Bitcoin, the revered pioneer of cryptocurrencies, carved a path for the entire digital asset realm.

A meteoric ascent, unlike any traditional asset, saw Bitcoin’s price surge over 1,200 percent from March 2020, eventually peaking at US$69,044 on November 10, 2021.

In typical Bitcoin fashion, its infamous volatility set in the following year, plummeting to US$15,787 by November 2022 amidst a backdrop of economic ambiguity and negative media attention.

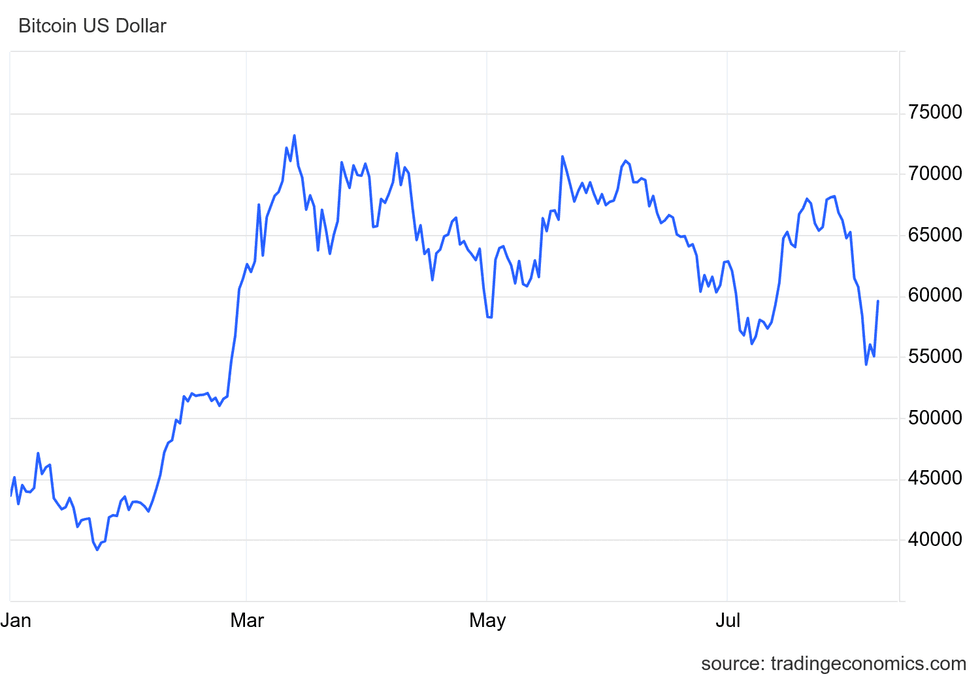

Entering 2024 slightly below US$45,000, Bitcoin has achieved monumental strides in the first half of this year. On March 11, 2024, Bitcoin hit a new pinnacle with a price of US$73,115.

But how did Bitcoin commence its journey, and what fuelled its recent price fluctuations? Let’s delve into the tale.

Bitcoin’s Modest Beginnings

At the onset of trading in 2009, Bitcoin’s nascent price stood at a mere US$0.0009, setting the stage for its remarkable trajectory.

A response to the 2008 financial crisis, Bitcoin emerged through a groundbreaking white paper titled “Bitcoin: A Peer-to-Peer Electronic Cash System” on October 31, 2008. A creation by the enigmatic entity known as Satoshi Nakamoto, the manifesto laid the foundations for a revolutionary cyber-currency challenging the status quo.

Secured through cryptography, Bitcoin embraced transparency and censorship resistance, leveraging blockchain’s might to forge an immutable ledger against duplicity. Its early adopters found allure in the potential to democratize finance, relinquishing control from traditional institutions.

Amid the reverberations of the 2008 financial turmoil, which rippled globally, Bitcoin’s genesis transpired on January 3, 2009, with the establishment of the Genesis Block. Featuring the first 50 Bitcoins and a poignant message critiquing governmental bailout strategies, Bitcoin’s mission took shape.

