Investors have witnessed a remarkable rally in tech stocks since the dawn of 2023. Innovations in burgeoning sectors such as artificial intelligence (AI) have showcased the immense potential of companies engaged in fields like chip design and cloud computing. The rise of Nvidia in this landscape is nothing short of meteoric, with its shares skyrocketing by an impressive 785% since the beginning of 2023.

Nvidia’s journey from a $360 billion market cap player to a groundbreaking $3 trillion valuation mirrors the ascent of tech giants like Apple and Microsoft, making it a stellar success story in the industry.

Potential to Follow Nvidia’s Path

Given its current status as the fourth most valuable company globally, Alphabet, with a market cap of $2 trillion, stands at the precipice of crossing the elusive $3 trillion magnate club. The heyday of Alphabet, dominated by cash cows and growth drivers across various markets, coupled with a stock value that suggests an appealing investment opportunity, positions it as the prime candidate to emulate Nvidia’s astounding achievement.

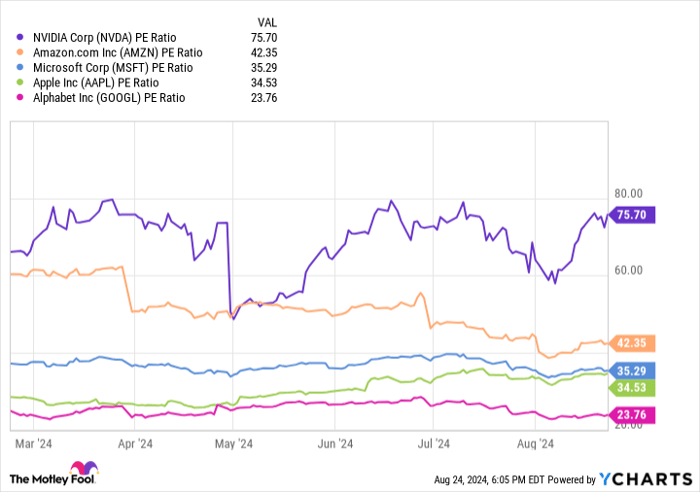

Alphabet’s stock has surged by a commendable 19% this year, outstripping many peers in the industry. Notably, the company boasts the most attractive price-to-earnings (P/E) ratio among its contemporaries, signaling a fortuitous moment for prospective investors to seize this undervalued gem.

Thriving in the Tech Landscape

Alphabet’s stronghold in the tech realm stems from its expansive reach across diverse industry segments. With juggernaut brands like Android, YouTube, Chrome, and a plethora of Google products under its belt, Alphabet reigns as the go-to services provider for myriad essential functions. The company’s products have garnered a massive user base, hosting an impressive nine platforms surpassing the 1-billion user mark as of 2023.

Through strategic reinvestment in its operations and a daring foray into novel ventures, Alphabet has navigated through an array of discontinued products, including the likes of Google Hangouts, Stadia, and Google Glass. This nimble approach has enabled Alphabet to secure lucrative roles in pivotal sectors like digital advertising, cloud computing, and AI, thereby fortifying its prowess in the market.

Alphabet’s revenue streams are largely buoyed by its robust digital advertising segment, accounting for a significant 78% of its revenue. As a key player in the $740 billion digital advertising industry, Alphabet commands a considerable 26% share of global ad sales, underscoring its dominance in the realm.

A Legacy of Steady Growth

Alphabet’s robust growth trajectory has been a testament to its unwavering resilience amidst tumultuous times in the tech arena. A shrewd investment of $10,000 in Alphabet’s stock back in 2014 would have blossomed into a substantial sum close to $58,000 today, accentuating the company’s track record of delivering sustained returns.

The company’s free cash flow reaching $61 billion this fiscal year underscores its financial heft to continue fortifying its operations and staying abreast of its rivals. With a modest P/E ratio of 24 vis-a-vis its competitors, Alphabet emerges as a compelling investment prospect poised to ascend to the $3 trillion echelon in the future.

Is Alphabet Worth Your Investment?

Before plunging into Alphabet’s stock, it’s prudent to weigh certain considerations. The Motley Fool Stock Advisor team has recently identified ten stocks believed to offer substantial returns in the forthcoming years, with Alphabet surprisingly not making the list. This discerning insight underscores the potential for substantial gains in the tech sphere beyond the purview of established giants.

Alphabet’s legacy of consistent growth, underscored by its remarkable performance over the last five years, places it at the forefront of the tech landscape. Amidst economic uncertainties and global pandemics, Alphabet has weathered the storm, exhibiting triple-digit growth in its earnings and stock valuation, further cementing its status as a stalwart performer in the industry.

The present confluence of factors, from Alphabet’s resilient business models to its enviable P/E ratio, makes it a compelling investment avenue that savvy investors may consider before the opportunity to join the hallowed $3 trillion league slips away.