Adapting to Consumer Trends in Broadcast Entertainment Industry

The Broadcast Radio and Television industry, amidst the turmoil of escalating cord-cutting, is witnessing a seismic shift in the consumption of digital content. Giants like Netflix, Fox, Roku, and TEGNA are not merely surviving; they are thriving. By diversifying content offerings to cater to the insatiable hunger for content, these companies have caught the wave of changing consumer preferences. The surge in digital content consumed through various platforms calls for adaptive strategies centered around profit protection, efficient cash management, and seamless technological integration.

Exploring the Landscape of Broadcast Radio and TV Industry

The Broadcast Radio and Television industry radiates with a plethora of entertainment, sports, news, and musical content across traditional platforms as well as digital media. These industry players, buoyed by technological advancements, are maneuvering through a volatile industry landscape. Amidst this whirlwind, a renewed focus on flexibility and transitioning towards a dynamic cost model is paramount for success.

Unveiling Key Trends Shaping the Industry

Shift in Consumer Preference a Key Catalyst: As companies hustle to bridge the gap between traditional linear TV and over-the-top services, they are striking gold with their global content offerings. Leveraging a spectrum of streaming platforms to reach consumers worldwide, these players are multiplying their ad revenues by enticing advertisers and major events to their digital domains. The era of increased digital viewing has paved the way for personalized content creation through AI and machine learning, ensuring a deeper user engagement.

Increased Digital Viewing Fuels Content Demand: The digital revolution has not only enriched the viewing experience but has also unlocked a treasure trove of consumer insights for industry players. Crafting tailored content supported by user data analytics has become the norm, heralding a new era of content monetization and user retention.

Uncertain Macroeconomic Landscape Impedes Production and Ad Demand: The Broadcast Radio and Television industry is grappling with headwinds from a stormy macroeconomic environment. As inflation, capital costs, and a probable recession loom, industry players are facing the heat of reduced ad budgets and escalating competition from tech conglomerates contending for a slice of the advertising pie.

Low-Priced Skinny Bundles Impact Revenues: In response to the cord-cutting phenomenon, the industry is rolling out “skinny bundles,” offering more affordable alternatives to traditional subscription models. While this shift caters to evolving consumer preferences, it poses a revenue challenge by diluting the top-line performances of these industry behemoths.

Assessing the Industry Performance and Valuation

Despite weathering a storm of uncertainties, the Broadcast Radio and Television industry has its share of shining stars. While the industry might be grappling with a sluggish trajectory, a few stocks are emerging as potential winners based on robust earnings outlooks. However, a deeper dive into shareholder returns and valuation metrics is imperative to navigate through the turbulent waters of this industry segment.

Mapping the Industry Against Sector Benchmarks

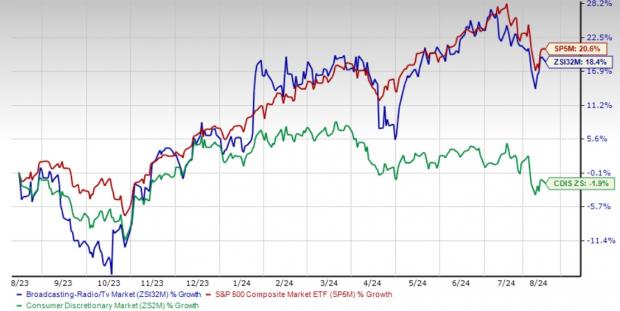

The Broadcast Radio and Television industry’s performance has trailed behind the broader Consumer Discretionary sector and the S&P 500 Index in the past year. With a modest decline in industry metrics juxtaposed against the substantial growth of the broader indices, these industry players are treading cautiously in unprecedented times.

EV/EBITDA Ratio (TTM)

Exploring Opportunities in Broadcast Radio and Television Stocks

Favorable Outlook for TEGNA

TEGNA has solidified its position as a key player in the U.S. broadcasting sector by strategically acquiring major networks. With a diverse portfolio of NBC, CBS, ABC, and FOX stations, TEGNA operates under long-term affiliation agreements, selling advertising spots and producing local content such as news and sports. The company’s shift towards content creation over traditional broadcasting mitigates the risks associated with cord-cutting, a prevalent threat in the industry. By investing in digital and streaming services, TEGNA is poised to unlock new revenue streams. Despite a 9.8% dip in shares year-to-date, the Zacks Rank #2 (Buy) company’s positive direction is evident, with a 0.6% rise in the 2024 earnings estimate.

Netflix Positioned for Growth

Netflix, a Zacks Rank #3 (Hold) entity, showcases promising growth due to its expanding subscriber base and revenue strategies like curbing password-sharing and introducing ad-supported tiers. The company, boasting 277.65 million paid subscribers globally, continues to invest heavily in localized content production. Notable releases like “Beyond Goodbye” and strategic moves in various markets indicate a forward-thinking approach. The 2024 earnings estimate of $19.08 per share, up by 4.1%, coupled with a substantial 33.1% return on shares this year, reflect Netflix’s solid market position.

Fox’s Strategic Initiatives

Fox leverages the growing demand for live programming, with properties like Fox News and Fox Business Network boosting user engagement. The recent Tubi launch in the UK, offering extensive on-demand content, underscores the company’s commitment to expansion. Generating a significant portion of revenue from live programming and bolstered by partnerships fostering innovation in advertising, Fox demonstrates resilience against the competitive video-on-demand landscape. Despite a slight decrease in earnings estimates for fiscal 2025, Fox’s stock has gained 31.4% year-to-date.

Insights into Roku’s Position

Roku, a Zacks Rank #3 company, benefits from strong user engagement on its platform, highlighted by the success of the Roku TV program. The platform’s elevation as a top TV streaming choice in North America and active account growth signify positive trends. Though facing a 38.3% stock loss this year, Roku continues to enhance its offerings with third-party streaming channels, driving user acquisition. The 2024 loss estimate narrowing by 49 cents to $1.45 per share indicates a potential turnaround for the company.