A milestone arrived on January 12, 2009, as Nakamoto conducted the first Bitcoin transaction with Hal Finney, a pivotal moment in Bitcoin’s evolution. It wasn’t until October 12, 2009, that Bitcoin gained value, with a Finnish developer exchanging 5,050 Bitcoins for US$5.02, crystallizing Bitcoin’s worth.

The inaugural Bitcoin purchase occurred on May 22, 2010, when Laszlo Hanyecz, a Florida programmer, traded 10,000 Bitcoin for two Papa John’s pizzas, anchoring Bitcoin’s value at around US$0.0025 for 2010.

Bitcoin’s price eventually breached the US$1 mark in 2011, surging to US$29.60 before retracting and exhibiting modest movement in 2012. Substantive growth materialized in 2013, propelling Bitcoin past US$1,000 and culminating at US$1,242 by December.

Bitcoin’s Price Ascendancy

Serenko Natalia / Shutterstock

January 1, 2016, initiated Bitcoin’s sustained price upsurge, commencing at US$433 and culminating at US$989 by year-end, marking a 128 percent appreciation.

Bitcoin’s ascendancy in mainstream appeal burgeoned in 2016, buoyed by distress in the stock market’s worst first week and geopolitical unease, positioning Bitcoin as a “safe-haven” asset in times of turbulence.

This year witnessed the UK’s Brexit referendum in June and Donald Trump’s election in November, stirring Bitcoin’s price surge during pivotal events.

Amidst this backdrop, industries increasingly turned to blockchain technology, with notable investments like IBM and Goldman Sachs’ US$60 million backing of Dig Asset Holdings. Bitcoin traded at US$418 by April, following a slight dip from February’s value of US$368.12.

In May, Bitcoin soared by 21 percent to US$539 by month-end, heralding further price hikes in the horizon.

The Wild Journey of Bitcoin: A Financial Rollercoaster

Bitcoin’s Turbulent Past

In the tumultuous world of cryptocurrency, where prices swing like a pendulum, Bitcoin has emerged as the undisputed “gold standard.” Its price history reads like a thrilling novel – soaring to dizzying heights, plummeting to gut-wrenching lows, and everything in between.

The Path to Legitimacy

Bitcoin’s ascent to mainstream acceptance was far from smooth. In the early days, it was dismissed as a speculative bubble, a passing craze that would soon fade into obscurity. However, partnerships with industry giants like Microsoft and Bank of America Merrill Lynch helped pave the way for its gradual acceptance as a legitimate investment vehicle.

The Meteoric Rise

As the years passed, Bitcoin’s popularity surged, culminating in a meteoric rise in 2017. The introduction of futures trading on the Chicago Mercantile Exchange marked a turning point, signaling to investors that Bitcoin was here to stay. FOMO gripped the market, fueling a frenzy of media coverage and celebrity endorsements.

The Unraveling

Despite its undeniable appeal, Bitcoin’s journey has been marred by extreme volatility. The year 2019 saw it yo-yoing from highs to lows, reflecting the erratic nature of the crypto market. However, this rollercoaster ride was far from over.

The Pandemic Test

As the world plunged into chaos in 2020 due to the pandemic, Bitcoin faced its toughest challenge yet. A sharp selloff sent prices tumbling, but the digital coin proved its resilience by bouncing back stronger than ever. The ensuing rally propelled Bitcoin to new heights, leaving traditional assets in its wake.

The Fall from Grace

Just as Bitcoin seemed unstoppable, cracks began to appear in its facade. Market uncertainties and a series of high-profile scandals shook investor confidence, leading to a sharp decline in 2022. The once-mighty cryptocurrency found itself on shaky ground, facing unprecedented challenges.

The Journey of Bitcoin: From Lows to All-Time Highs in 2024

The Bitcoin Rollercoaster

Bitcoin set a new all-time high price on March 14, 2024, reaching US$73,737.94 per BTC. This monumental leap came after a tumultuous period of recovery from its lows in 2022.

Bitcoin’s performance in the latter part of 2023 and throughout 2024 showcased its resilience and potential, defying the odds stacked against it.

As concerns plagued the banking system, Bitcoin rallied in March 2023 to US$28,211 following the distress caused by the collapse of several US banks, instigating a renewed faith in the digital currency.

