U.S. legacy automaker General Motors GM is on a winning streak in the trading world. With the shares lingering above $49/share in the recent trading sessions, culminating at $49.78 on Friday, the stock is inching closer to its 52-week pinnacle of $50.50.

As one of the world’s largest and most reliable automobile manufacturers boasting a market cap exceeding $55 billion, General Motors outshined the U.S. auto market with a commanding 16.2% share in 2023. While GM’s internal combustion engine (“ICE”) pickups and SUVs have been crowd favorites, the company is reshaping the landscape by diverting substantial investments towards eco-friendly vehicles.

The Road to Success

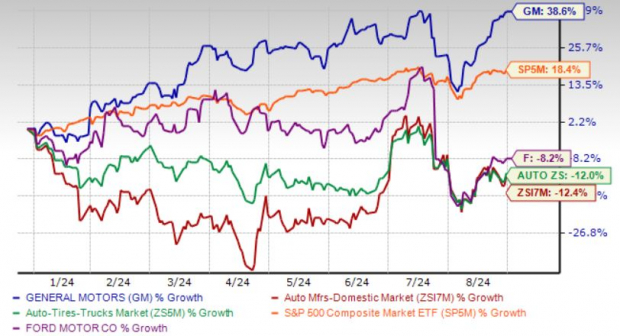

With the future of transportation steering towards electric and autonomous avenues, General Motors emerges as a beacon of hope for investors, standing at a remarkable discount. The company has witnessed an impressive surge of over 38% year-to-date, outperforming industry benchmarks, sector indices, and even its closest competitor, Ford F.

The Hidden Gem

Exceeding earnings estimations consecutively over the past four quarters with an average earnings surprise of 18.8%, General Motors showcases an upward momentum in its revenue outlook for 2024 and 2025.

Cornering the Market

Boasting a forward earnings multiple of just 4.98, General Motors’ price-to-earnings ratio is notably lower than the industry standard of 33.93, positioning the stock as a lucrative catch. Despite hovering close to its yearly highs, the stock remains a bargain, trading at a 60% markdown from its 5-year zenith and a 15.7% discount relative to the median. In light of these figures, General Motors offers substantial value, currently flaunting an enticing Value Score of A.

The Bullish Outlook

General Motors’ robust cash flow has garnered attention, with the company raising the bar on adjusted automotive FCF guidance to the tune of $9.5-$11.5 billion, surpassing the former forecast of $8.5-$10.5 billion. Notable for its P/CF ratio standing at 2.95, General Motors’ valuation is significantly below the industry 5-year average of 19.23, solidifying its stance as a strong investment opportunity.

Five Anchors for Optimism

General Motors is setting the stage for a bright future: Following significant cost-cutting measures and market share gains in North America, General Motors is poised for growth in electric vehicle production, with a focus on battery technology and expanding its EV lineup.

GMNA leads the way: Strengthening market share in the United States, General Motors’ North American division has surpassed pre-pandemic levels, projecting increased adjusted earnings and per-share profits for 2024.

Driving towards electrification: Despite market competition, General Motors is accelerating its EV strategy, targeting profitability in the EV segment by late 2024, supported by the Ultium Drive system and state-of-the-art battery plants.

Cruise at full throttle: Cruise, General Motors’ autonomous vehicle subsidiary, is gearing up for a relaunch of fully autonomous rides and an alliance with Uber, signaling a resurgence in the self-driving industry.

A robust financial foundation: With $35.8 billion in automotive liquidity and a share buyback program signaling confidence in future prospects, General Motors’ financial stability remains unshaken.

A Smooth Ride to Success

With a Zacks average price target of $55.74 per share, investors eye a potential 12% upside from current levels. General Motors’ innovative strides in electric vehicles, coupled with its stronghold in the ICE market, position the stock for substantial growth.

Trading near its 52-week peak, General Motors remains a compelling investment option, backed by solid fundamentals, attractive valuations, and optimistic forecast revisions for 2024, promising a bright road ahead.

Unveiling Top Stock Picks for the Next Month

Elite Selections Unveiled

In a crowded stock market where dragons and bulls often clash, a beacon of hope shines through. Enter the domain of Zacks, where the oracle of experts has bestowed upon us the wisdom of 7 distinguished stocks. From the grand list of 220 Zacks Rank #1 Strong Buys emerges these gems, labeled as “Most Likely for Early Price Pops.”

Dating back to the glistening days of 1988, this elite selection has not just danced but wallowed in the symphony of market success. Clocking in with an average annual gain of +23.7%, these handpicked 7 darlings have outpaced the market whirlwinds twofold. They’re not just stocks; they are the lofty ships amidst the turbulent seas of market speculation.

Strategizing for the Future

When the echoes of trading linger in vaulted halls, one must hearken to the call of strategy set forth by Zacks. These handpicked 7 stocks beckon for attention, not just for the sake of it but to craft a symphony of financial success that resonates through the annals of time.

The history books of the financial world sing praises to the victors who ride the waves of market prowess. For investors seeking the elixir of future success, these 7 stocks stand as pillars of reliability, resilience, and reward.

As the clock ticks towards the future, what better way to secure your financial ark than by placing your faith in the formidable advice of Zacks. These 7 nominations are not just fleeting whispers in the winds of finance but the solid ground upon which empires rise and fall.