Investor Concerns and Revenue Forecast

Nvidia Corp’s jittery investors eagerly anticipate updates on its Blackwell chip rollout, despite recent setbacks. The stock incurred a 15% decline following the disclosure of engineering challenges impeding the Blackwell chip’s launch. CEO Jensen Huang’s attempts to reassure investors did little to stem the negative tide. Nevertheless, Nvidia foresees “several billion dollars” in revenue from Blackwell in the upcoming fiscal fourth quarter.

Industry Expert Insights

Industry experts, including Zacks Investment Management’s client portfolio manager Brian Mulberry and Bank of America analysts, have flagged the Blackwell chip delay as a significant concern. Mulberry, in particular, views the timely execution of Blackwell as crucial for stabilizing Nvidia’s stock amid a lack of positive catalysts. Mai Capital Management’s portfolio manager, Chris Grisanti, dismissed the recent stock selloff, highlighting the expansive AI ambitions of tech giants like Microsoft and Amazon whose AWS services are fueling the industry.

Market Response and Supplier Dynamics

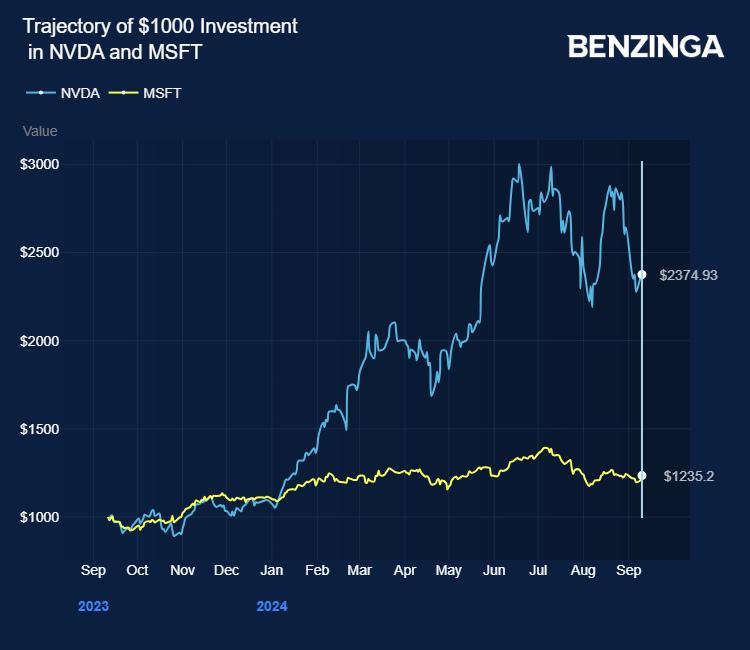

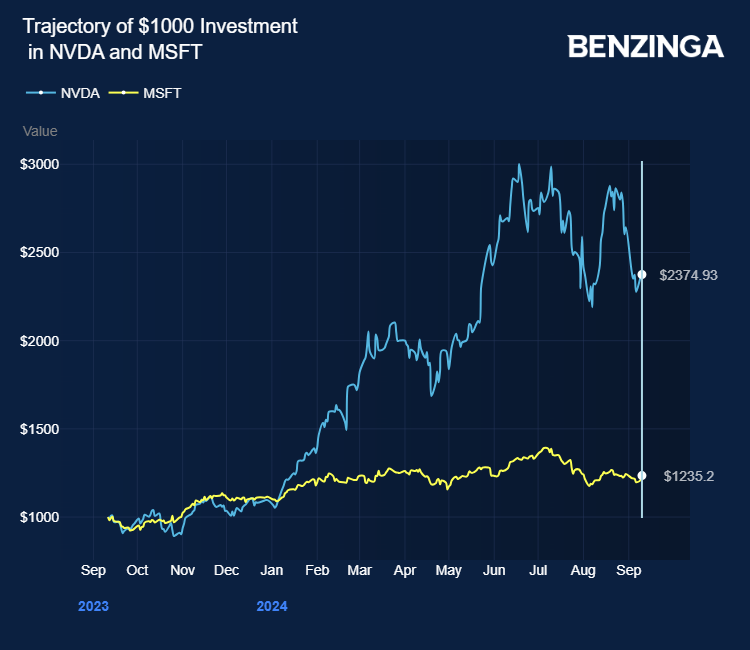

Despite the recent market turbulence, Nvidia’s key supplier, Taiwan Semiconductor Manufacturing Co, reported a 33% surge in topline growth in August 2024. This growth signifies optimism surrounding smartphone market recovery and sustained demand for Nvidia’s AI chips. Notably, Nvidia’s stock has appreciated by over 137% in the past year, offering investors potential exposure through ETFs such as iShares Russell 1000 Growth ETF and iShares S&P 500 Growth ETF.

Current price action sees NVDA stock down 0.37% at $106.08 as of the latest check on Tuesday.

Photo via Shutterstock