Despite regulatory challenges from the SEC targeting major players like Coinbase Global and Binance, Bitcoin stood firm above US$25,000, buoyed by BlackRock’s pursuit of a Bitcoin exchange-traded fund.

The cryptocurrency surged above US$30,000, hitting US$31,500 in July 2023, maintaining this level for almost a month before slipping slightly. By September, prices had eased to US$25,150.

However, institutional backing and anticipation of SEC approval for numerous Bitcoin exchange-traded funds in early 2024 led to a resurgence in Bitcoin’s value. In November, it traded at US$37,885, climbing further to US$42,228 by year-end.

Subsequently, with the SEC greenlighting 11 spot Bitcoin ETFs, the price soared to US$46,620 in January 2024, and in February, it peaked at US$61,113, demonstrating the market’s bullish sentiment.

The rally continued as Bitcoin surged to US$73,737.94 on March 14, 2024, surpassing silver’s market capitalization, cementing its status as a dominant force in the financial landscape.

The Impact of the 2024 Bitcoin Halving

Prior to halving events, Bitcoin tends to experience price surges. The 2024 halving, which reduced miner rewards from 6.25 to 3.125 Bitcoin in April, was anticipated to influence price dynamics.

The halving in April marked a pivotal moment for Bitcoin, with many attributing the subsequent price hike to this event. Yet, given the limited history of halvings, predicting price trends remains a challenge.

Following the halving in April, Bitcoin’s price maintained stability around US$63,000 to US$65,000, highlighting the market’s confidence in the digital asset. By late April, it inched above US$66,000.

Despite stable pricing, Bitcoin’s trading volume exhibited fluctuations, with a notable uptick followed by a sharp decline. External factors like the Federal Reserve’s policy meeting in April influenced price dips, with Bitcoin briefly falling to US$56,903.

Reports of potential approval for spot Ether ETFs by the SEC boosted Bitcoin’s value, pushing it above US$71,000 in May. The SEC’s subsequent approval in late May further propelled Bitcoin’s price, demonstrating its interconnectedness with other digital assets.

While Bitcoin oscillated between US$67,000 and US$69,000 in mid-2024, external events like the Federal Reserve’s decisions and global regulatory actions caused fluctuations. Bitcoin briefly dropped to a two-month low of US$55,880 in July due to market uncertainties but swiftly rebounded following positive signals from the Federal Reserve.

With increasing institutional adoption and evolving market dynamics, Bitcoin’s portrayal has shifted from a speculative asset to a “risk-on” investment, reflecting its susceptibility to market sentiments, investor confidence, and broader economic conditions.

Bitcoin price chart via TradingEconomics.com. Bitcoin price chart in US dollars from January 1, 2024, until August 8, 2024.

Bitcoin Price Volatility: A Rollercoaster Ride for Investors

Bitcoin’s Rollercoaster Price Journey

Bitcoin’s price surged from US$57,899 to US$66,690 in the aftermath of the July 13 assassination attempt targeting US presidential candidate Donald Trump. This surge was fueled by perceptions of improved odds for a Trump victory, as he advocated for the crypto industry. The market embraced uncertainty, clearly reflected in Bitcoin’s price movements.

Conversely, when current US President Joe Biden withdrew from the 2024 race on July 21, and Vice President Kamala Harris assumed the role of the Democratic nominee, Bitcoin exhibited resilience with no major price corrections, signaling investor adaptability to political shifts.

Recent weeks have been rife with key events influencing Bitcoin’s trajectory. This includes the lackluster performance of spot Ether ETFs, concerns about a potential US government Bitcoin sell-off, Trump’s proposal of a national Bitcoin stockpile, and his diminishing election prospects in the wake of growing support for Harris.

Most notably, a significant price plunge struck Bitcoin in early August following an economic scare that triggered a massive sell-off across global markets and cryptocurrencies, underscoring the pervasive impact of external factors on the crypto landscape.

Bitcoin: Present Price and Recovery

As of 4:00 p.m. EDT on August 8, Bitcoin was trading at US$59,490, exhibiting a partial rebound from the substantial losses incurred earlier in August. The plunge on August 5 mirrored broader market fluctuations driven by a concatenation of events, including disappointing economic data and an unexpected Japanese interest rate hike.

