Amazon (NASDAQ: AMZN) has etched itself as a towering figure in global commerce and technology landscapes, disrupting e-commerce and cloud computing realms. Yet, as the economic tides shift from pandemic peaks, Amazon faces the fierce winds of maintaining its growth trajectory.

Challenges Amid Growth

Even stalwarts face headwinds, as evidenced by Amazon’s revenue in Q2 2024. A mere 10% uptick to $148 billion marks a deceleration from the staggering 40%+ spikes in prior years, a setback beneath analysts’ expectations.

Resilience and Vision

However, amidst the tapestry of doubt, a prominent investor – colloquially known as Kody’s Dividends – wields an unwavering belief in Amazon’s enduring narrative. “Amazon stands as a paragon of efficient execution. Each segment of the business displayed robust growth in the latest quarter,” effused Kody, perched in the upper echelons of TipRanks’ stock mavens.

“Amazon’s core tenets of competitive pricing, expansive inventory, and unparalleled service continue to reap rewards. This propelled sales across units, advertising, and subscription services upwards in the quarter,” bolstered the sage investor.

Future Horizons

Further, Kody underlines Amazon’s multitude of growth catalysts on the near horizon. The e-commerce titan’s global footprint in online retail burgeons, claiming a larger slice of the consumption pie. Additionally, Amazon Web Services (AWS) emerges as a beacon of expansion. “As the premier torchbearer in cloud computing, AWS garners the sweetest fruits from the tree of global IT expenditures,” Kody pointed out.

An Opportunity Cloaked in Discount

Poised at a precipice of potential, Kody deems Amazon a siren call for investors, particularly with its shares allegedly trading at a 40% markdown from fair valuation based on Price-to-Operating Cash Flow ratios.

If Kody’s numerics align and Amazon mirrors its growth projections, the digital colossus might unveil a staggering 114% growth runway by 2026’s curtain call. Presently, Kody waves the Strong Buy banner over AMZN shares, a testament to his confidence in the stock’s prospects.

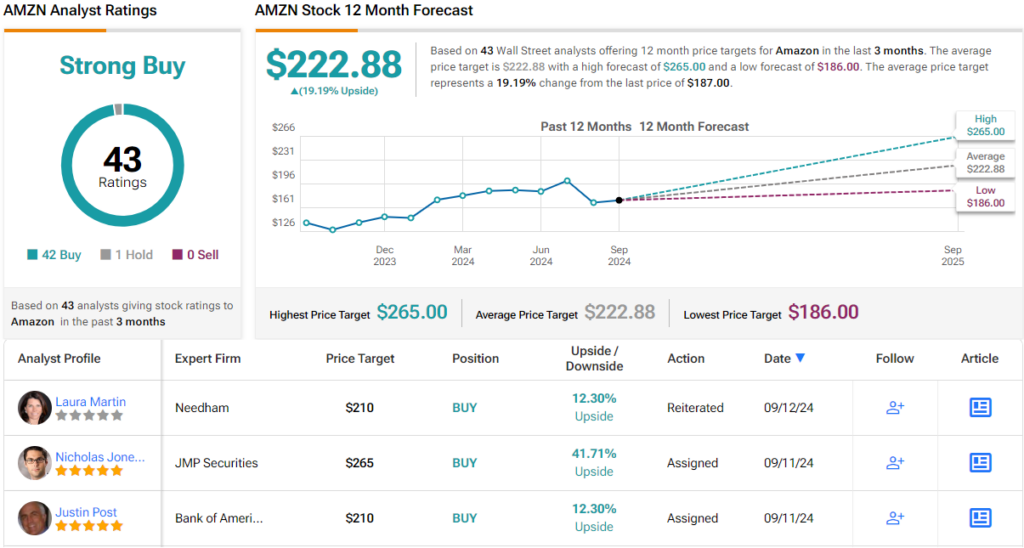

Backing this bullish narrative, Wall Street’s analysts chime in harmony, painting Amazon with a gleaming Strong Buy brush. With a consensus target price of $222.88, a quaint 19% return gleams on the horizon.

For investors seeking the compass of astute investments, TipRanks’ Best Stocks to Buy serves as a beacon, illuminating all of TipRanks’ insights on equities.

Important to mention, the viewpoints articulated in this piece solely represent the featured investor’s stance. The content intends to serve solely as edifying, urging readers to conduct personal due diligence prior to investment.