The energy sector, with its intricate dance of supply, demand, and investor sentiment, has long been a source of intrigue for traders and market observers alike. As summer temperatures rise, so does the fervor in the energy market, with stocks ripe for the picking as opportunities abound amidst the volatility.

The Oversold Opportunities

When discussing the ebb and flow of market dynamics, the Relative Strength Index (RSI) takes center stage as the key to unlocking potential in undervalued companies. Offering a glimpse into a stock’s strength on upswings and downturns, the RSI serves as a lighthouse guiding traders through the short-term storm of price action.

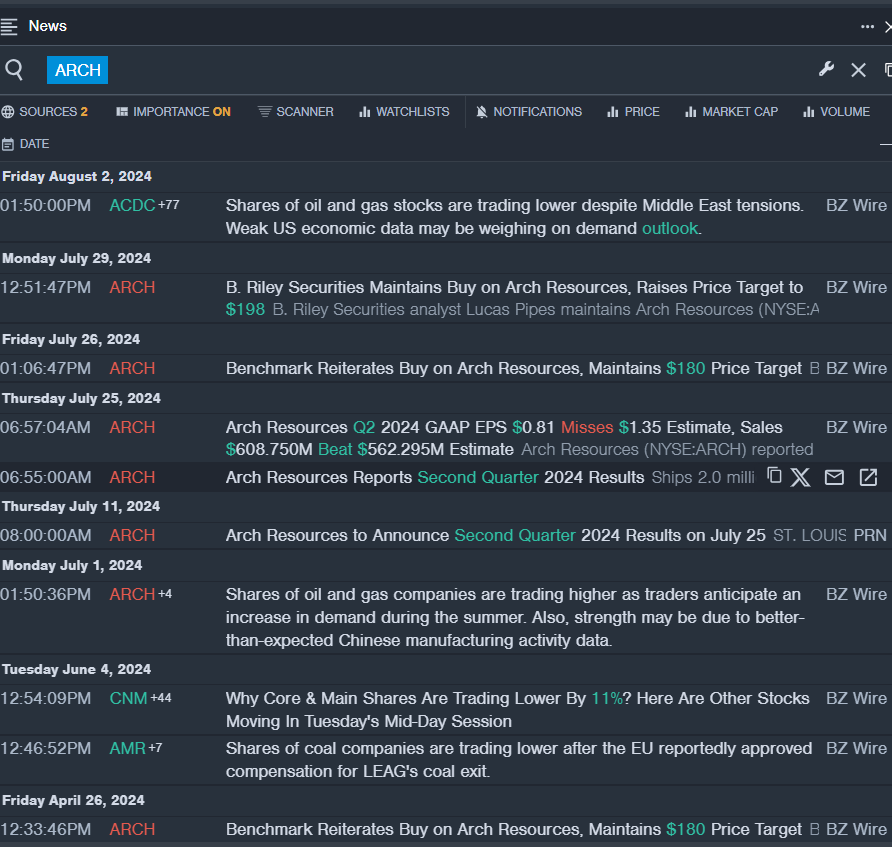

Arch Resources Inc (ARCH)

- Arch Resources Inc recently weathered a storm of its own, posting weaker quarterly earnings tied to unforeseen challenges. The company’s resolve, akin to a skilled sailor navigating turbulent waters, shone through as they deftly managed the aftermath of a bridge collapse in Baltimore. Despite the setback, Arch’s stock, having weathered a 21% downturn, appears poised to set sail once more.

- RSI Value: 28.15

- ARCH Price Action: Recent market close saw Arch Resources Inc’s stock priced at $128.53.

Nextdecade Corp (NEXT)

- NextDecade Corp, faced with the daunting news of a court-mandated halt to operations at their LNG Facility, saw their stock plummet by 38% in a month. However, like a phoenix rising from the ashes, NextDecade finds itself on the cusp of resurgence with a recent uptick in stock price, signaling a potential shift in the winds of fortune.

- RSI Value: 23.51

- NEXT Price Action: Market closure marked a positive trajectory for Nextdecade Corp, closing at $5.05.

Chesapeake Energy Corp (CHK)

- Chesapeake Energy Corp recently weathered turbulent seas with a significant decrease in quarterly earnings, sending ripples of uncertainty through the market. Despite this, the company’s steadfast commitment to operational efficiency and capital improvements offers a glimmer of hope for investors. As the stock saw a 14% dip over the past month, the stage might be set for a remarkable comeback, akin to a seasoned mariner navigating choppy waters.

- RSI Value: 29.44

- CHK Price Action: The most recent trading session closed with Chesapeake Energy Corp’s stock at $72.25.

As we witness the cyclical nature of the energy market, with its highs and lows resembling the ebb and flow of the tides, investors brace themselves for potential opportunities hidden within the turmoil. The coming quarter holds promise for those willing to ride the waves of volatility, seeking to unearth the gems buried beneath the surface of oversold stocks.