With a deep sigh and a heavy heart, Ford Motor Company finds itself in the throes of recalling 90,736 of its automobiles due to insidious engine intake valve issues. Casting a dark shadow over the automotive giant, the National Highway Traffic Safety Administration (NHTSA) solemnly reported on a fateful Saturday that these faulty valves possess the ominous potential to break while in motion, leading to catastrophic outcomes. The distressing saga unfolded following an exhaustive investigation that dawned its first light in January 2022, illuminating 22 documented instances where engine intake valves shattered into oblivion, descending ominously into the combustion chamber and leaving behind a wake of irreparable engine damage.

The scope of this recall encompasses vehicles birthed into existence between 2021 and 2022, sporting the revered badges of Bronco, F-150, Edge, Explorer, Lincoln Nautilus, and Lincoln Aviator, each equipped with either a 2.7 liter or 3.0 liter Nano EcoBoost engine. Ford’s loyal dealers now face the challenging quest of testing each beloved auto and replacing engines that harbor this disheartening defect.

The Unveiling of Ford’s Engine Valve Predicament by U.S. Regulators

Stepping into the spotlight, the esteemed U.S. auto safety regulator, the NHTSA, candidly unveiled the alarming narrative surrounding Ford’s engine valves. A foreboding prophecy that some of these vital components might succumb to the harrowing fate of breaking while engaged in their mechanical dance, heralding a tale of “engine failure and a loss of drive power.” Ford’s sober analysis unearthed a troubling reality – certain engine intake valves were birthed, not adhering to the design specifications for hardness. The consequence of this transgression? A state of brittleness and a susceptibility to shattering under the relentless pressures of motion.

Delving deeper into the anatomy of this calamity, Ford revealed that the once-sturdy intake valve materials fell victim to the capricious whims of the supplier’s grinding processes, straying far from the boundaries of control specifications. Responding with a resolute stance, Ford mandated a change in the intake valve material for vehicles crafted post the ominous date of October 31, 2021.

Navigating the Horizon: Evaluating Ford’s Prospects Amidst Recalls

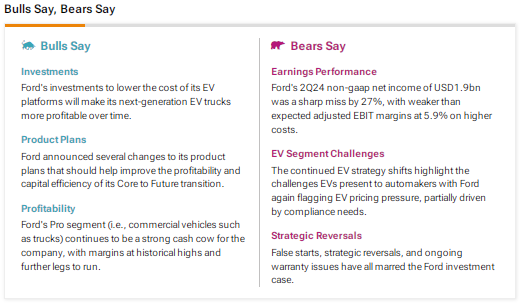

Lost in the tempest of macro pressures and the unsettling discord of product recalls, Ford finds itself under the watchful gaze of Wall Street analysts, each harboring a unique vantage point. In a tone reminiscent of a musical refrain, TipRanks’ Bulls Say, Bears Say tool echoes the melodic cacophony of opinions swirling around Ford’s domain. A symphony of divergent perspectives unfolds, with some analysts serenading Ford’s symphony of electric vehicle (EV) ambitions with a jubilant note of approval. Bulls, enamored by the rhythm of Ford’s investments in the sanctum of cost optimization for its EV platforms, find solace in the promising cadence of the Ford Pro unit, a tapestry that interweaves commercial vehicles into the fabric of tomorrow.

Alas, underneath the harmonious melody lies a dissonant undertone, as the Bears voice their apprehensions in a somber key. Their lamentations speak of continued strife amidst the challenges of EV pricing pressures and the haunting specter of ongoing warranty issues that mar Ford’s once-glorious horizon.

Deciphering Ford’s Fortunes: A Divided Wall Street Verdict

As the dust settles and the echoes of discord fade into the distance, Wall Street’s murmurs remain torn asunder, struggling to forge a unified path for Ford’s stock trajectory. Peering through the looking glass of TipRanks, the reverent F stock stands adorned with a mantle of Moderate Buy consensus, embroidered with five Buys, seven Holds, and one solitary Sell rating. Like a siren song beckoning from the distant shores of certainty, the hymn of the average Ford Motor stock price target of $14 whispers of a potential 25.1% ascent from the current juncture. Yet, the melancholy refrain lingers on, with F shares bearing the weight of a 3.1% descent year to date, lost in the enigmatic tides of uncertainty and turmoil.