American beer maker Molson Coors has made a significant decision to retract some of its Diversity, Equity, and Inclusion (DEI) policies in response to mounting pressure from activists. The move also involves the company’s discontinuation of participation in the Human Rights Campaign’s Corporate Equality Index, a system used to assess LGBTQ+ inclusion within the workplace.

The Influence of Activist Pressure

Molson Coors’ choice to backtrack on its DEI policies underscores the growing influence of both progressive and conservative groups in shaping corporate initiatives. The decision aligns with a broader trend of companies reevaluating their DEI approaches, driven partly by intense scrutiny from various stakeholders, including filmmaker Robby Starbuck.

At the heart of the matter lies a debate over the extent to which DEI policies should prioritize specific demographics, with some critics arguing that such measures may inadvertently exclude certain groups. TAP’s recent policy adjustments mark a strategic shift in response to ongoing societal conversations about diversity and inclusion.

Broader Implications for Industry Dynamics

Molson Coors’ policy reversal reflects broader shifts within the corporate landscape, where companies are grappling with the intricate balance between fostering inclusivity and addressing concerns of potential discrimination. The decision to align executive compensation with performance metrics rather than aspirational diversity goals signals a recalibration of priorities aimed at enhancing overall organizational effectiveness.

The evolving stance on DEI across industries, as evidenced by Molson Coors’ reconsideration, highlights the nuanced interplay between socio-political pressures and corporate decision-making. By taking a step back from prescriptive DEI measures, the company seeks to cultivate a workplace culture that promotes unity and mutual respect among employees from diverse backgrounds.

Market Response and Investor Sentiment

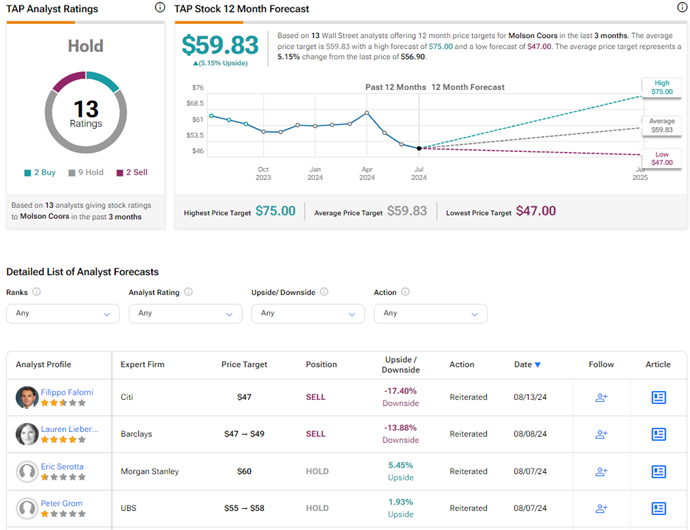

Analysts’ cautious outlook on Molson Coors stock reflects ongoing challenges facing the beer industry, compounded by broader economic uncertainties. While the company’s strategic realignment may introduce short-term volatility, the long-term benefits of fostering a more inclusive work environment could position TAP for enhanced resilience and sustained growth in the competitive market landscape.

Investors closely monitoring TAP stock dynamics should consider the broader industry context and evolving consumer preferences when evaluating the company’s growth prospects. Molson Coors’ decision to divest certain brands as part of its strategic realignment underscores a proactive approach to streamlining operations and focusing on core business priorities.