Nvidia (NVDA) has been hogging the limelight on Wall Street, standing tall at the epicenter of the artificial intelligence (AI) revolution. The chip designer’s market value has more than doubled in 2024 and skyrocketed almost 800% since late 2022, pushing its market cap above $3 trillion today.

However, as investors remain fixated on Nvidia, let’s not overlook three other mega-cap stocks that have seen a remarkable surge of over 40% in 2024, outpacing the S&P 500 Index and its 18% gains by a substantial margin.

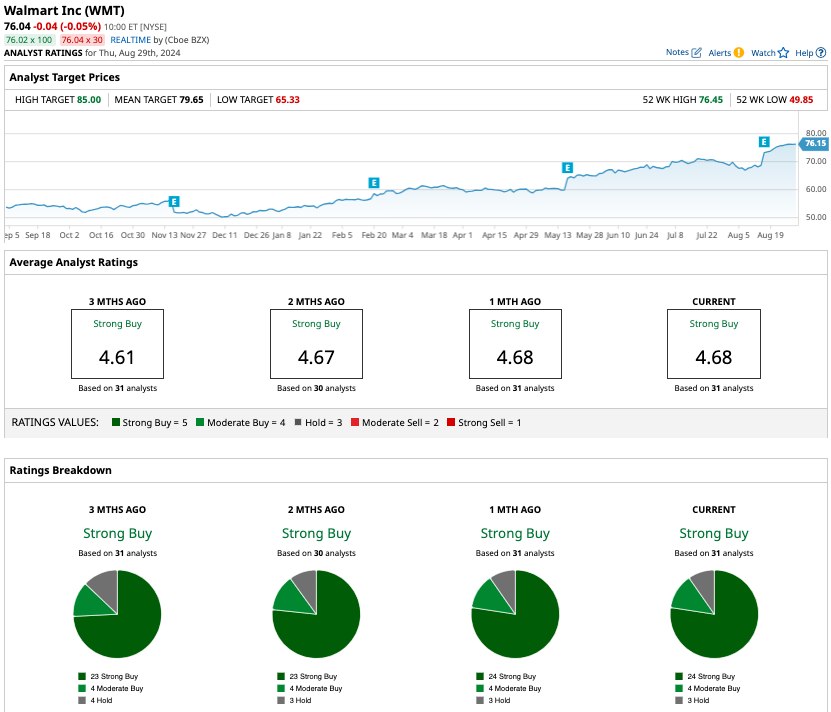

Walmart Stock – A Retail Behemoth Thriving Against All Odds

Walmart (WMT), valued at $612 billion, has defied the odds as a big-box retailer in a sector known for its resilience during economic downturns. Despite its sheer size and challenges related to consumer spending, Walmart reported a 5% growth in quarterly revenue to reach $169.34 billion in fiscal Q2 of 2025. The company expects sales to climb between 3.75% and 4.75% year over year.

Why should you pay attention to Walmart’s performance? The retail giant’s results offer valuable insights into the pulse of the U.S. economy. In Q2, Walmart’s comparable sales in the U.S. surged by 4.2%, excluding the impact of fluctuating fuel prices. This metric holds significance as it includes store sales from outlets operational for at least a year.

Additionally, Sam’s Club witnessed a 5.2% growth in comparable sales, while e-commerce revenue soared by 21%. Walmart highlighted a year-over-year increase in both store and online visits. Transactions were up by 3.6%, with the average ticket size rising by 0.6% compared to the corresponding quarter of the previous year. The stock has rewarded shareholders handsomely, delivering a 200% return in the past decade and a 44.6% surge in 2024 alone.

Meta Platforms Stock – Riding High on Social Media Dominance

Meta Platforms (META), the titan of social media with platforms such as Facebook, Instagram, and WhatsApp, boasts a market value of $1.31 trillion. The company’s stock has soared 48.2% in 2024 and over 76% in the last 12 months, driven by robust earnings and revenue growth.

In Q2 of 2024, Meta witnessed a 22% year-over-year surge in sales, amounting to $32 billion. This marked the fourth consecutive quarter with sales growth exceeding 20%. Notably, net income skyrocketed by 73% to $13.47 billion, up from $7.79 billion in the previous year.

Meta thrives on its online ad revenue, a segment where it continues to gain market share. The company’s ad sales rose by 22% in Q2, outpacing the growth of industry peers such as Alphabet (GOOGL) and Microsoft (MSFT). Investing heavily in capital expenditures to lead the AI race, Meta allocated $8.47 billion to capex in Q2 and anticipates ending the year with capex between $37 billion and $40 billion.

Eli Lilly Stock – Dominance in Healthcare Propels Stock Surge

Eli Lilly (LLY), the healthcare behemoth, has witnessed a remarkable 62.7% growth in 2024, valuing the company at a substantial $901.8 billion.

Recently, Eli Lilly announced an innovative pricing strategy for its weight loss drug, Zepbound, offering it at a 50% discount or more compared to competitors. The 2.5 mg dose is priced at $399 for a four-week supply, while the 5 mg variant costs $549. The company’s impressive lineup also includes Mounjaro, approved for treating Type 2 diabetes, which, along with Zepbound, generated nearly $7 billion in sales in the past six months.

Lilly’s breast cancer drug sales surged by 42% in the first half of the year to $2.4 billion. Additionally, three other drug treatments reported double-digit sales growth. Despite trading at a steep 58x forward earnings multiple, Eli Lilly’s stock is expected to witness earnings more than double year over year in 2024. Analysts project a robust 75% annual growth in adjusted earnings over the next five years.