Wednesday, stocks soared and have recovered most of last week’s losses. As has been the case several times during the current bull market, tech stocks and the QQQ led the way higher. While there has been some rotation recently, tech stocks again flexed their muscles, as evidenced by the QQQ doubling the gains of the other major U.S indices with its more than 2% gains on massive volume. What caused the market’s dramatic gains on Wednesday, and is the current correction over, or is the current rally nothing more than an oversold technical bounce?

The Unwavering AI Growth Trajectory

General Motors (GM) CEO Charles Wilson once said in a congressional hearing, “As goes GM, so goes the market.” Illustrating how top industry groups can be a leading indicator during bull markets cycles. The artificial intelligence (AI) market ballooned to $184 billion in 2024 from about $50 billion in 2023 and is projected to reach $826 billion by 2030 (as per Statista).

Nvidia’s Dominance in the Landscape

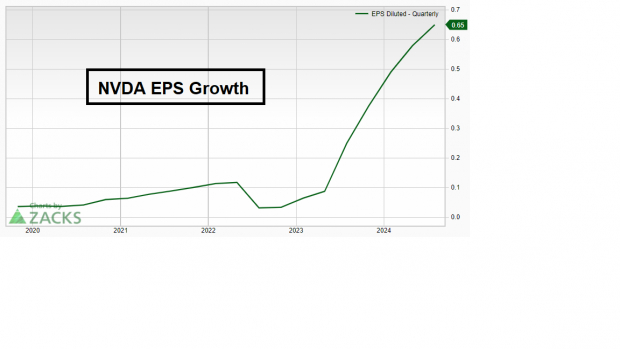

Nvidia (NVDA) leads the current bull market due to its high-performance chips ideal for the accelerated computing required for AI. Nvidia has exhibited impressive earnings growth, with its annual EPS expected to more than quadruple from 2023 to 2024, followed by another doubling in 2025.

Image Source: Zacks Investment Research

While Nvidia and other AI giants like Arm Holdings (ARM) continue to deliver strong earnings, concerns have arisen on Wall Street regarding the sustainability and pace of AI-related growth. Nevertheless, three significant recent occurrences within the AI industry indicate that the AI expansion has substantial room for further growth.

1. Jensen Huang’s Insights Spark Nvidia’s Rally

Yesterday at the Goldman Sachs (GS) tech conference, NVDA CEO Jensen Huang reiterated, “Demand for chips is great.” This seemingly straightforward statement reaffirmed to investors the significant chip demand, resulting in about a $250 million gain in NVDA’s market cap and propelling the Nasdaq higher.

2. OpenAI’s Valuation Skyrockets

OpenAI, the operator of the highly successful large language model (LLM) ChatGPT and backed prominently by Microsoft (MSFT), is reportedly seeking an over $6 billion investment, valuing the company at approximately $150 billion. OpenAI’s valuation was below $100 billion earlier this year, showcasing continued investor eagerness to be part of a premier company within the AI revolution.

3. Klarna Boosts Efficiency with AI

Sebastian Siemiatowski, CEO of Swedish fintech giant Klarna, announced this week the company’s shift from software purchases from Salesforce (CRM) and Workday (WDAY) to internally developed AI tools. Klarna previously disclosed significant cost reductions and enhanced customer satisfaction through AI. Klarna’s AI-driven efficiency improvements are anticipated to influence other tech firms keen on cost optimization.

Bottom Line:

Jensen Huang’s remarks, the surge in OpenAI’s valuation, and Klarna’s favorable results utilizing AI signify that the AI revolution is ongoing, with further expansion anticipated. Expect AI to spearhead the tech sector’s advancements and uplift the market into the forthcoming year.

Anticipated Infrastructure Stock Surge Across America

A massive drive to revamp the deteriorating U.S. infrastructure is on the horizon. It’s a bipartisan, urgent, and ineluctable development. Trillions are earmarked for expenditure, paving the way for significant wealth accumulation.

The critical query remains, “Are you positioning yourself early in the right stocks to leverage their maximal growth potential?”

Zacks has unveiled a Special Report to guide you in this endeavor, and it’s complimentary today. Uncover 5 specialized companies poised to benefit most from the extensive construction and restoration of roads, bridges, buildings, along with robust cargo transportation and energy transformation.

The Historic Rise of AI Stocks: A Financial Look

Revolutionizing Investment Landscape

Walking down the annals of history, we find treasured tales of those rare financial epochs where mammoth growth and disruptive innovation interlace into one beautiful dance. Undeniably, we stand at the cusp of a similar epoch, one marked by the meteoric rise of Artificial Intelligence (AI) stocks.

Seizing the Opportunity

The tantalizing aroma of opportunity wafts through the halls of the stock market as investors cast their eyes upon Microsoft Corporation (MSFT), Salesforce Inc. (CRM), NVIDIA Corporation (NVDA), ARM Holdings PLC Sponsored ADR (ARM), General Motors Company (GM), Invesco QQQ (QQQ), and Workday, Inc. (WDAY). These are not merely tickers; they are the prophets of innovation, the harbingers of change, and the heralds of imminent financial growth.

Anchored in Predictive Potential

The allure stems from the predictive potential that AI stocks manifest. Similar to a labyrinthine chessboard where every move foretells the future, AI stocks harbor the hope of wondrous growth. It is akin to a skilled alchemist wielding a philosopher’s stone that transmutes base metals into gold; these stocks have the Midas touch, promising returns beyond wildest imaginations.

Revelation Unveiled

Like a magician revealing the secrets behind a bewildering trick, analysts delve deep into the fundamental workings of these stocks. An in-depth revelation reveals the intricate symphony of financial indicators, market trends, and technological innovations that underpin the rise of AI stocks. It is not just a mere surge; it is a divulgence of the way the financial cosmos unfolds, laying bare the blueprint of success for investors to follow.

Resonating Echoes of Optimism

As the echo of optimism reverberates through the financial corridors, investors find themselves at a crossroads of choice and opportunity. To shy away is to deny oneself a chance to ride the wave of innovation, to embrace uncertainty, and emerge victorious in the annals of financial history. To seize the moment is to embrace the future, one brimming with promises of untold wealth and uncharted territories.