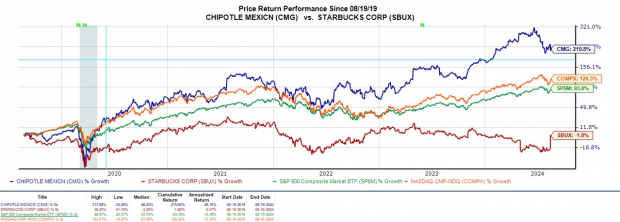

In an unexpected twist, Chipotle Mexican Grill’s CEO Brian Niccol announced his departure to take the reins at Starbucks. With Chipotle’s stock soaring over +200% in the last five years compared to Starbucks -2%, investors are grappling with deciding which of these retail restaurant giants is the smarter choice with Niccol’s impending leadership at Starbucks.

Image Source: Zacks Investment Research

Growth Comparison

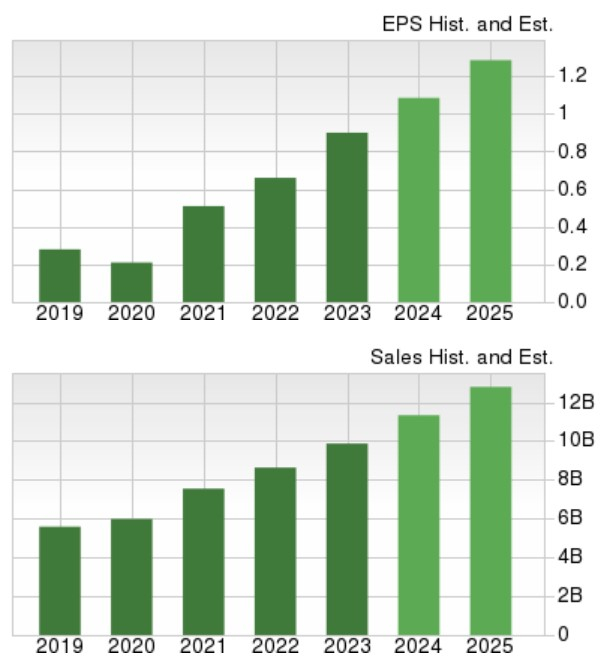

After a monumental 50-1 stock split in June, Chipotle’s annual earnings are forecasted to surge by 20% in fiscal 2024 to $1.08 per share from last year’s $0.90 per share ($45 per share/50). Additionally, a robust 18% EPS growth is anticipated in FY25.

On the revenue front, Chipotle’s total sales are expected to climb by 15% this year and further increase by 13% in FY25 to $12.79 billion.

Image Source: Zacks Investment Research

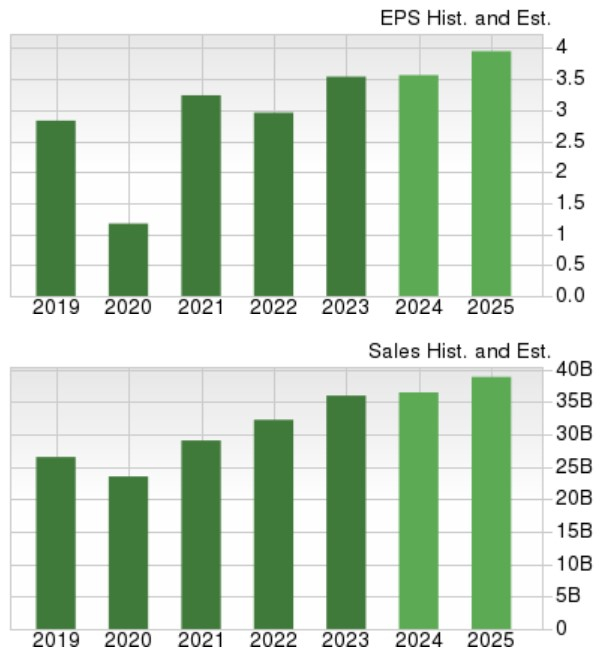

Moving to Starbucks, annual earnings are predicted to remain relatively flat in FY24 but are poised to grow by 11% in FY25 to $3.94 per share. Starbucks’ total sales are slated for a 1% increase in FY24 and a 6% expansion next year to $38.84 billion.

Image Source: Zacks Investment Research

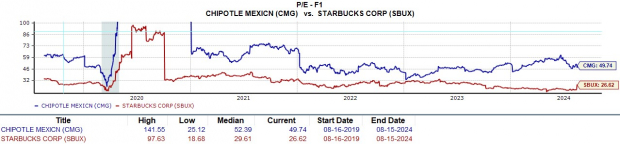

Valuation Comparison

While Chipotle flaunts impressive growth figures, Starbucks possesses a more appealing valuation. SBUX trades at 26.6X forward earnings, close to the S&P 500’s 23.3X, whereas CMG trades at a notable premium to the broader market at 49.7X.

Image Source: Zacks Investment Research

Balance Sheet Comparison

Financial robustness plays a crucial role in stock selection. Despite Starbucks having more cash reserves, Chipotle boasts a stronger balance sheet.

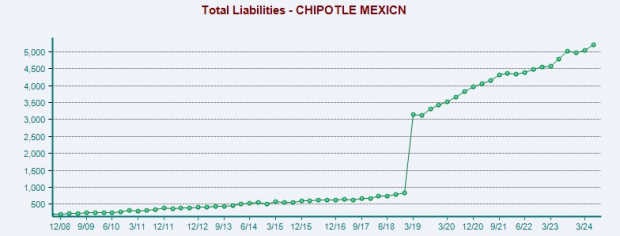

Chipotle currently holds $1.49 billion in cash & equivalents with $8.92 billion in total assets against $5.2 billion in total liabilities.

Image Source: Zacks Investment Research

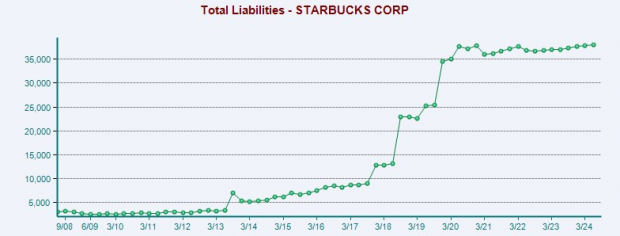

On the other hand, Starbucks has $3.39 billion in cash & equivalents with $38.04 billion in total liabilities compared to $30.11 billion in total assets.

Image Source: Zacks Investment Research

Final Thoughts

Starbucks faces a pressing need for an operational overhaul as solvency concerns loom over the company’s balance sheet. However, under Brian Niccol’s guidance, there is optimism that Starbucks can reach the same heights of success seen at Chipotle. For now, Starbucks and Chipotle stock both hold a Zacks Rank #3 (Hold) and present as attractive long-term investments given their promising prospects, although better buying opportunities may arise in the future.