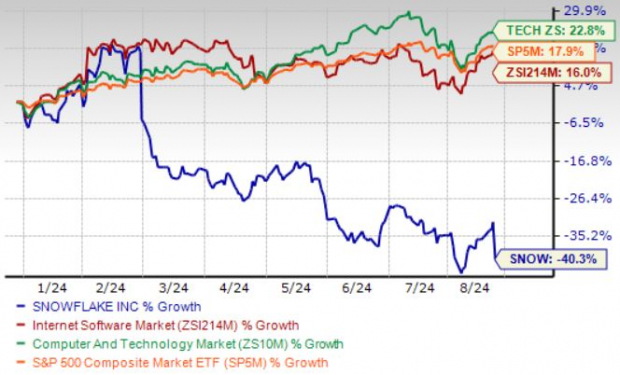

Snowflake (SNOW) shares have taken a tumble, dropping over 12% in the wake of their second-quarter fiscal 2025 results. Despite delivering impressive numbers due to robust product adoption, Snowflake witnessed a 29.5% surge in product revenues, totaling $829.3 million in the fiscal second quarter. This amounts to a substantial 95.4% of the total revenues for that period.

Hitting the Slopes

The fiscal 2025 forecast for Snowflake predicts a 26% rise in product revenues, an improvement from the previous forecast of $3.3 billion with a 24% year-over-year growth. However, this growth rate falls short compared to the 38% increase in fiscal 2024.

While SNOW maintains its non-GAAP product gross margin at 75% and a non-GAAP operating margin of 3%, both are anticipated to contract year over year by 300 basis points and 500 basis points, respectively.

With a projected non-GAAP adjusted free cash flow margin of 26% for fiscal 2025, reflecting a slight decrease from the 29% reported in the prior fiscal year, Snowflake’s shares have suffered a decline attributable to the company’s margin forecast, chiefly impacted by elevated GPU costs.

Financial Flurries

Snowflake outshone expectations in the realm of earnings and revenue for the second quarter of fiscal 2025. The company recorded non-GAAP earnings of 18 cents per share, besting the Zacks Consensus Estimate by 20%, although marking a year-over-year decline of 18.2%.

Revenues also soared, hitting $868.8 million, surpassing estimates by 2.26% and exhibiting a 29% increase from the previous year.

Staying Afloat in Deep Waters

Snowflake’s recent performance revealed a net revenue retention rate of 127% for existing customers. The company welcomed a 21.2% year-over-year hike in its customer base, reaching 10,249 in the most recent quarter. Among these clients, 510 generated over $1 million in product revenues over the last 12 months, marking a 28% increase from the previous year, while the number of Forbes Global 2000 customers rose by 5% to 736.

With a cash balance of $3.23 billion, Snowflake unveiled an extended share buyback program worth $2.5 billion, underscoring its robust liquidity position.

Weathering the Storm

Despite a positive third-quarter guidance with projected product revenues ranging from $850-$855 million, Snowflake’s operating margin is expected to hold at 3%. Analysts anticipate a 22% year-over-year growth in revenues for the third fiscal quarter.

However, the stock’s current valuation paints a different picture. Snowflake’s Value Score of F implies an overstretched price, especially when compared to the broader Zacks Computer & Technology sector. The company’s forward 12-month Price/Sales stands at 11.54X, significantly higher than the sector’s 6.46X.

Exploring New Territories

Snowflake’s expanding portfolio heralds promising long-term prospects, with recent introductions such as Marketplace Listing Auto-Fulfillment & Monetization and geospatial analytics bolstering its offerings. The company’s association with prominent partners like Amazon, Microsoft, NVIDIA, and several others further augments its position in the market.

The launch of Polaris Catalog, a vendor-neutral open catalog for Apache Iceberg, has enriched Snowflake’s ecosystem, offering enhanced choice, flexibility, and security to enterprise users.

In Conclusion

As Snowflake navigates through uncertain terrain, its moderate growth outlook and elevated valuation make it a risky investment in the short term. Holding a Zacks Rank #3 (Hold), potential investors may benefit from awaiting a more opportune entry point in the stock before considering a purchase.