Heightened uncertainty in the Asian market about a potential US recession triggered a significant selloff, causing Bitcoin to shed over 18 percent of its value within 24 hours. However, the market gradually stabilized as investors began to analyze the long-term implications of the economic trends more cautiously.

Insights into Bitcoin and Blockchain

A blockchain serves as a decentralized ledger for all cryptocurrency transactions, underpinning the foundation of digital currencies like Bitcoin. Its immutable, transparent nature has catalyzed its adoption across diverse industries ranging from banking, cybersecurity, to supply chain management, highlighting its disruptive potential.

Investing in Bitcoin: FAQs

Seeking to invest in Bitcoin? Numerous crypto exchange platforms and peer-to-peer trading apps such as Coinbase Global, CoinSmart Financial, BlockFi, Binance, and Gemini provide avenues for purchasing Bitcoin and securing it in digital wallets.

Bitcoin’s Finite Nature and Halving Events

Unlike conventional fiat currencies, Bitcoin has a fixed supply capped at 21 million coins, with about 19.79 million currently in circulation as of August 8. The scheduled halving events every four years reduce block rewards by half, sustain scarcity, and bolster Bitcoin’s value by stimulating demand-supply dynamics. The most recent halving in April 2024 trimmed block rewards from 6.25 to 3.125 Bitcoins.

The Crypto Landscape and Banking Industry

Cryptocurrencies, epitomized by Bitcoin, offer a decentralized alternative to traditional banking systems, appealing to a demographic keen on assets outside the conventional financial realm. Notably, privacy and autonomy from central authorities distinguish crypto assets, drawing interest from a growing cohort, especially among the digitally inclined younger generation.

The Ebb and Flow of Cryptocurrency Investments

Cryptocurrency vs. Traditional Banking

Cryptocurrency transactions offer a swift and cost-effective alternative to traditional banking methods. The allure lies in their agility and minimal associated fees, disrupting the conventional financial landscape.

Notably, banks are catching on to the growing popularity of cryptocurrencies. Bitcoin and its counterparts are gaining mainstream acceptance, prompting many financial institutions to venture into investments in the crypto and blockchain arena.

Is Bitcoin Still a Lucrative Investment?

Despite Bitcoin’s soaring success in 2024, its hallmark volatility remains a persistent concern. Investors comfortable with risk-taking might find opportunities in the cryptocurrency realm, historically proving profitable as Bitcoin bounces back from its 2022 crash. However, cautious investors gravitate towards less turbulent markets to navigate risks prudently.

Curious about the current allure of Bitcoin as an investment? Explore more insights in our article pondering “Is Now a Good Time to Buy Bitcoin?”

Unveiling the Top Bitcoin Holders

The enigmatic figure behind Bitcoin, Satoshi Nakamoto, is speculated to hold the most significant stash of the digital currency. Analysis of early Bitcoin wallets suggests that Nakamoto possesses over a million of the nearly 19.5 million Bitcoins circulating.

Unlocking Elon Musk’s Crypto Ventures

Elon Musk, the frontman of Tesla and Twitter, has dabbled in both Bitcoin and the whimsical Dogecoin. Musk’s tweets and Tesla’s strategic moves have notably shaped the trajectories of these cryptocurrencies over time.

While the exact extent of his holdings remains undisclosed, Musk has hinted at personal investments in Bitcoin, Dogecoin, and Ether. Reports surfaced in 2023 revealing his clandestine support for Dogecoin, adding a nuanced layer to his crypto involvement.

Noteworthy is Tesla’s foray into the crypto sphere, acquiring $1.5 billion worth of Bitcoin in 2021, subsequently divesting 75% the following year. By February 2024, the electric vehicle powerhouse held an estimated 9,720 Bitcoins, securing a spot as one of the top three publicly-traded companies in Bitcoin holdings.

In a candid social media post in January 2024, Musk affirmed his continued allegiance to Dogecoin and SpaceX’s stake in Bitcoin, underscoring his enduring ties to the crypto domain.

This text revisits an article initially featured by the Investing News Network in 2021.