Nasdaq’s NDAQ recent move to tighten its delisting procedures for non-compliant companies has set off reverberations in the financial world. The focus is on penny stocks that fail to maintain a minimum bid price above $1 for 30 consecutive sessions, leading to a potential swift exit from the exchange if remedial action is not taken within a specified timeframe.

The proposed changes are aimed at elevating the listing standards on Nasdaq, thereby highlighting only the most resilient small-cap companies. This strategic shift could have a cascading effect on the broader market, notably impacting the performance of the Russell 2000 index, which reflects the fortunes of small-cap entities.

An Uplift for Small-Cap Stocks:

A recent surge in the value of small-cap stocks, possibly triggered by a rotation away from heavyweight tech companies, has brought lesser-known enterprises into the limelight. This underscores the opportunity for investors to explore potential gains in this segment that stands out amidst the prevailing market dynamics.

Exploring Leveraged ETFs in the Small-Cap Arena:

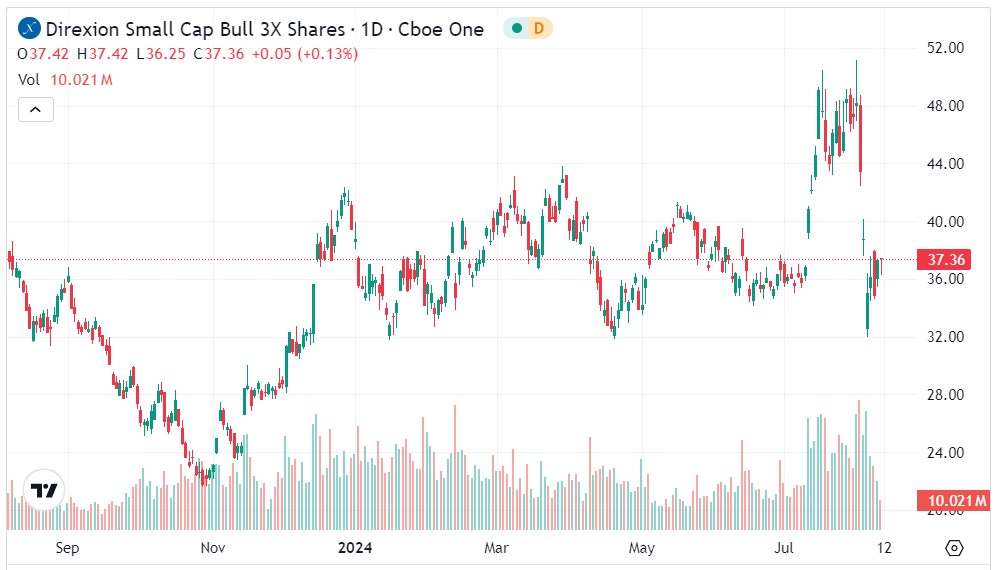

Amid this backdrop, Direxion offers two leveraged exchange-traded funds catering to investors eying high-risk, high-reward scenarios within the small-cap space. The Direxion Daily Small Cap Bull 3X Shares TNA seeks to magnify the daily returns by 300% of the Russell 2000 index, while the Direxion Daily Small Cap Bear 3X Shares TZA offers an inverse exposure with similar leverage.

It’s essential to note that these ETFs are tailored for traders who engage in short-term market speculation as the compounding leverage and heightened volatility in small-cap stocks could lead to value erosion if held for an extended period.

Analyzing ETF Performance:

Recent market movements have seen TNA experiencing significant price swings, oscillating between highs and lows. Despite recent fluctuations, the ETF hovers around certain key support levels, with investors eyeing the $40 milestone as a probable target.

- Current trends indicate TNA bulls aiming to consolidate above the $38 mark before charting a course towards the psychologically significant $40 threshold.

On the other hand, TZA has navigated through its own set of challenges in the recent past. Despite facing obstacles, the ETF has shown resilience by hovering around crucial support levels, with the $20 level looming as a significant target for traders with a bearish stance on small caps.

- Small-cap bear investors tracking the TZA are striving to fortify their position above the $18 support line, eyeing a potential climb towards the $20 mark.

A Closer Look at the Market Dynamics: The sharp movements in these ETFs indicate the intensity of sentiment and activity in the market, underscored by a mix of speculation, cautious optimism, and calculated risk-taking among traders navigating the small-cap landscape.

As the financial arena witnesses these transformative shifts in the wake of Nasdaq’s proposed delisting amendments, the spotlight on small-cap companies, notably reflected through the Direxion ETFs, presents a unique opportunity for investors to capitalize on the evolving market dynamics, provided they are wary of the intricate nuances associated with leveraged ETFs.

Image by Mohamed Hassan from Pixabay