Step into the chip industry, and you can almost hear Nvidia’s triumphant melody playing on repeat. Investors, in awe, watch as Nvidia (NASDAQ: NVDA) continues its meteoric rise, scaling the summit of tech giants with a market cap soaring over $3 trillion. The past five years have been a crescendo of success, with stock gains of almost 3,000% painting a golden horizon for long-term shareholders. But as the orchestra nears its final notes, a new tune emerges.

The Looming Cloud Over Nvidia

Nvidia’s financial operetta has seen its operating income swell by more than 2,000% in half a decade, hitting a crescendo at $48 billion. The catalyst behind this symphony? Nvidia’s chips leading the AI revolution and captivating the tech realm. Being the premier source of these chips has sent Nvidia’s revenue and profit margins dancing to an unprecedented rhythm, leaving competitors like Intel in the shadows.

Yet, a storm brews as Amazon, Alphabet (Google), and Microsoft whisper of ventures into the chip-making world. With Amazon crafting its Inferentia and Trainium chips to challenge Nvidia, a rift emerges. Though their offerings lag behind Nvidia’s prowess for now, the symphonic truth remains – a crescendo in investments signals a symphony of competition that may strip Nvidia of its melodic pricing power.

A Crescendo in Competition

Nvidia’s crescendo has been fueled by expanding profit margins, soaring from a modest 15% to a harmonious 60% in recent years. The sweet melody of profitability plays louder as Nvidia stands virtually unchallenged in the AI chip realm. This lone tune grants Nvidia pricing power, fueling revenue growth and expanding margins – a sonnet to shareholders’ ears.

However, dissonance lurks as the clouds of competition gather. The three giants – Amazon, Google, and Microsoft – are tuning their chips to hum a different melody. As demand stays constant but supply proliferates, the timeless law of supply and demand threatens Nvidia’s operatic harmony, whispering of a potentially discordant future.

Harmonious Risks and Discordant Realities

Nvidia’s stock is a sonnet of momentum, echoing with crescendos of growing earnings and revenues. Yet, a fortissimo in chip supply from competitors could strike a dissonant chord, casting shadows on Nvidia’s financial libretto.

The tale of increased competition is a ballad that alters the melody of chip supply, forewarning of falling prices and dwindling profit margins. Should this bleak aria play out, Nvidia’s earnings may face a somber decline, setting a turbulent canvas for investors to ponder.

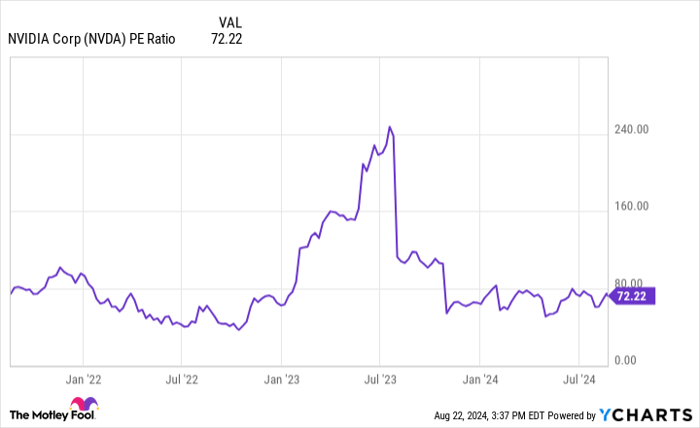

Currently, Nvidia’s P/E ratio stands at a lofty 73, nearly tripling the S&P 500 index average. However, should the melody of pricing power wane, revenues and profits will strike a less-than-rousing note. A waning P/E ratio atop a $3 trillion theater stage paints a risky motif for Nvidia’s future, hinting at an eventual denouement to its monster stock crescendo.

Final Overture

The curtain rises on Nvidia, its encore standing on a precipice. As investors await the final act of this technological opera, the ensemble of competitive discord grows louder. Nvidia’s future tune may be uncertain, but one thing rings clear – the melody of competition may well be the final note in Nvidia’s symphonic saga.