DBS remains bullish on the future of Alibaba Group Holding Limited (HK:9988), projecting a substantial 44% upside potential following the release of the company’s latest June quarter results. Analyst Sachin Mittal from DBS, a five-star rated analyst on TipRanks, has reaffirmed a Buy rating on the stock, highlighting Alibaba’s dominant position in the e-commerce realm and its diversified business offerings.

Alibaba, a prominent Chinese technology company renowned for its online marketplace, has caught the attention of investors with its promising performance.

Promising Outlook for Alibaba’s Diversified Portfolio

DBS holds an optimistic view on Alibaba’s trajectory, especially its extensive portfolio that spans cloud computing, digital media, and entertainment sectors. This diverse range of interests not only bolsters Alibaba’s revenue streams but also underpins a strong Buy rating from DBS.

Mittal has specifically highlighted the growth potential of Alibaba’s international commerce platforms, such as AliExpress, Lazada, and Trendyol. The company’s International e-commerce segment delivered remarkable results in the June quarter, with a 32% year-over-year sales increase. Looking ahead, Mittal forecasts a 23% CAGR for this segment from FY24 to FY27. Furthermore, DBS expresses confidence in Alibaba’s Cloud Computing business, expecting a solid 9% CAGR over the same period.

From September 2024 onwards, Alibaba plans to introduce a 0.6% service fee on GMV per transaction for its merchants on Taobao and Tmall. Mittal believes this move will enhance customer management revenue (CMR) and subsequently boost earnings. DBS anticipates a significant 7% growth in the company’s CMR for FY25.

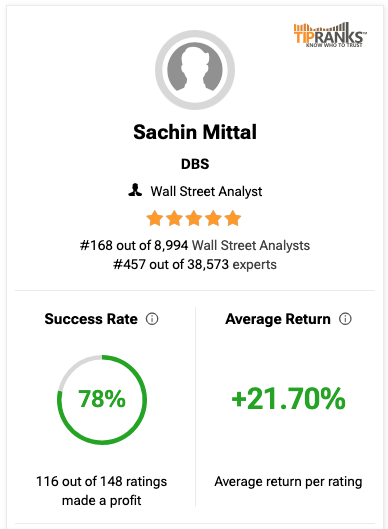

TipRanks Recognition of Analyst Sachin Mittal

Mittal’s stellar track record as an analyst is underscored by his five-star rating on TipRanks. Placed at an impressive rank of 168 out of over 8,900 analysts, Mittal boasts a commendable 78% success rate, achieving an average return of 21.7% per rating.

TipRanks provides a valuable platform for evaluating financial experts based on their track record, enabling users to identify and monitor top-performing analysts. This can assist investors in discovering new opportunities and making informed investment decisions.

Key Insights from Alibaba’s Recent Performance

Alibaba’s latest June quarter results presented a mixed picture. The company excelled in its Cloud business, witnessing a 6% year-over-year revenue increase to ¥26.5 billion. This growth was primarily fueled by the adoption of artificial intelligence (AI) products and robust public cloud expansion. However, revenue from Alibaba’s e-commerce division, the Taobao and Tmall Group, experienced a slight decline of 1% to ¥113.37 billion.

Despite these fluctuations, Alibaba’s overall revenue showed a 4% year-over-year rise to ¥243.2 billion. However, the company reported a 27% decrease in net income, amounting to ¥24.02 billion.

Assessing the Viability of Alibaba’s Stock

Year-to-date, Alibaba’s stock has witnessed a 7.6% increase, reflecting a moderate upward trend. On TipRanks, 9988 stock has garnered three Buy and two Hold recommendations. The current Alibaba share price target stands at HK$99.10, suggesting a substantial 22% upside potential based on the existing trading price.

For more insights into 9988 analyst ratings and market forecasts, investors can refer to in-depth analyses available on TipRanks.