RingCentral RNG shares have seen a 1.9% increase over the last six months, contrasting with a 13.4% drop in the Zacks Internet – Software and Services sector. This ascent is no fluke; RNG’s AI endeavors have been the wind beneath its wings.

Recently, RingCentral introduced enhanced features to its AI-driven contact center solution, RingCX. The updates encompass real-time AI-powered assistance for supervisors and agents, AI-based coaching insights, and an Intelligent Virtual Agent (IVA) framework for swift integration with RingCX. Notably, Yellow.ai, Cognigy, and Google DialogFlow support the existing IVA ecosystem.

These new AI enhancements are slated to roll out in the U.S. shortly and will grace international markets and partners’ horizons by early 2025, giving RingCentral’s demand an added oomph.

Since its inception in November 2023, RingCX has resonated with 350 customers, marking a 70% increase in adoption rates. RingCentral’s commitment to adding new features continuously (300 in the last quarter alone) sets it apart. The RingSense AI feature has captivated half of the RingCX customer base, opting for the paid AI functionality.

RNG Stock’s AI Advancements Drive Prospects

RNG’s strategic inclusion of AI tools remains a linchpin in its growth trajectory, tapping into the expanding demand for Unified Communications as a Service (UCaaS) and contact center Software-as-a-Service (SaaS) solutions.

With a slew of recent AI-driven product launches including RingSense, RingCX, RingSense for sales, and RingCentral Events, RNG has been successful in attracting a loyal clientele.

RingCentral’s ambition to achieve $100 million exit Annual Recurring Revenue (ARR) through new products by 2025 appears within reach, steering the company towards its goal.

The enterprise segment’s robust performance in the second quarter of 2024 showcases double-digit growth in the UCaaS business. RNG sealed around 20 deals exceeding $1 million in total contract value (TCV), with a notable 30% YoY increase in the average TCV of large deals.

Expanding partnerships with industry giants like Cox Communications, Vodafone, and Microsoft underline RingCentral’s upward trajectory. Notably, 50% of major deals in Q2 2024 involved RingCentral integrated with Microsoft Teams, while Vodafone is extending RingCX to its global customer base.

RNG’s Bright Q3 Outlook

RingCentral foresees Q3 2024 revenues between $600.5 million and $603.5 million, depicting an 8% YoY rise. Subscription revenues are expected to land between $572 million and $575 million, indicating an 8% YoY growth.

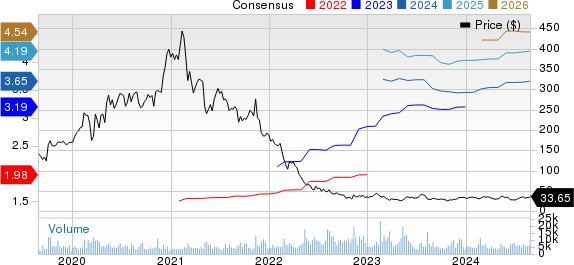

Zacks Consensus Estimates for Q3 2024 revenue and earnings stand at $601.9 million and 92 cents per share, respectively, showing healthy growth potential.

Investment Implications for RNG Stock

RingCentral emerges as an appealing prospect for investors eyeing growth, driven by its innovation streak and market positioning. The company’s high Growth Score and undervaluation (Value Score of B) make it an enticing option. With RNG trading at a lower Price/Sales ratio than the industry average, the stock holds promise for discerning investors.

Currently sporting a Zacks Rank #2 (Buy), RingCentral remains on an upward trajectory.

Consider AEYE Stock Instead

AudioEye AEYE emerges as another top bet, boasting a Zacks Rank #1 (Strong Buy) at present. With a Growth Score of A and a long-term earnings growth rate pegged at 25%, AEYE presents an attractive opportunity for investors seeking growth prospects in the dynamic market environment.

Zacks Highlights a Top Semiconductor Stock

This semiconductor gem, a fraction of NVIDIA’s size, has the potential to soar even higher. Fueled by strong earnings and a growing customer base, this stock is positioned to meet the escalating demand for Artificial Intelligence, Machine Learning, and the Internet of Things. As the global semiconductor industry is projected to skyrocket in value, this stock stands out as a promising contender for prudent investors.