Intelligent investing is synonymous with unwavering patience. Research substantiates this wisdom – demonstrating that steadfast commitment to the stock market yields superior returns over time. Bearing this in mind, let’s delve into two impeccable buy-and-hold options that deserve the attention of long-range investors.

Image source: Getty Images.

Amazon: The Giant

Allow me to highlight the first no-brainer stock: Amazon (NASDAQ: AMZN). While there are myriad reasons to possess shares in this legendary corporation, let’s zero in on some key financial measures that underscore why Amazon stands out as a top-tier long-term investment.

Firstly, Amazon’s vast scale is unparalleled, boasting an annual revenue exceeding $600 billion, second only to Walmart in the realm of American revenue generators.

Secondly, despite its colossal size, Amazon exhibits impressive growth, with a revenue surge of approximately 10% year over year. At its present magnitude, Amazon is garnering roughly $60 billion per annum in fresh sales.

Thirdly, Amazon spearheads cutting-edge technologies globally. Notably, the company’s cloud segment, Amazon Web Services (AWS), is a major driver of new yearly revenue, growing at a rate of about 19%. Furthermore, Amazon pioneers the robotics sphere, boasting over 750,000 robots laboring ceaselessly in its distribution centers. Finally, with myriad artificial intelligence initiatives in play, Amazon harnesses generative AI to streamline its e-commerce operations and power its ubiquitous voice-activated echo devices.

In essence, Amazon’s substantial and expanding sales figures affirm the company’s ongoing innovation in customer service and acquisition. Over the next decade, Amazon stands as a prime stock selection for its amalgamation of established enterprises alongside inventive ventures.

Meta Platforms: A Cashflow Gem

The subsequent no-brainer stock choice is Meta Platforms (NASDAQ: META). What distinguishes Meta as an unequivocal pick is its capacity to drive shareholder value – the paramount criterion for any stock.

To elaborate, Meta generates copious amounts of free cash flow, the lifeblood of any premier stock.

Think of it as a garden hose. When the spigot is wide open, water gushes forth rapidly. As the valve closes gradually, the water flow diminishes.

In corporate terms, the valve symbolizes operating expenses and capital investments, whereas the water signifies free cash flow – the residual after deducting employee salaries, taxes, and various costs from revenue.

Meta’s forte lies in its robust free cash flow generation, a metric that continues to escalate.

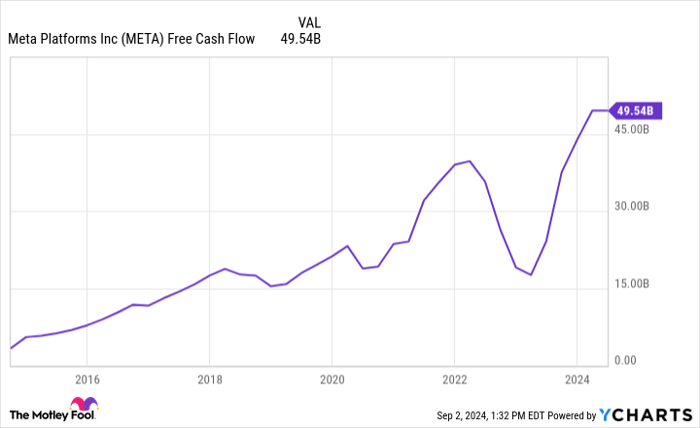

META Free Cash Flow data by YCharts

Over the past decade, Meta has surged its free cash flow from approximately $3 billion to nearly $50 billion – a staggering feat. Notably, numerous renowned large companies fail to amass $50 billion in sales, let alone in free cash flow. In simple terms, Meta’s robust free cash flow designates it as a powerhouse in the stock market arena.

With a bounty of free cash flow at its disposal, Meta’s management can augment shareholder value through diverse avenues, such as dividend disbursements, share buybacks, or strategic acquisitions.

To encapsulate, Meta’s free cash flow abundance positions it as a formidable force in the stock market landscape, furnishing management with myriad strategies to elevate its share price. This gratifying prospect should elate investors for years to come.

Unveiling the Path of Amazon Stock Investment

Investing in Amazon stock might spark your financial curiosity, yet before diving into this investment venture, a discerning look is warranted.

Past Recommendations and Future Possibilities

A recent analysis by the Motley Fool Stock Advisor team unveiled their handpicked 10 best stocks of the hour deemed ripe for investors to pluck. Interestingly, Amazon did not make this revered list. These curated stocks are projected to yield unparalleled returns in the foreseeable future.

Reflect on a past revelation. Back on April 15, 2005, Nvidia was in a similar spot on the list. Imagine what would have transpired if $1,000 was funneled into this stock on that very day of recommendation. The result? A staggering $630,099, an astronomical financial leap that raises the eyebrows of even the most seasoned investors.*

The blueprint for financial triumph, as provided by Stock Advisor, encompasses a user-friendly roadmap to navigate the uncharted waters of stock investments. Serving investors with regular portfolio updates, strategic insights, and a pair of fresh stock suggestions every month, the Stock Advisor service has effortlessly managed to outpace the S&P 500 returns by a factor of four since its inception in 2002.*

Yearning for a glimpse of the top 10 tagged stocks? Hesitate no more, click the link below to satiate your financial curiosity with a peek at the coveted list.

*Stock Advisor returns as of September 3, 2024