Since Tesla’s IPO over a decade ago, the electric vehicle giant has weathered immense scrutiny, market volatility, and skepticism from high-profile pundits. In a landscape where U.S. auto start-ups rarely succeed, especially in the realm of electric vehicles, Tesla’s journey has been nothing short of extraordinary. Despite initial unprofitability and economic turmoil, Tesla has defied all odds, soaring more than 17,000% since its inception, surpassing traditional automakers like Toyota, Ferrari, General Motors, and Ford in market capitalization.

The stock’s wild ride hit a peak in November 2021 at $414.50 before retreating significantly. Many wonder if Tesla’s peak has passed or if the recent correction presents a lucrative opportunity for investors.

To assess Tesla’s trajectory, it’s crucial to delve into key catalysts and data points:

Tesla’s Valuation Puzzle

One of the persisting bearish arguments against Tesla has been its lofty valuation. Critics question why a company with less revenue than industry giants commands such a massive market cap. Yet, two factors shed light on Tesla’s premium:

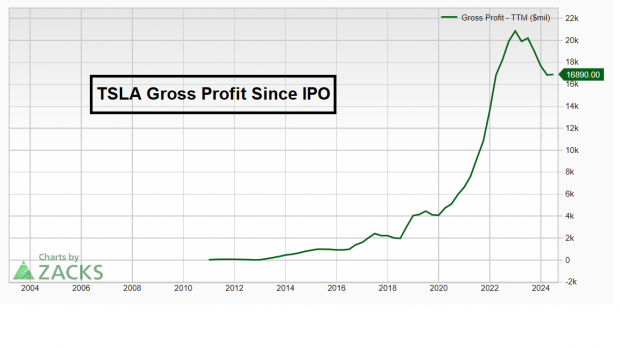

1. TSLA’s Robust Growth: Tesla’s rapid growth trajectory, highlighted by its notable gross profit figures compared to stalwarts like GM, showcases its ability to outpace competitors and gain market share.

2. Diversified Business Model: While Tesla is known for its cars, it also operates in burgeoning sectors like solar energy, EV infrastructure, and autonomous driving technology. This diversification into tech-centric domains contributes to its elevated valuation.

Tesla’s Robotaxi and Full-Self Driving (FSD): The Deciding Factors

Detractors often accuse Elon Musk of overhyping Tesla’s potential without delivering on promises. However, Musk’s track record of defying skeptics, from the success of the Model S to the mass-market appeal of the Model 3, speaks volumes. Musk’s timelines may be ambitious, but his ability to create shareholder value is undeniable.

Despite delays, the upcoming Robotaxi reveal on October 10th at the Warner Brothers campus is highly anticipated. Musk’s bold proclamation that Tesla’s future hinges on Robotaxi and FSD technology, with potential shares reaching $5 trillion by 2030, underscores the transformative impact these innovations could have. In the race for autonomous supremacy against Waymo, Tesla’s FSD technology has been lauded as significantly safer than the average U.S. car, a testament to its potential.

The Groundbreaking Potential of Tesla’s Full-Self Driving (FSD) Robotaxi

Musk’s assertion that Tesla could revolutionize the ridesharing landscape with Robotaxis, competing with industry stalwarts like Uber, signifies a seismic shift in the transportation industry. Despite facing competition from Alphabet’s Waymo, there is ample room for Tesla and other innovators to thrive. Studies, such as ARK Invest’s analysis, affirm Tesla’s FSD technology to be 18 times safer than conventional U.S. cars, hinting at a future where safety and innovation converge.

Lower Interest Rates: Fueling Tesla’s Bullish Momentum

Elon Musk’s vocal criticism of the Federal Reserve’s interest rate policies underscores the significance of borrowing costs for high-priced purchases like EVs. With the Fed signaling rate cuts to ease borrowing expenses, consumers stand to benefit from reduced costs, potentially driving greater adoption of Tesla’s innovative lineup.

Cybertruck in Production

Tesla’s Road to Success: A Deep Dive into Recent Developments

The Rise of the Cybertruck: Future Expansion Imminent

With the Cybertruck slowly making its way across roads in North America, Tesla’s futuristic creation is becoming a common sight. The company’s strategic production improvements are set to boost the prevalence of Cybertrucks in various regions. Additionally, Tesla’s plans for a Cybertruck tour in Asia hint at potential expansions in sales territories, promising new horizons for the innovative electric vehicle market.

Encouraging Signs from China: Tesla Sales on the Rebound

China’s prominent position in the global electric vehicle market cannot be understated, with over 50% of EV sales originating from this powerhouse. Despite recent challenges in the Chinese market, Tesla’s August sales figures represent a significant turning point. Surging past July numbers by 37%, Tesla’s sales exceeding 60,000 units in August mark a robust performance and the strongest month for the company in 2024, signaling a potential recovery in the Chinese market.

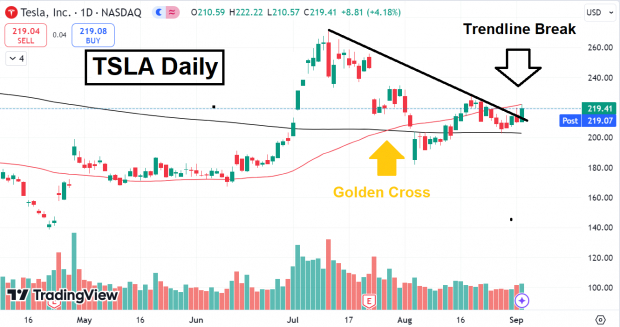

Technical Triumph: Bullish Signals for Tesla

Tesla’s recent stock performance has triggered two bullish signals that suggest a positive trajectory. Firstly, by surpassing a downtrend line from July, Tesla shares have demonstrated resilience and momentum in the market. Secondly, the crossing of the 50-day moving average above the 200-day moving average has initiated a “Golden Cross,” indicating a significant uptrend and potential for further growth.

Image Source: TradingView

Conclusion

Since its IPO, Tesla, under the leadership of Elon Musk, has defied skeptics and emerged as a resilient force in the market. Despite recent challenges, the company showcases several indicators suggesting that Tesla is poised to excel well into 2025, solidifying its position as a top performer.