Warren Buffett’s Exit and Steven Cohen’s Entrance

The tech landscape, especially the realm of AI-focused stocks, has long been a scene of adulation on Wall Street. However, amidst the cacophony of enthusiastic investors, a notable figure has taken a step back.

Renowned investor Warren Buffett, famous for his substantial holdings in Apple (NASDAQ:AAPL), significantly reduced his AAPL position in Q2, shedding approximately 390 million shares. This move, equating to over half of his stake, marks a significant pivot for the investing legend in the first half of 2024.

Apple wasn’t the only tech giant feeling the repercussions. In the same quarter, Buffett divested his entire position in Snowflake (NYSE:SNOW), selling around 6 million shares valued at nearly $989 million.

As Buffett takes a step back, another titan of finance, Steve Cohen, through his asset management firm Point72, has entered the fray. Cohen’s firm is gearing up to launch a specialized AI-focused fund, and in the interim, the billionaire investor has been acquiring shares of both AAPL and SNOW, companies making substantial strides in the AI domain.

Apple’s Resurgence in the AI Race

After a spell relinquishing its title as the world’s most valuable company, Apple has reasserted its dominance, reclaiming the top spot. The tech behemoth, which had temporarily ceded ground to rival Microsoft amidst the AI surge, is back on the summit.

Apple’s brief descent from the top coincided with subduing sentiments surrounding the company. Concerns about iPhone demand, particularly in crucial markets like China, were looming. However, the results from FQ3 (June quarter) indicate a trajectory correction; though iPhone sales dipped, the decline was mild, with other business segments offsetting the shortfall and catapulting Apple beyond revenue and profit expectations.

Looking ahead, Apple seems poised to tackle an issue that had been unsettling investors. While peers were capitalizing on the AI wave, Apple appeared to be lagging behind. Yet, with the advent of Apple Intelligence and the upcoming iPhone iteration launch next month, the company is finally seizing the AI opportunity.

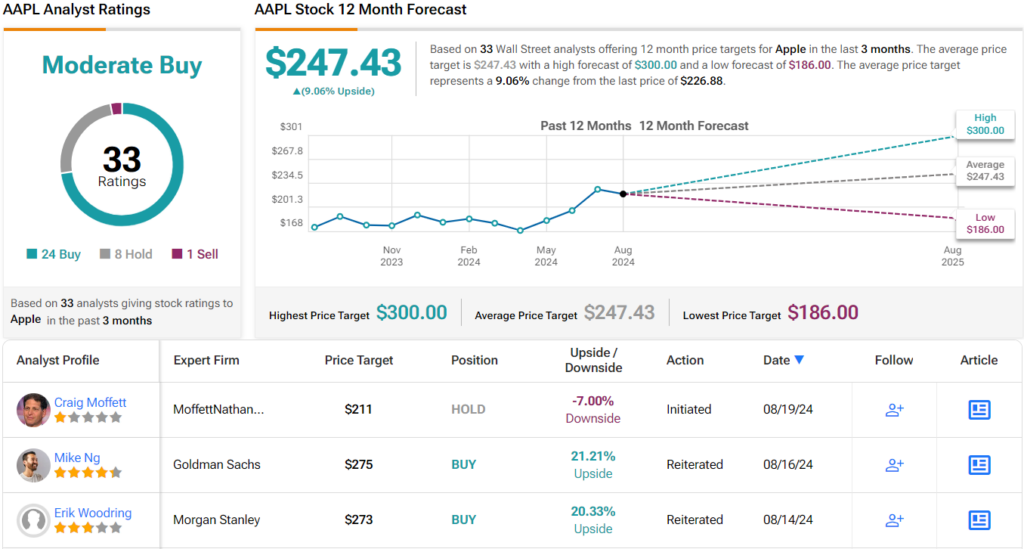

Reflecting the perceived potential, Cohen took a sizable bet on Apple in Q2, initiating a new position by acquiring 1,573,924 AAPL shares valued at $357 million.

In a bullish outlook, Wedbush analyst Daniel Ives believes Apple’s role in the forthcoming AI era is gaining recognition. “We believe the Street is starting to slowly recognize that with Apple Intelligence on the doorstep in essence Cupertino will be the gatekeepers of the consumer AI Revolution,” Ives articulated.

Snowflake’s Stormy Path in the AI Arena

While technology fuels the current bullish market sentiment, Snowflake seems to have missed the jubilant parade. Since the inception of the year, the stock has receded by 34%, despite its potential as an AI beneficiary.

