General Dynamics: A Military-Grade Performer

General Dynamics Corporation (GD), a stalwart in the defense industry, has consistently proven itself as a bastion of financial stability and growth. This $81.2 billion giant boasts a diverse business model encompassing aerospace, marine systems, combat systems, and information technology.

GD stock, up by 14.2% year-to-date, exhibits resilience in the face of market fluctuations. Its dividend history, spanning 33 years, underscores its commitment to rewarding shareholders through consistent payout increases.

With a forward dividend yield of 1.92%, GD outperforms the industrial sector average, signaling its financial health and potential for growth. The company’s recent Q2 performance saw revenue surge by 18% year-on-year to $12 billion, with a notable rise in diluted earnings per share (EPS) to $3.26.

Driven by a lucrative aerospace segment and robust demand for defense products, GD remains a strong contender for investors seeking long-term financial rewards. Analysts project a steady earnings uptick, further solidifying its position as a top pick for income seekers.

The Procter & Gamble Company: A Consumer Goods Powerhouse

Established in 1837, The Procter & Gamble Company (PG) is a venerable name in the consumer goods realm, renowned for its high-quality household and personal care products. With a market value of $396.3 billion, P&G continues to impress investors with its steady performance, reflected in a 14.6% year-to-date gain.

As a Dividend King, P&G stands out for its remarkable track record of consistent dividend hikes over 68 years. Offering a forward yield of 2.4%, above the sector average, P&G’s sound financials and commitment to shareholder value are evident.

In fiscal 2024, P&G’s robust sales growth and increased core earnings per share demonstrate its resilience amid economic challenges. The company’s strategic focus on generating substantial free cash flow bodes well for sustaining dividends and supporting stock repurchases.

Wall Street’s positive outlook on P&G is evident through analyst ratings, with expectations of moderate growth in the coming years. With an average target price of $174.88, PG stock presents a promising opportunity for investors seeking stable income streams.

The Golden Arches: A Financial Odyssey of McDonald’s Corporation

Global Fast-Food Icon

Stepping into the financial landscape teeming with giants, McDonald’s Corporation (MCD) stands tall as one of the most iconic entities in the world of fast-food chains. With a sprawling empire spanning over 40,000 locations across more than 100 nations, McDonald’s is synonymous with speedy service, delectable offerings, and budget-friendly meals that have entrenched it firmly in the hearts of consumers worldwide.

Dividend Aristocrat

A legacy carved in gold, McDonald’s flaunts a sturdy business model and a brand value that gleams brighter than the golden arches it proudly displays. Its unwavering financial prowess over 48 bountiful years has not only elevated it to the status of a Dividend Aristocrat but has also made dividend distribution a hallmark of its identity.

Market Performance

With a market valuation of $198 billion, the journey of MCD stock in the current year has seen a modest decline of 6%, a stumble compared to the broader market dynamics. However, offering an alluring forward dividend yield of 2.4%, surpassing the consumer discretionary average of 1.89%, proves that McDonald’s stock remains a beacon of stability in an ocean of market fluctuations.

Financial Resilience Amidst Challenges

Embodying financial resilience, McDonald’s stability echoes profoundly against the backdrop of inflationary headwinds that cast a shadow over its recent second-quarter performance. Even though net revenue remained stagnant at $6.5 billion and adjusted earnings took an 8% dip, analysts foresee a minor setback in 2024 followed by a robust rebound with a 7.8% spike in 2025.

Analyst Outlook

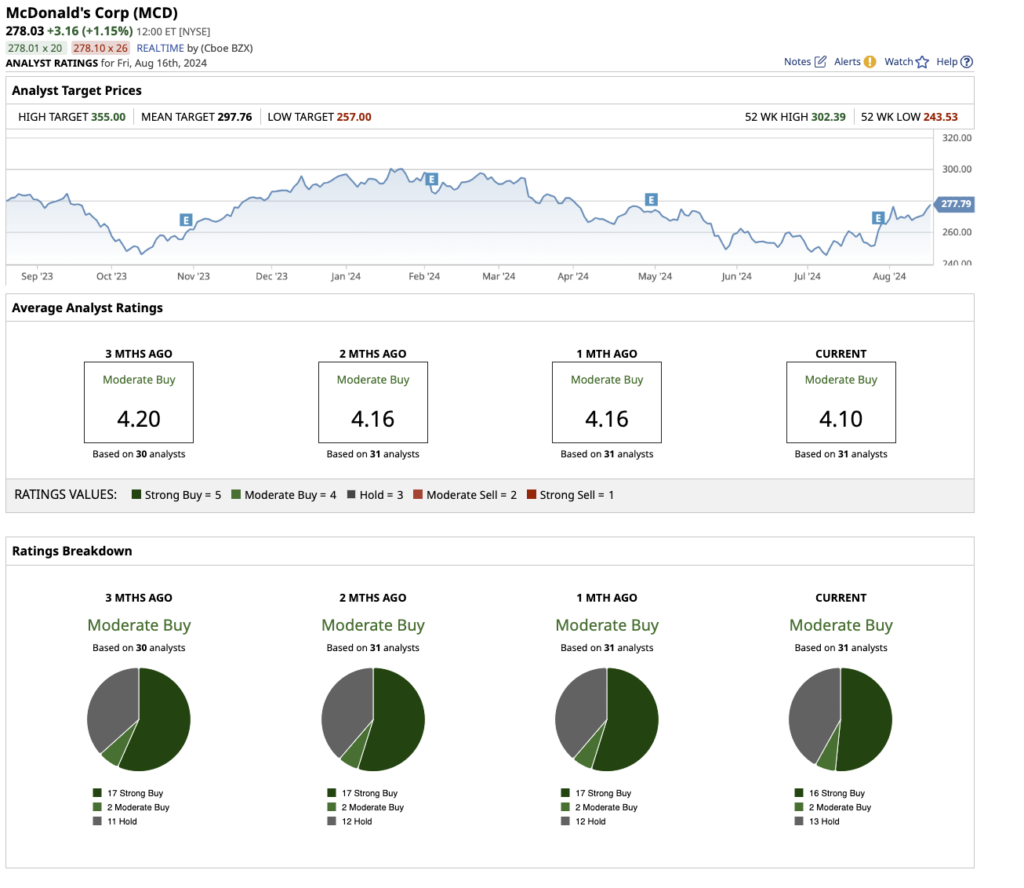

Surveying the realm of analytical foresight, the consensus reveals an average rating of “moderate buy” for MCD stock, navigating through the counsel of 31 experts. Among them, 16 chant “strong buy,” 2 sing praises of a “moderate buy,” while 13 suggest a harmonious “hold.”

Future Projections and Investment Potential

Casting a gaze into the crystal ball of financial augury, analysts paint a colorful picture with a mean target price of $297.76 for McDonald’s, hinting at a promising 7% leap from its current domain. With the ceiling set at a lofty $355, the potential for growth sparkles bright, beckoning investors towards a horizon of financial prosperity.

Safe Harbor for Dividend Seekers

In the vast expanse of dividend opportunities, McDonald’s stock emerges as a steadfast lighthouse, offering a beacon of reliability and tranquility for those seeking a safe haven for their investments.