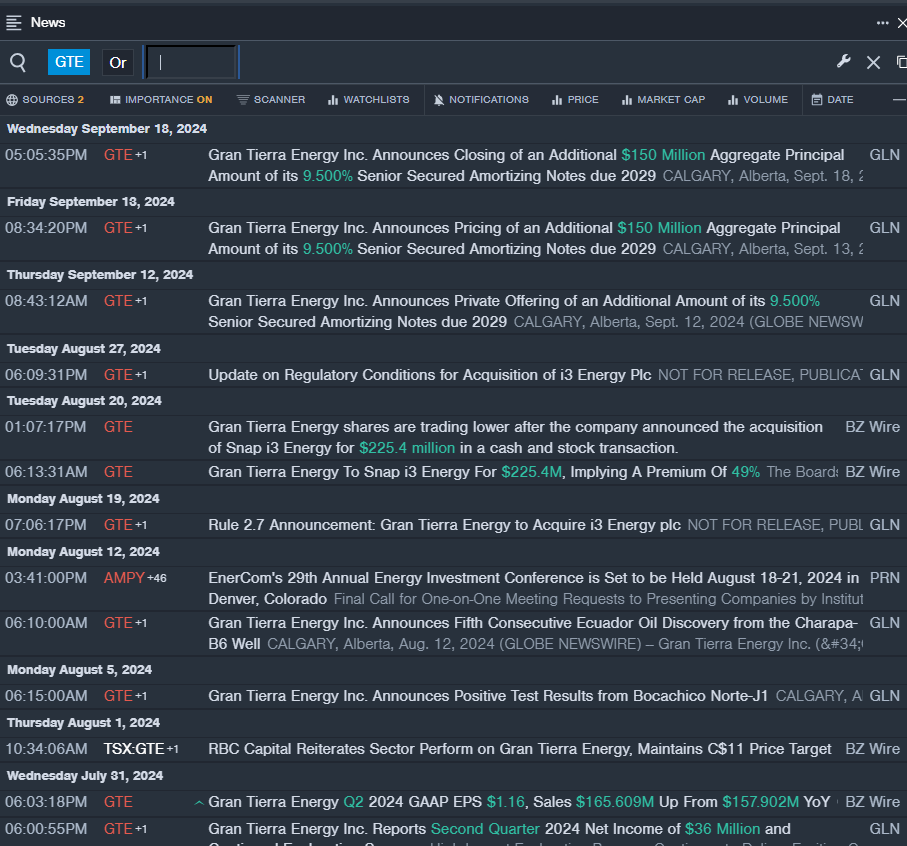

- With a recent announcement marking the closure of an additional $150 million aggregate principal amount of its 9.500% senior secured amortizing notes due 2029 on September 18, Gran Tierra Energy Inc’s stock has seen a significant decline of approximately 31% over the past month, reaching a 52-week low of $4.72.

- RSI Value: 27.50

- Price Action: Despite this downward trend, shares of Gran Tierra Energy fell 6.4% to close at $5.90 on a recent trading day.

Vivakor Inc

- Traversing a similar path, Vivakor Inc witnessed a decline of around 28% in its stock value over the past month. With a 52-week low of $0.44, the company seeks to navigate through turbulent waters as it strives for recovery and growth.

- RSI Value: 27.07

- Price Action: Reflecting ongoing market challenges, shares of Vivakor experienced a slight 0.7% decrease, closing at $1.43 in a recent trading session.

Crown LNG Holdings Ltd

- Facing its own set of hurdles, Crown LNG Holdings Ltd received notification from Nasdaq regarding its failure to meet minimum bid requirements, leading to a sharp 45% decline in its shares over the past month. Plummeting to a 52-week low of $0.26, the company grapples with the winds of change blowing through the market.

- RSI Value: 22.60

- Price Action: Exemplifying this struggle, shares of Crown LNG Holdings took a substantial dip of 10.6%, closing at $0.26 in recent trading.

As investors navigate through the maze of oversold energy stocks, the potential for lucrative gains looms on the horizon. Each company’s RSI value serves as a compass, guiding traders through the tumultuous seas of the stock market, hinting at possible reversals and rebounds that could lead to profitable outcomes.