Snowflake offers a cloud-based data warehousing platform facilitating efficient storage, management, and analysis of vast datasets. Setting itself apart from traditional data warehouses, the platform segregates compute and storage, enabling scalable and adaptable data processing. With a user-friendly, SQL-based interface that operates across various cloud providers, including AWS, Azure, and Google Cloud, Snowflake has carved a niche.

Despite actively bolstering its AI capabilities, integrating machine learning and AI tools within its platform, the stock’s trajectory has been mired in disappointment. Lackluster earnings have dampened spirits, exacerbated by the company’s intensive investments in AI feature development. This has inflated costs due to heightened GPU expenses, while the anticipated revenue upsurge from these ventures remains unrealized.

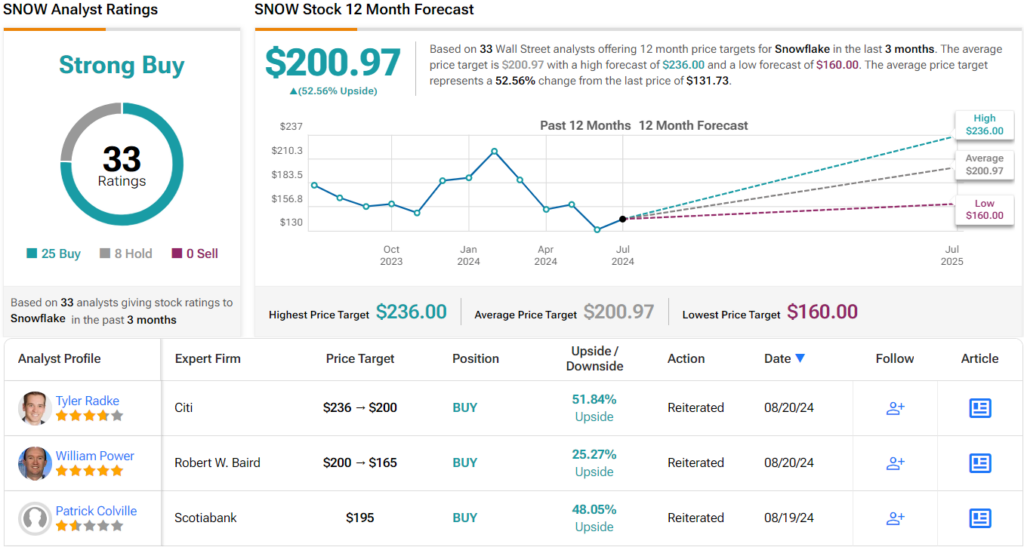

Unfazed by the turbulence, Cohen initiated a fresh position in Snowflake during Q2, acquiring 533,623 SNOW shares valued at over $70.1 million. Despite a recent data breach tarnishing the company’s image, analysts like Scotiabank Patrick Colville foresee Snowflake’s underlying prospects to be robust.

The Rise of Snowflake: A Cloud Data Warehouse Phenomenon

Analyst Patrick Colville recently expressed a bright outlook on Snowflake, heralding it as the premier cloud data warehouse and an emerging beneficiary of artificial intelligence. Colville’s bullish sentiment is underscored by an Outperform (Buy) rating on SNOW shares, accompanied by a hefty $195 price target, suggesting a potential upside of approximately 48% from the current valuation.

Analyst Consensus

Colville’s optimism is not a solitary voice in the crowd. Garnering support from the majority of his peers, Snowflake boasts 24 Buy ratings and 8 Holds, culminating in a coveted Strong Buy consensus rating. The average price forecast of $200.97, slightly above Colville’s target, implies a robust 53% surge in the stock’s value in the foreseeble future.

Future Prospects

Snowflake’s trajectory seems to be veering towards a meteoric rise, drawing on the synergy of technological innovation and market demand. Colville’s endorsement and the prevailing bullish sentiment among analysts signal an encouraging outlook for investors looking to capitalize on the potential of this burgeoning powerhouse in the cloud data sphere.

For those seeking investment opportunities in undervalued equities, TipRanks’ Best Stocks to Buy tool offers a treasure trove of insights to aid in strategic decision-making.

Disclaimer: The views expressed in this piece belong solely to the featured analysts. The content is intended for informational purposes, underlining the importance of conducting thorough due diligence before committing to any investment ventures.